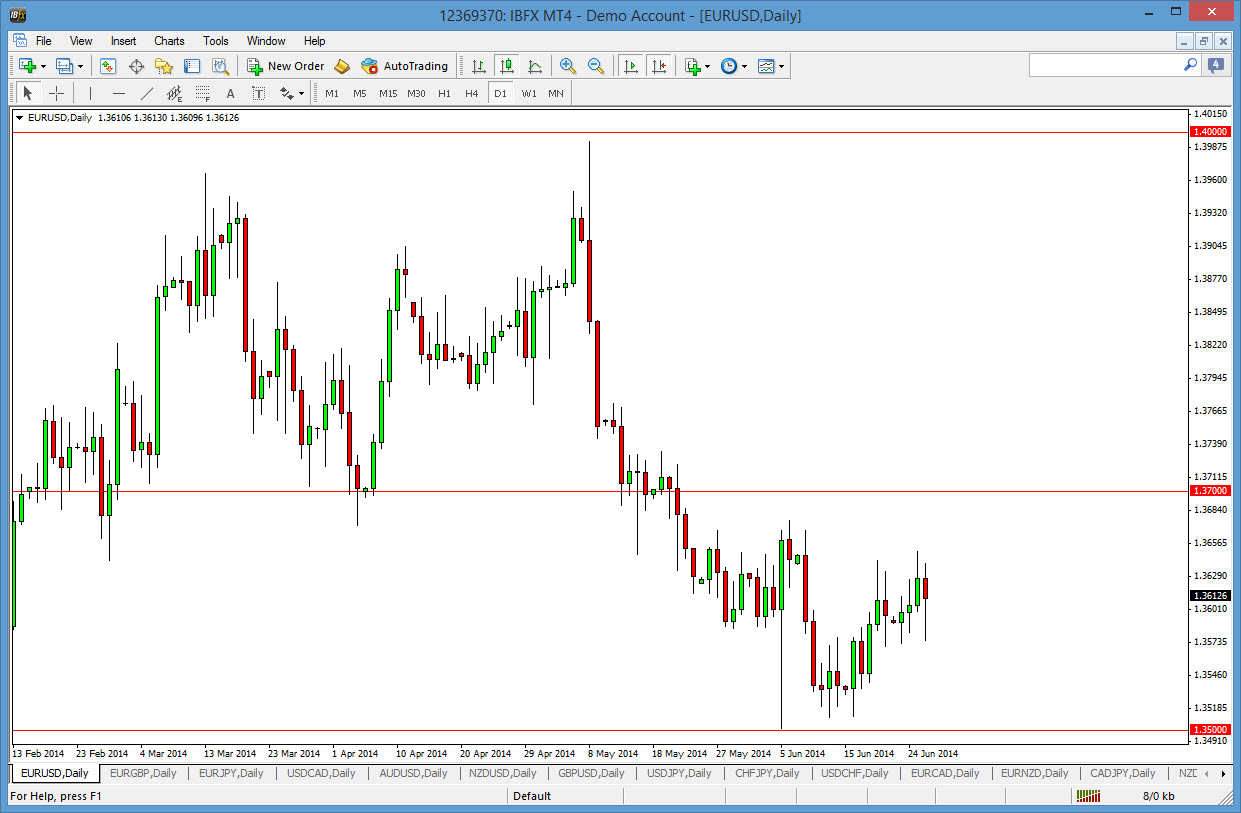

The EUR/USD pair fell during the bulk of the session on Thursday, dropping down to the 1.3575 level. With that being the case, the market ended up finding all kinds of support down there to turn back around and form a massive hammer. The hammer of course is rather supportive, but it’s unfortunately in the middle of a lot of noise. Because of this, I’m not very confident about trading this pair at the moment, and they do recognize that even though it looks like the market is going to struggle to go much higher. Even if it did, the 1.37 level would be massively resistant, and as a result I don’t really feel the need to start buying this market even on a break of the top of a hammer, which is normally one of my favorite signals.

This market is in a range, and I don’t see that changing.

The range that this market finds itself in is relatively obvious, as it appears that the market feels comfortable between the 1.35 level on the bottom, and the 1.37 level on the top. That being the case, it appears that we are essentially right in the middle of that range, and as a result even if we go higher there really isn’t much to be gained. I am much more interested in shorting near the 1.37 level on a resistant candle, or perhaps buying down at the 1.35 level if we see support.

Right now, we are essentially in “no man’s land.” This is the middle of the range and therefore you could look at this as so-called “fair value.” That fair value should continue to attract the market like a magnet, and should also cause a lot of noise and because of that I just don’t see any clear reason to be risking any serious amount of money in this market, as we should continue to see a lot of indecision in this market, as the summer months will certainly bring in less interest in the market as a lot of the big players will be on holiday.