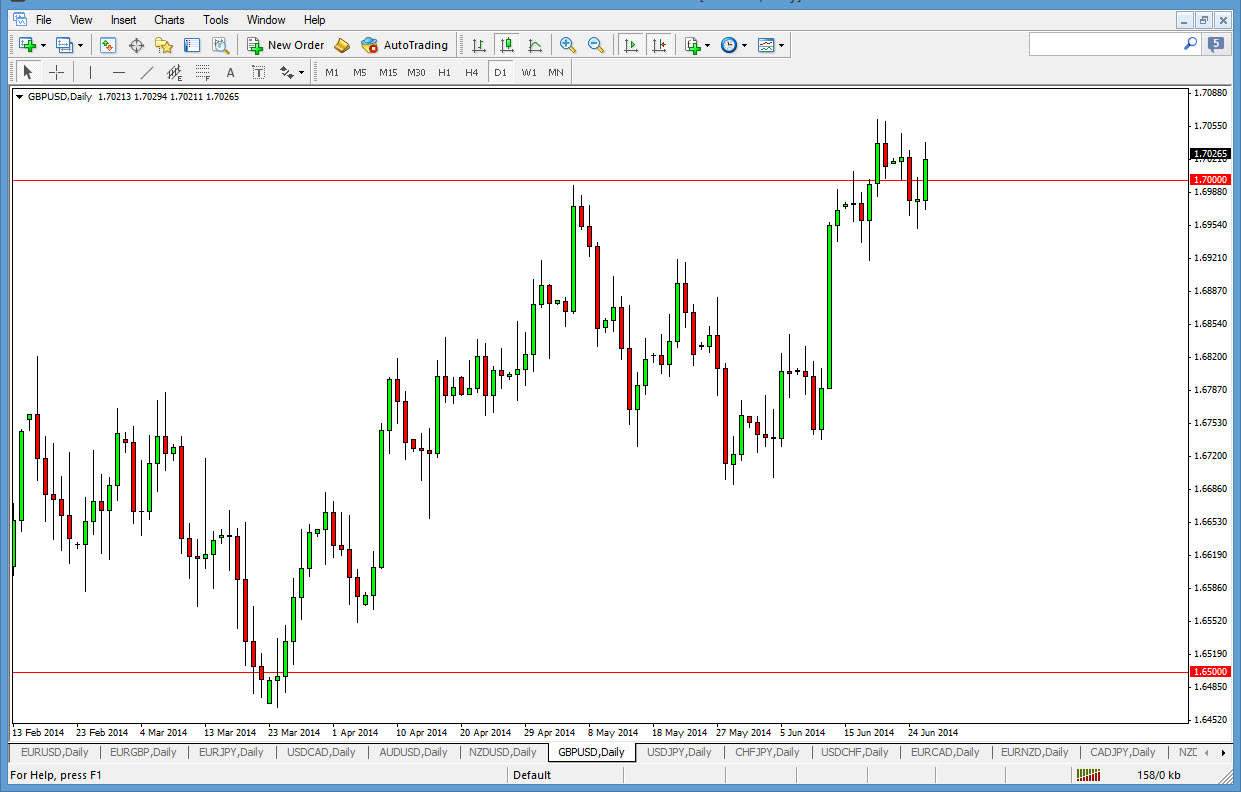

The GBP/USD pair broke to the upside during the session on Thursday, claiming well above the 1.70 level again, which of course has been significant support and resistance, and of course is also a large, round, psychologically significant number. I like this area, and I believe that we will eventually break out to the upside from here, heading to the next major area - 1.75 as seen on the longer-term chart.

However, the 1.70 level is significant on the longer-term chart as well, so I think that a break out above here is going to take a little bit of a momentum build up. We could have sideways motion from here, but I believe ultimately we will hold up enough momentum as more and more people see how strong the British pound that could eventually be. I also think that the move to the 1.75 level will happen sometime this summer, and should offer plenty of buying opportunities going forward.

Buying on the dips.

Going forward, I am going to be buying on the dips via the short-term charts. This will be especially true once we break out, as I think the market will be choppy as Forex markets generally have been, and I don’t see any reason to think that that’s going to change. However, buying every time the market pulls back is the way to go as buyers should return to this market time and time again. I also believe that the 1.69 level is a massive “floor” in this marketplace.

The impulsive candle that we saw from a couple of weeks ago tells me that there is a massive amount of buying pressure. With that, I have zero interest in shorting this market, and the fact that the US GDP revision numbers came out much weaker than anticipated tells us that the Federal Reserve will probably remain a fairly loose with its monetary policy for a long period of time. Certainly tightening is going to have to slowdown, and as a result this pair should continue to go higher.