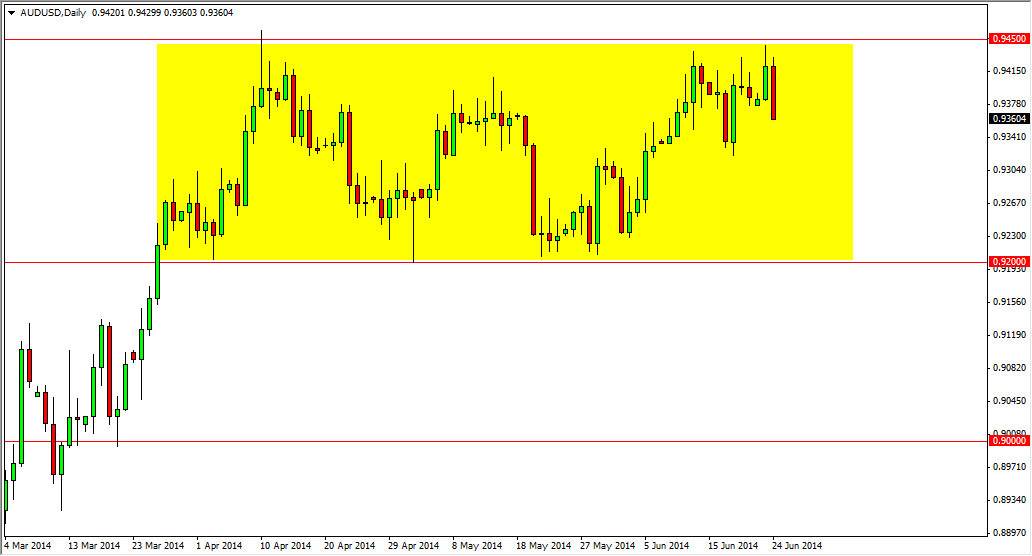

The AUD/USD pair fell hard during the session on Tuesday, showing the 0.9450 level to be resistive enough to keep the market within the consolidation area that has been so important since the middle of May. With that being the case, I feel that the market will probably drift a little bit lower, but I also see a significant amount of support near the 0.93 handle. That area and a supportive candle would be reason enough to start buying in my opinion, as we could simply be trying to build up enough momentum to finally break above the resistance area above.

On top of that, I realize that the resistance probably goes all the way to the 0.95 handle. Because of that, I think that we need to break above 0.95 level in order to have a longer-term buy-and-hold type of situation, but this pullback could be a nice buying opportunity as the support below should bring more buyers in, and could build up enough momentum to finally break out to the upside.

Watch the gold markets as well.

The goal markets have looked a bit perky lately, and because of that I feel that the Australian dollar will probably follow suit even enough time. If the gold markets can break out above the $1325 level, I think that the odds of an Australian dollar break out above the 0.95 level increase massively. It doesn’t mean that it will happen during the same trading session, it’s just that it should send more money into the gold markets, which typically means that the Australian dollar will be picked up as well.

Remember, Australia is a major exporter of gold, and that of course has massive relation with the home currency. Ultimately though, I believe it also is a symptom of low yields in the United States. The bond markets in America still offer very little in the way of return, and traders are quite frankly starting to be forced into riskier assets, courtesy of the Federal Reserve. I think we break out, it’s just a matter of when.