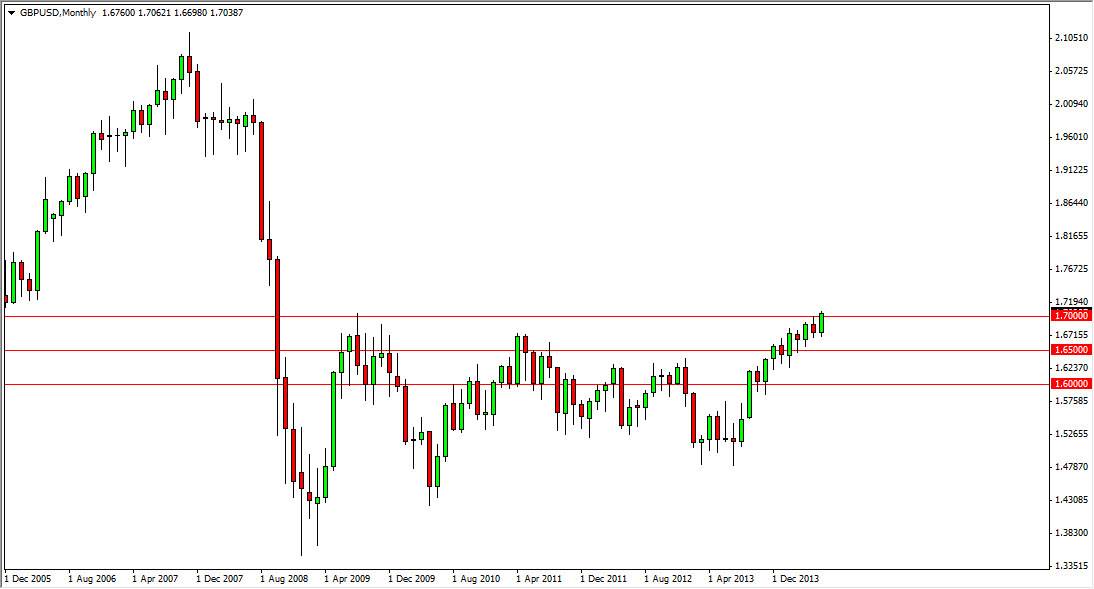

The GBP/USD pair has had a fairly significant move higher during the month of June. With the attached monthly chart, you can see that we are closing out the month above the 1.70 handle, and that is in fact a fairly big deal. You can look at the candles and although you don’t see massively large ones over the last six months or so, you do see that we are progressively marching higher. I also recognize of the 1.70 level has in fact been a fairly big deal previously, and I think it’s only a matter of time before the British pound breaks out to the upside with significant force.

In fact, it would not surprise me that the pair has broken out to the upside by the time we reach July 1. It’s possible that it may take a little longer than that, but quite frankly I think this market is going to target the 1.75 handle over the course of the summer. I don’t know that it will happen during the month of July, but we should certainly see a continued bullishness.

Central banks moving in opposite directions?

The British economy looks to be pulling out of recession. This will of course call for tighter monetary policy sooner or later. The Federal Reserve on the other hand has to look at fairly weak GDP numbers coming out of the United States, and therefore have to worry about whether or not tightening could have a negative effect on the economy. Simply put, I believe that the interest-rate differential between these two currencies may expand slightly. I don’t necessarily think that the US dollars going to get absolutely pummeled, I just think that the British pounds going to strengthen.

With that being said, I believe that we are heading to the 1.75 handle. Whether or not we get there during the month of July is completely different question, but I certainly do not feel comfortable shorting this market at all. In fact, we may be entering a longer-term buy-and-hold type of situation. I am very long the British pound right now, not only against the US dollar, against several other currencies.