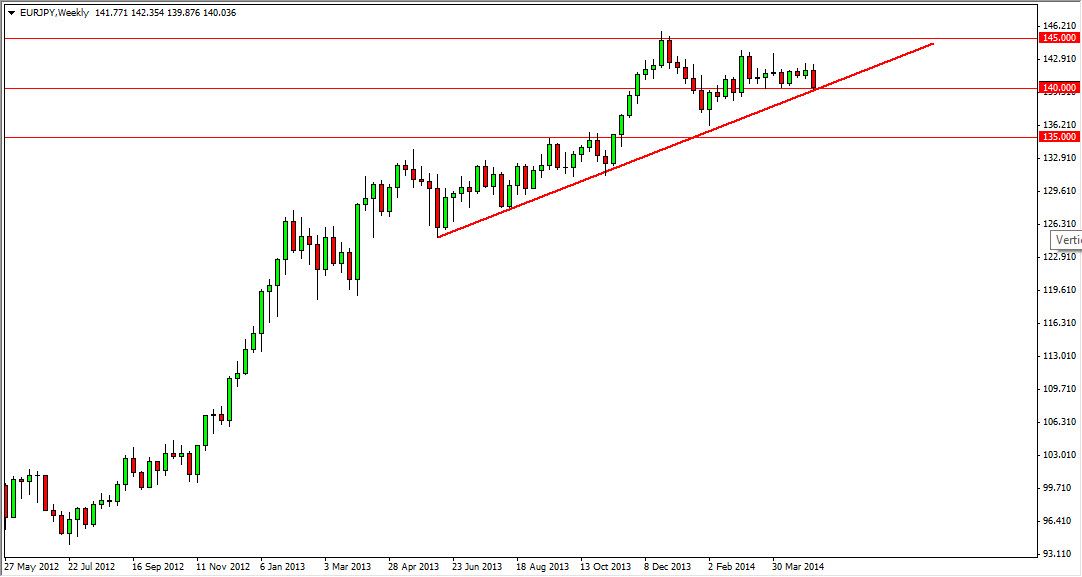

EUR/JPY

The EUR/JPY pair initially tried to rally this past week, but in the end fell like a stone. The Euro fell everywhere, as the ECB stated it was willing to intervene in June if the value of the Euro seemed too high. With that, the EUR sold off, and this pair was of course no different. However, there is significant support at 140, and a trend line to deal with. Because of this, I wouldn’t be too surprised at a bounce. However, if we fall below 139 – look out below.

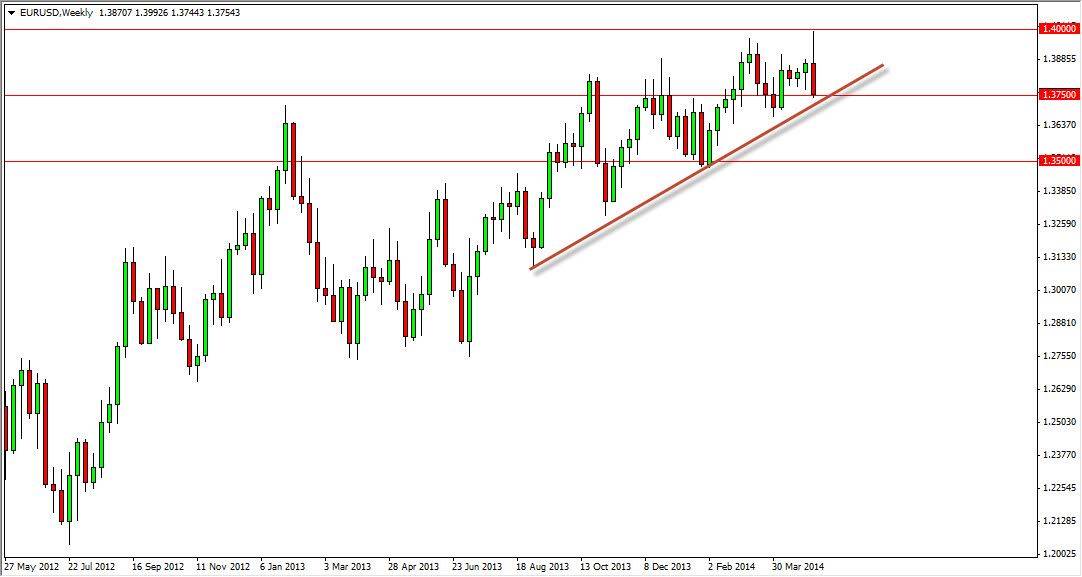

EUR/USD

The EUR/USD did almost the same thing, but initially rallies much harder. This will be the epicenter of the fight for the ECB, as the 1.40 level is truly what has caused so much concern for Brussels. The pair is sitting on the 1.3750 level, and an uptrend line as well. Because of this, I think it is only a matter of time before the buyers step back in – but I think the bounce will only offer further selling opportunities. As with the EUR/JPY, there is a point where I would expect a serious fall – maybe at the 1.37 level?

