EUR/USD Signal Update

Monday’s signals were not triggered and expired.

Today’s EUR/USD Signals

Risk 0.50%

Entries must be made before 5pm London time today.

Long Trade 1

A long trade can be taken following confirmation price action on the H1 time frame following the first touch of 1.3751.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even at 1.3788.

Remove 50% of the position as profit at 1.3810 and leave the remainder to run.

Short Trade 1

A short trade can be taken with a sell limit order at the first touch of 1.3949.

Put a stop loss at 1.3983.

Adjust the stop loss to break even at 1.3915 and take 40% of the position off as profit there.

Leave the remainder of the position to run.

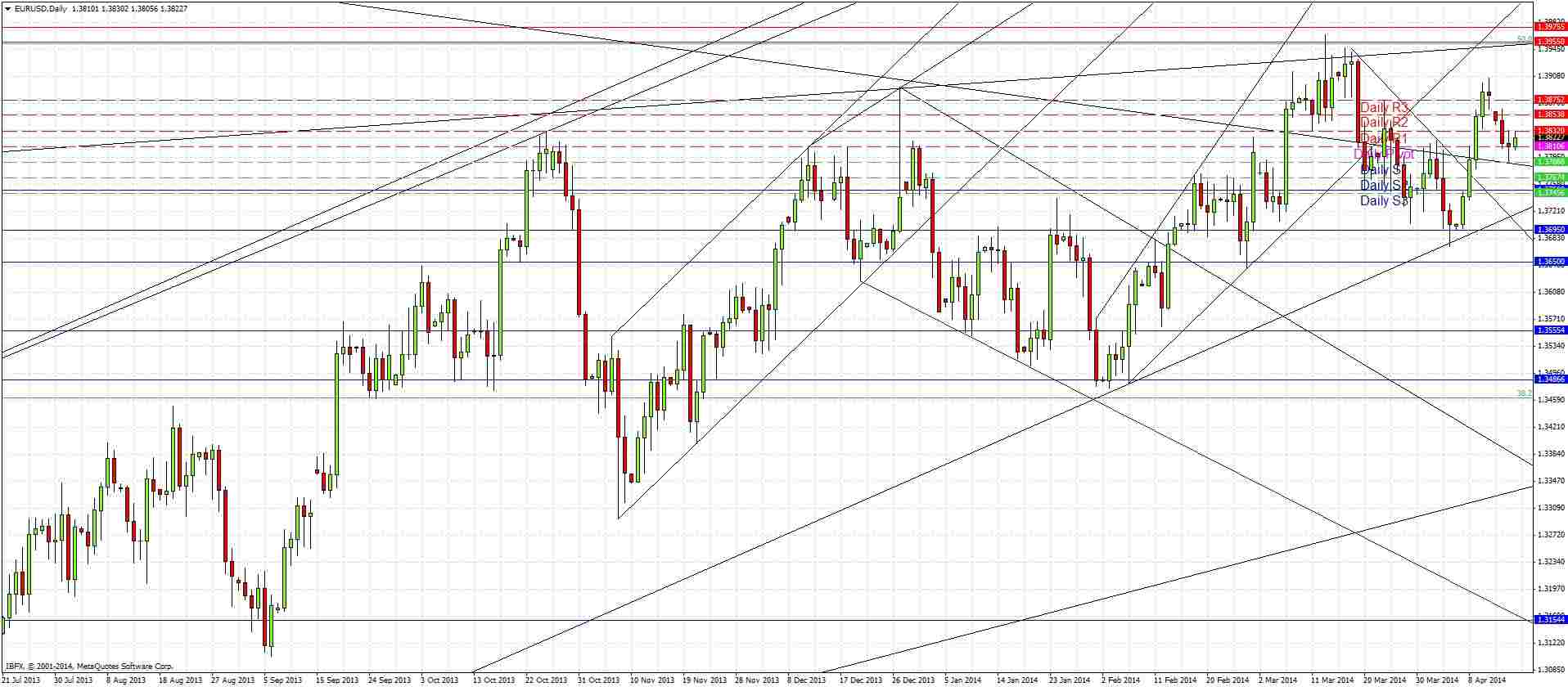

EUR/USD Analysis

Following my previous signals and analysis two days ago on Monday morning, the pair continued to fall and the weekend gap has still not been filled. We did find some support a little below the 1.3800 level just above the broken long-term bearish trend line, which is a somewhat bullish sign. However we do not have any very good support or resistance levels anywhere nearby between 1.3750 and 1.3955, which combined with the general lifelessness of the market right now will probably make today not a very good day to trade.

We have a little upwards momentum now this morning prior to the London open so it might be that the weekend gap gets filled. However the Chair of the Federal Reserve is due to speak after London closes today, so it may well be that today’s real action will only occur after that time.

It is unlikely we will reach either of the interesting levels today before London closes. The broken long-term bearish trend line could become especially powerful when it becomes confluent with the 1.3750 area. Above us there is excellent confluence at the 1.3950 area where a long-term upper channel trend line is confluent with both the flipped resistance zone and the 50% level of the major downwards move that has occurred over the past few years.

I agree with Christopher Lewis that this pair looks likely to be choppy now, but I have identified the very long-term bearish trend line as already broken and below us, while he has drawn it above us. Therefore he is technically more bearish than I am. I see the position of the major trend lines right now as still showing a fairly bullish picture, as we are still within a bullish channel and have broken out from a bearish inner trend line.

There are no high-impact news releases due today concerning the EUR. At 1:30pm London time there is a release of US Building Permits data. The Chair of the Fed is speaking just after the London close at 5:15pm. Therefore it is likely to be a quiet day for this pair, especially before the New York open.