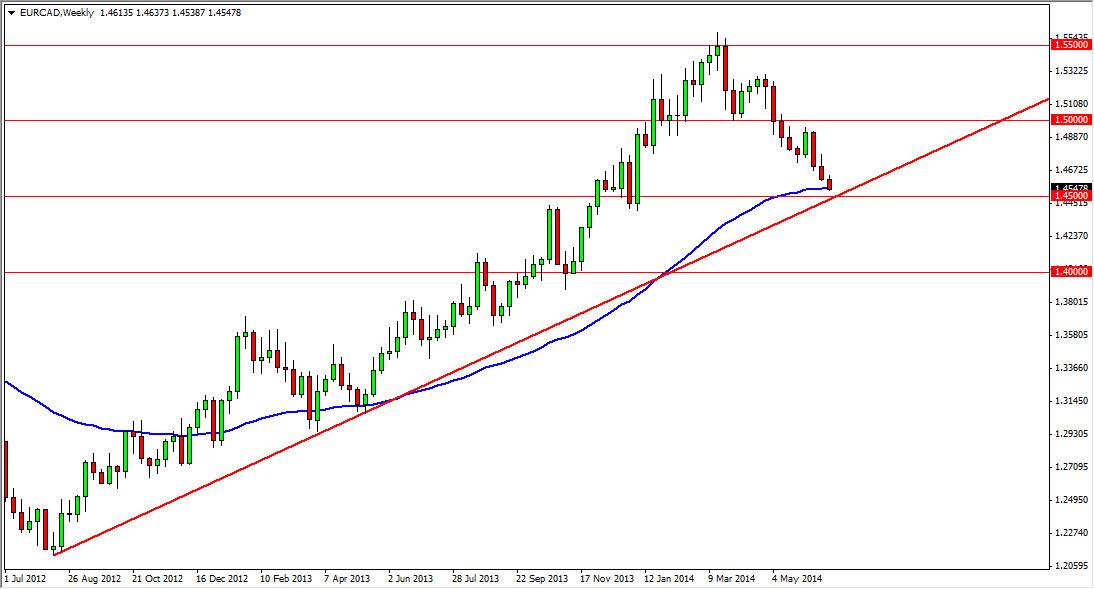

The EUR/CAD pair is one that I believe will be fairly interesting during the month of July. After all, on the weekly chart attached to this article, you can see that the 52 week moving average is sitting just below the candle for the end of June. Also, there is a significant uptrend line that seems to dissect the 1.45 level. With this, we could see a significant amount of support come back into the marketplace, and send this market higher.

I checked the Fibonacci retracement levels, and we don’t really have one in this general vicinity. That’s too bad, because I like to try to line up as many reasons to be in a trade as possible. One of the things that could work in the favor of the uptrend for this market is the EUR/USD. After all, quite often they will move in tandem as it is a “Europe versus North America” play. However, we have to keep in mind that the oil markets look like they could get much stronger. My opinion is that the Euro is much more sensitive to oil prices than the US dollar these days, simply because the Americans are starting to drill significant amounts of oil in places such as North Dakota, Oklahoma, Texas, and of course Alaska.

July could be a very significant month for this market.

I believe the July should be significant for this pair. We have a bit of a binary trade at the moment, we either see the market bounce from here and continue to go higher, or we see a breakdown. It is a bit early to predict which one will happen, but that doesn’t mean that there isn’t a trade here. My opinion is that if we can get a supportive candle on the weekly chart right near the 1.45 handle, the risk reward ratio is certainly worth taking a flyer. On the other hand, if we break down below the 1.45 handle, I believe that we will then head to the 1.40 handle. Remember though, this is not a pair that tends to move rapidly, patience will be required.