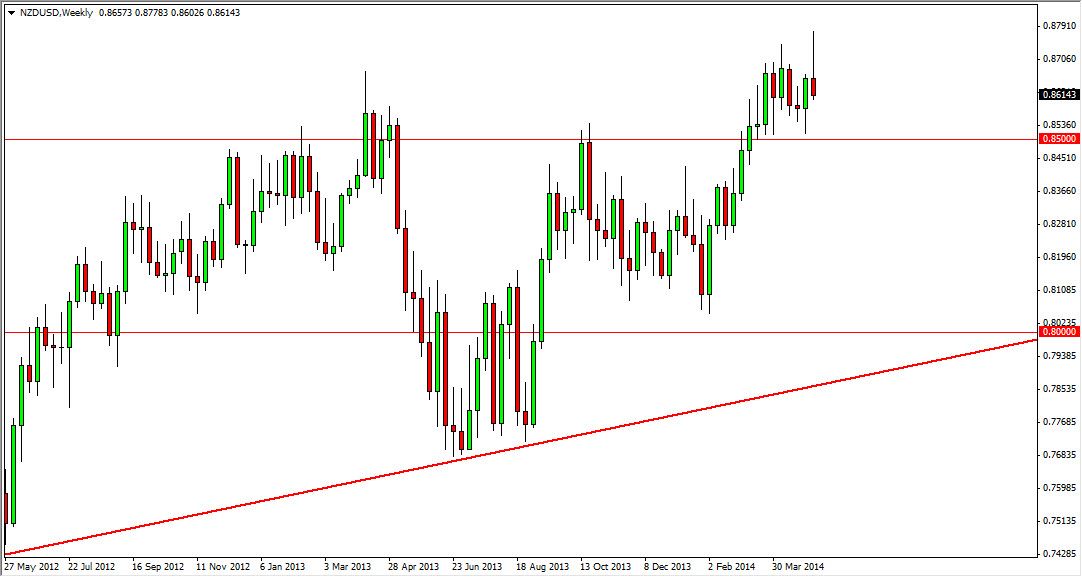

NZD/USD

The NZD/USD pair initially rallied as well, but found a ton of resistance at the 0.88 level. This isn’t a huge surprise, but in the end the New Zealand dollar has been very well supported over time, and as a result I think that the shooting star that has now formed for the week is simply a statement that the market intends to pullback and find buyers below in order to continue going higher. The 0.85 level is supportive, and I think the buyers will show up closer to that handle.

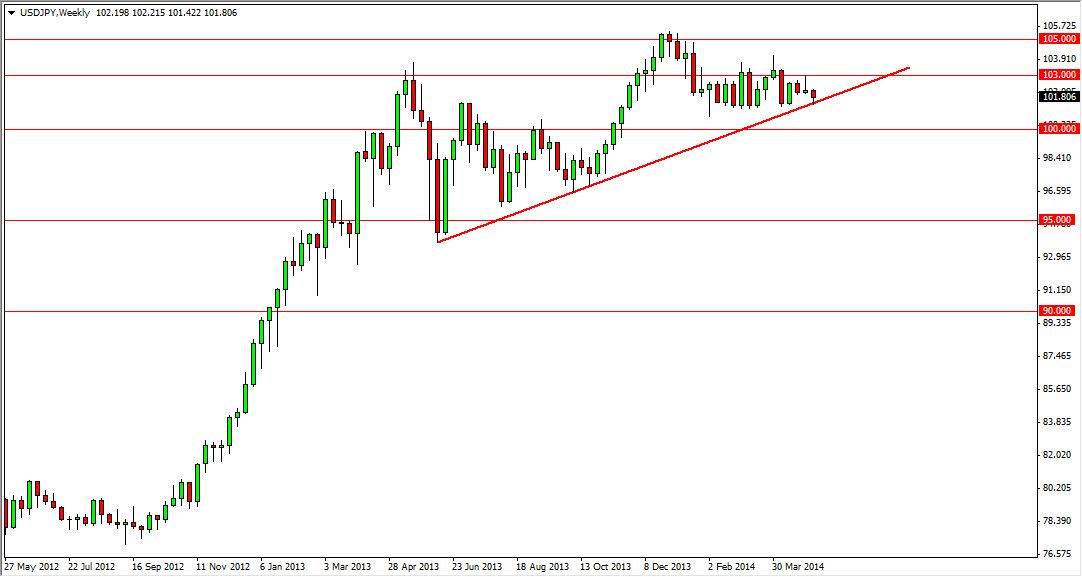

USD/JPY

The USD/JPY pair fell most of the week, but got a bit of a boost in the end. The resulting hammer is interesting to me, as it sits on top of two support levels – the 101.50 area, and the uptrend line on the chart. I think that this week will be important, and I admit I have an upside bias in this pair. Because of this, I think we will in fact go higher, and that the market will target 103 first, and then the 105 level. However, if we break below the 101 level – 100 is calling, and then 98.