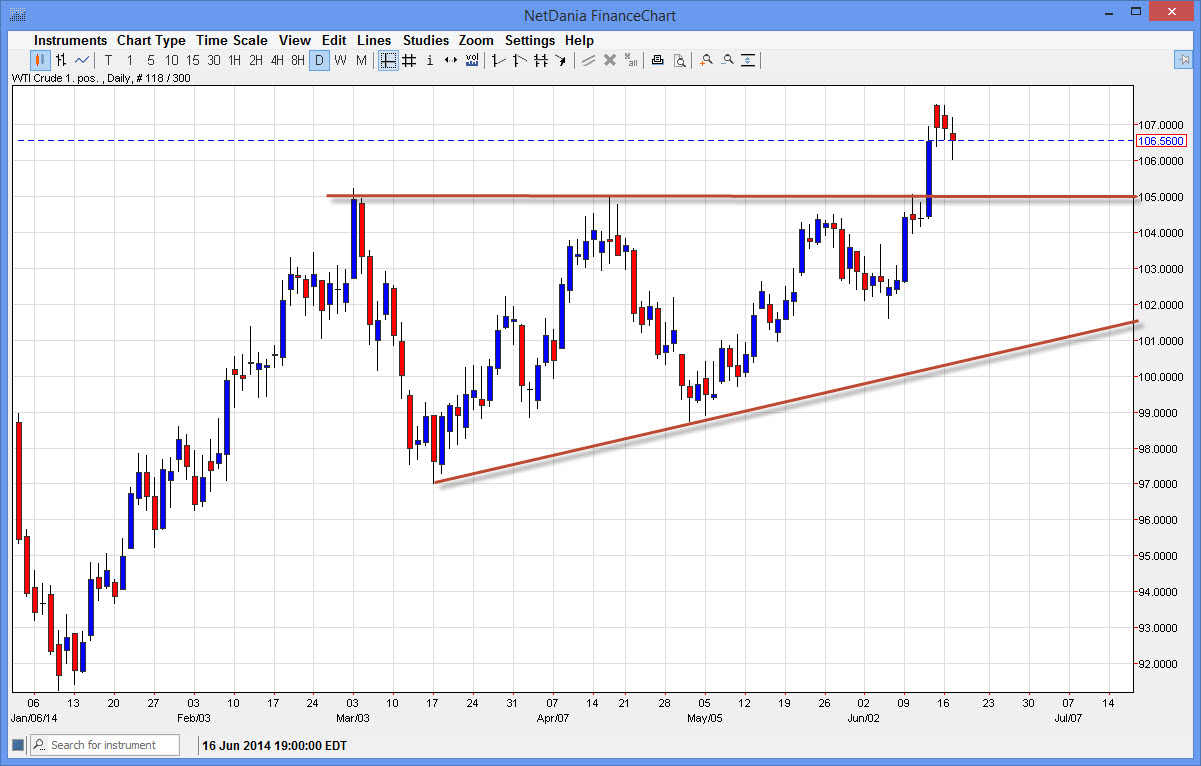

The WTI Crude Oil market went back and forth during the session on Tuesday, finding support down at the $106 level. However, I suspect that there is probably a little bit more in the realm of bearishness, as the $105 level of course was a much more significant resistance area that we broke out of. Many times, when you see a breakout like this, you’ll often see the market come back to confirm that the former resistance is in fact support. I think that’s what’s about to happen, and as a result I would be waiting closer to the $105 level to start buying.

On the other hand, if we do break higher and to a fresh, new high, I believe that I would have to be buying at that point. Ultimately, I don’t see anything that will keep this market from going to the $110 level, which is the next major psychologically significant number. Also, the $110 level is significant on the longer-term charts, which of course will attract market participants.

Headlines will continue to move this market.

I believe that this market will continue to be moved by several different things going on around the world at the moment. One of the most major ones of course is the fact that Iraq is being split into several pieces. This will leave a lot of questions about supply going forward if the insurgents do in fact overthrow the government. This is of course on top of the problems in the Crimea, which of course features Russia, a major oil exporter.

The US dollar is being thrown around at the moment against particular currencies, so there is the possibility that we see US dollar weakness come into play as well, which of course can always move the oil markets to the upside given enough force. I really don’t see a scenario in which I see selling this market, so I am basically looking for an excuse to start buying. It is worth noting that based upon the measurement of the ascending triangle that we broke out well, in theory this market should target the $113 handle.