USD/JPY Signal Update

Yesterday’s signal expired without being triggered, as the price never hit 102.83.

Today’s USD/JPY Signal

Risk 0.75%.

Entry may be made at any time up until 8am London time tomorrow.

Long Trade

Enter long upon the first next bar break of any bullish pin or engulfing hourly candle after the first touch of 102.83. After one hour from the close of the first hourly candle that closes above 102.83, this trade becomes invalidated.

Put the stop loss 1 pip under the local swing low.

Move the stop loss to break even when the price reaches 103.44. Take 75% of the position as profit at this level and leave the remainder to run.

Short Trade

Enter short upon the first next bar break of any bearish pin or engulfing hourly candle after the first touch of 103.84. After one hour from the close of the first hourly candle that closes above 103.84, this trade becomes invalidated.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 103.00. Take 75% of the position as profit at this level and leave the remainder to run.

USD/JPY Analysis

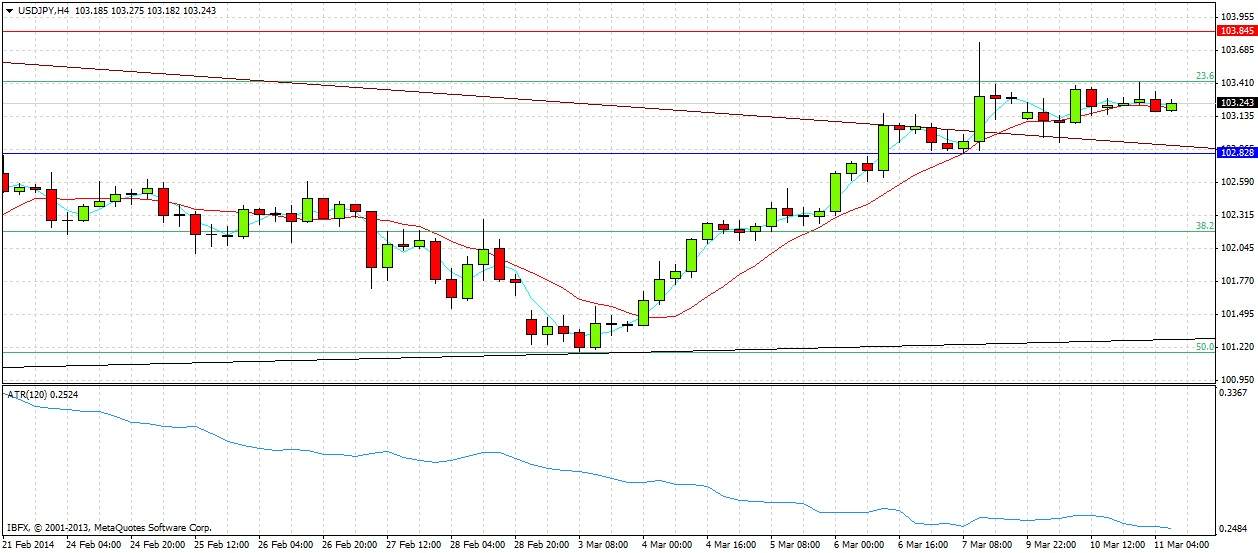

Last week saw a strong move up by all the major currencies against the JPY. This pair broke a bearish trend line that had been established since early January. Yesterday was expected to be a quiet day and in fact it was quiet, with the pair printing a somewhat bullish inside candle on the daily chart, with yesterday’s low just retesting the broken trend line from above before moving up modestly.

Although we have already had a bullish retest, I am still waiting for the price to fall down to the 102.83 level which is currently quite confluent with that trend line, and to look for an opportunity confirmed by price action there. As we have a confluent of a flipped resistance to support level and a broken trend line retest, this should be a high-probability trade.

Unfortunately there is plenty of local resistance not far overhead at around 103.40, which is the 23.6% Fibonacci retracement level of the previous major long-term upwards move. Above that we have a resistance level at 103.84, where I am now prepared to look for a short trade if confirmed by the price action when the level is next reached.

There are no important data releases scheduled today concerning either the JPY. Regarding the USD, at 2pm London time there is the USD-related JOLTS Job Openings. It may be another relatively quiet day for this pair.