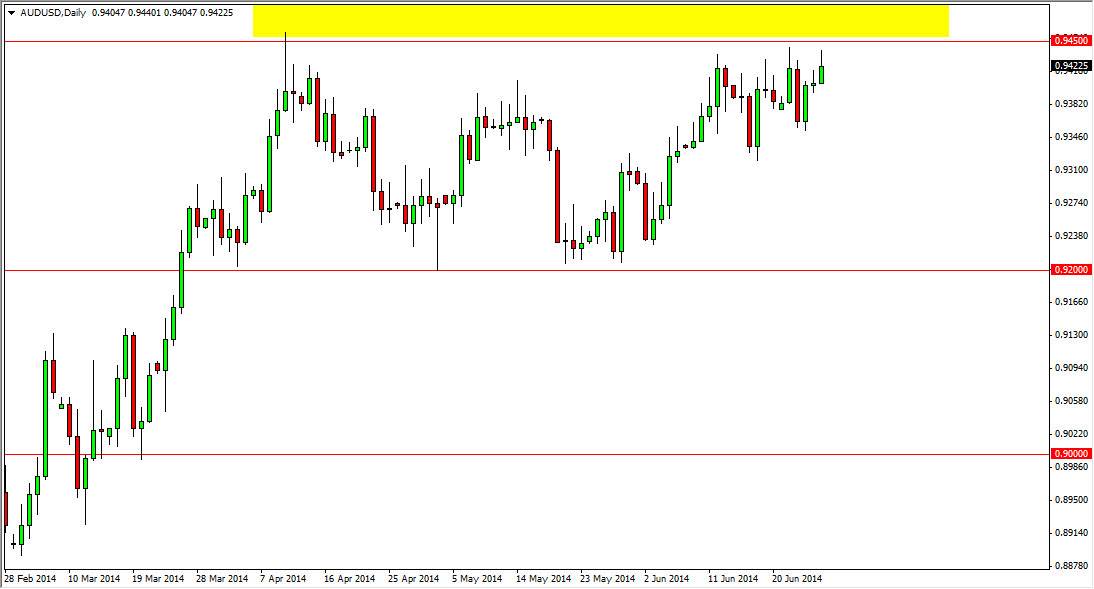

The AUD/USD pair tried to rally during the session on Friday, but failed again near the 0.9450 level. This area has offered a significant amount resistance previously, so it is not a surprise that we struggle to break higher. In fact, I believe that the market has a significant amount of resistance all the way to the 0.95 handle, of course is a large, round, psychologically significant number. This market should continue to the parity level if we can get above that handle, and I believe that gold markets are starting to tell us the same thing.

After all, the gold markets look like the ready to take off to the upside, but need to get above the $1320 level in order to do so. If we can get above there, I feel that the gold markets will go to the $1400 level, and that will more than likely send the Australian dollar much higher as Australia is such a large exporter of gold to the world.

Watch for the old correlations to return.

There are two things that tend to move this market place, one being the price of gold in the other being the interest-rate outlook of the Federal Reserve. While the Federal Reserve has been tapering off of quantitative easing over the last several months, the weaker than anticipated GDP numbers out of the United States seem to suggest that the Federal Reserve won’t be tightening as quickly as once thought. With that, it’s very likely that the Australian dollar will continue to gain against the US dollar, simply because the industry differential should remain favorable to owning the Aussie.

Even if we pullback from here, I believe that the market has plenty of support and the fact that we seem to be forming some type of ascending triangle makes me believe that the market is building up more and more pressure to the upside and it’s only a matter of time before the pressure becomes too great for the bearish to take. Ultimately, they will give up and the market should go much higher, much like a beach ball that has been held underwater. It will eventually shoot straight up, and there will be quite a bit of money to be made in this market.