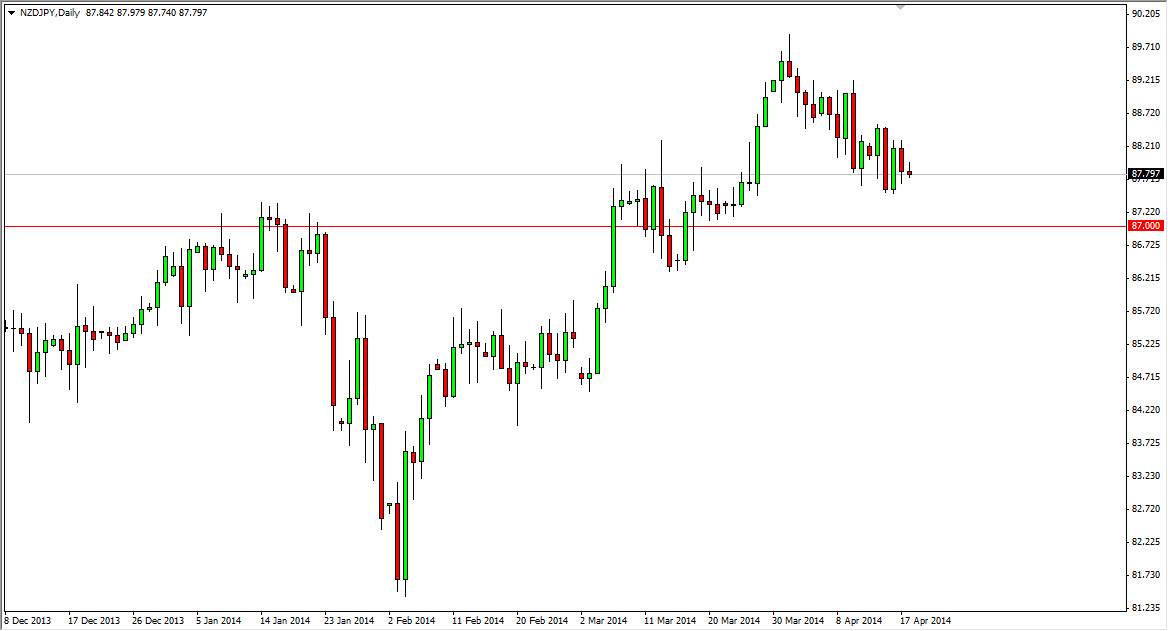

The NZD/JPY pair had a slightly negative session on Friday, but with the low liquidity in the marketplace, it’s very difficult to make much out of that particular candle itself. Nonetheless, the New Zealand dollar has been drifting lower lately, against not only the Japanese yen, but most currencies around the world. That being the case, it tells me that we are still drifting a little bit at this point, and because of this I am actually waiting for a decent candle to get involved in this market which is most certainly in an uptrend.

With that, I’m looking for supportive candle between here and the 87 handle, as I would expect a lot of buying pressure to be in that cluster. At the moment though, I’m going to have to wait for daily close in order to risk any trading capital as there are potential issues in this general vicinity, after all we could meander around the 87 handle for a while. It has been a place of consolidation in the past, and quite frankly there’s nothing to stop it from being so again.

Risk on

The first thing you need to know about this pair it is essentially a “risk on market.” In other words, if risk is doing well around the world, with stock markets and commodities for example, this pair will climb over time. It’s the interest rate differential the drives this pair, and even though the New Zealand interest rates aren’t nearly as high as they once were, they are still astronomically higher than the Japanese interest rates, especially considering that the Bank of Japan has made it very clear that they are looking to add further stimulus sometime in the future.

With this, I believe that this pair does continue going higher, but perhaps we have just needed to take a little bit of a rest after the recent breakout. After all, we did fail at the 90 handle which of course is a large, round, psychologically significant number. I think that we are to simply trying to build up enough momentum to break above the 90, and head much higher.