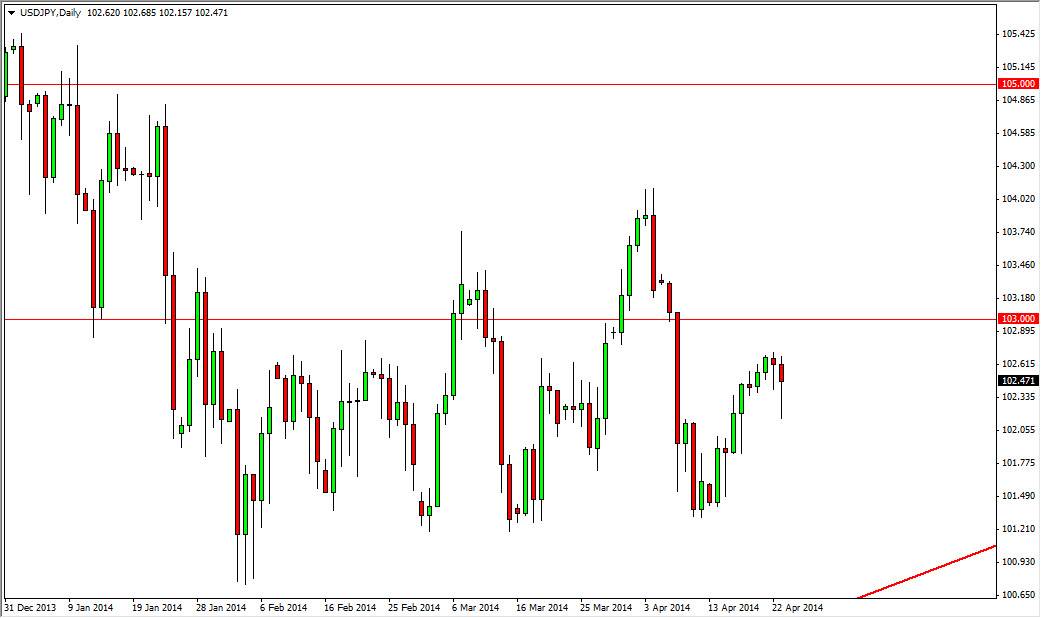

The USD/JPY pair fell most of the session on Wednesday, but found enough support right around the 102 level in order to bounce and form a hammer area of course his hammer is a significant bullish sign, and the fact that it is that the top of the mini cluster doesn’t exactly hurt the bullish case either. On top of that, there is quite a bit of noise down to the 101.50 level, an area that is provided support for the buyers several times now since New Year’s.

Those of you that are been following my reports know that I am long-term bearish of the Japanese yen anyway, especially considering that the Bank of Japan has been entering quantitative easing operations time and time again to bring down the value of the currency. Remember, the Japanese need a week Yen in order to lift exports, as the economy is so export driven.

Expect continued QE from the Bank of Japan.

Ultimately, the Bank of Japan will get what it wants. This looks a lot like 1995, when this pair bounced around for several months before finally taking off to the upside. The Bank of Japan is willing to step in and buying Japanese government bonds driving the interest rates down. Remember, this pair tends to fluctuate based upon the interest rate differential of the bonds from both the 10 year markets, and as the Federal Reserve continues to taper off of monetary easing, the same 10 year notes in the United States should offer more interest.

Full disclosure, I am short of the Japanese yen against other currencies, but not the US dollar. That is a straight differential play, so when you’re talking about a currency like the Turkish lira or the New Zealand dollar, you have much more of a “carry trade” feel. It’s going to be a while before we see that truly come out in this pair, but eventually the Americans will have to raise interest rates one way or the other. Once that happens, the Bank of Japan will get its wish, and this pair will continue higher. The meantime, I’m looking at 103 as the first target, 104 next, and then 105. Above 105, we certainly to the 110 level, which is my target for the end of the year.