Although gold gained some ground against the American dollar for a second session on Tuesday, strong economic numbers out of the United States and long-side profit taking hindered the bulls’ advance. The pair initially climbed to a 10-week high of 1325.75 before pulling back to 1318. The Conference Board’s consumer confidence index came in stronger than expected with a print of 85.2 and the Commerce Department said sales of new homes rose 18.6% to an annualized pace of 504K homes from 425K.

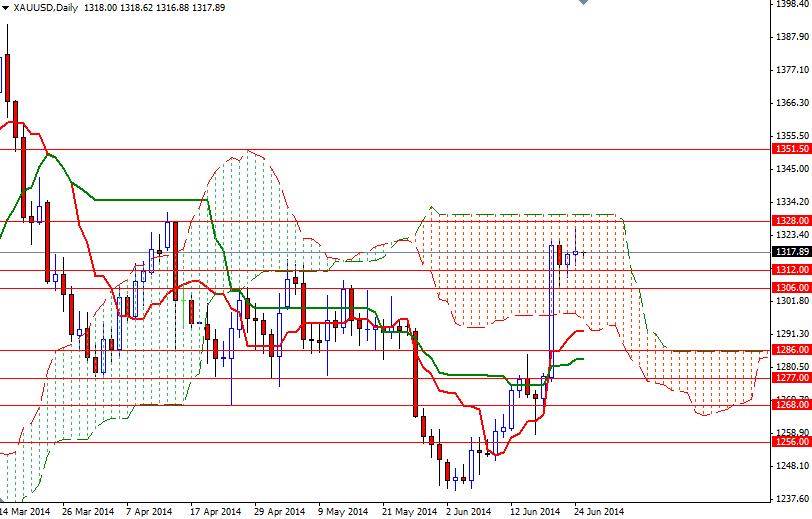

Yesterday’s candle confirms that there is an intense battle going on between the bears and bulls. The pair encountered heavy resistance around the 1326 level and lost momentum so people may take that as a sign of exhaustion. As I repeated lately, trading above the Ichimoku clouds on the 4-hour time frame provides support to the precious metal but in order to confirm that the bulls are dominant, I believe that a sustained break above the 1328/31 resistance area which also converges with the top of the Ichimoku cloud (daily chart) is essential. Until that happens, the market will be going back and forth.

If the bears increase the downward pressure and XAU/USD pair starts to fall, expect to see support at 1312 and 1306. A daily close below the 1306 level would make me think that we are heading back to the 1297 level, which happens to be the bottom of the cloud. Today sees release of important economic reports from the U.S. such as durable goods orders and gross domestic product, so expect volatility.