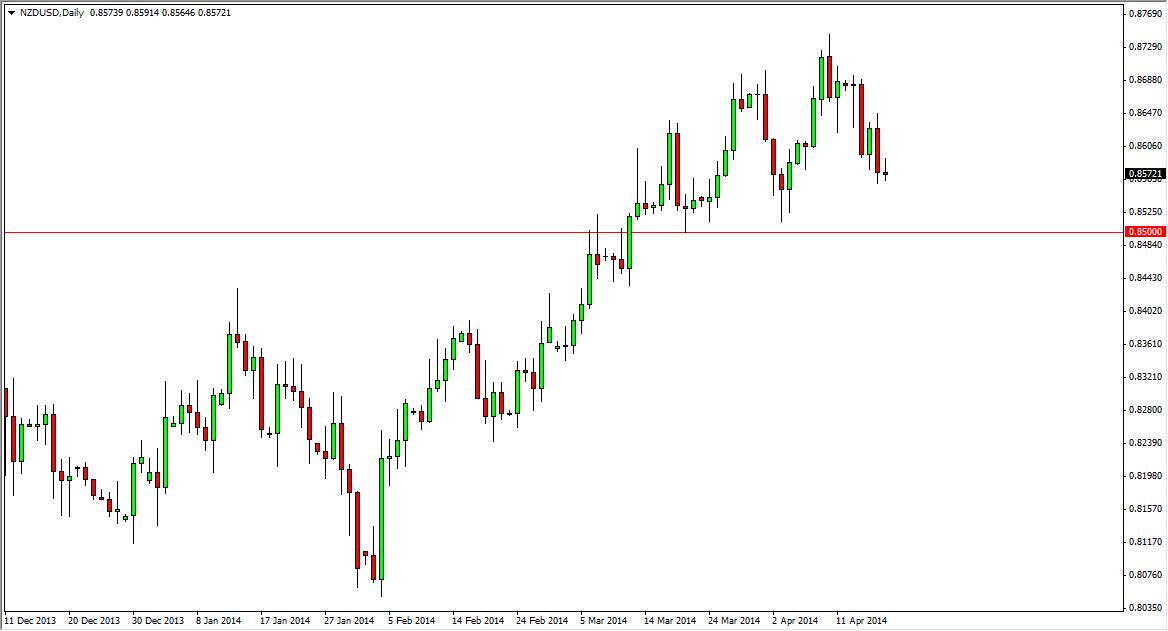

The NZD/USD pair tried to rally a bit during the session on Friday, but with the Good Friday holiday in full fact, liquidity just wasn’t enough to push the market in one direction or the other. That being the case, there is a too much you can read from the daily candle, but the fact is that the hair has been drifting lower lately, and even with the pullback at this point in time, we are still well above significant support at the 0.85 handle. Because of this, I believe that this market could very easily pullback a little bit, before finding a significant amount of support down at the aforementioned 0.85 level.

Because of this, I feel that this market will more than likely try to continue going higher in the long-term, but in the end we have to wait for some type of supportive candle in order to get involved. Certainly the candle that formed on Friday didn’t give us much of a sign that the market is ready to pop higher, and the more realistic candle that was formed on Thursday certainly doesn’t do much to garner any type of confidence either.

Pay attention to the commodity markets.

Pay attention to the commodity markets around the world, as the New Zealand dollar tends to be greatly influenced by the risk appetite of investors. If commodities go higher in general, as well as perhaps the stock markets, that is a sign that the New Zealand dollar should continue to go higher at that point. I see plenty of support below that tells me it should anyway, and I don’t think that there’s any real fear of this market coming undone anytime soon. After all, there is plenty of support at the 0.85 level, the 0.84 level, and you could even make an argument for the 0.8350 handle. With that much noise below, it’s very difficult to imagine selling this pair anytime soon. All I’m doing is waiting on some type a supportive candle in order to get involved again, as I believe that the uptrend is still very much intact.