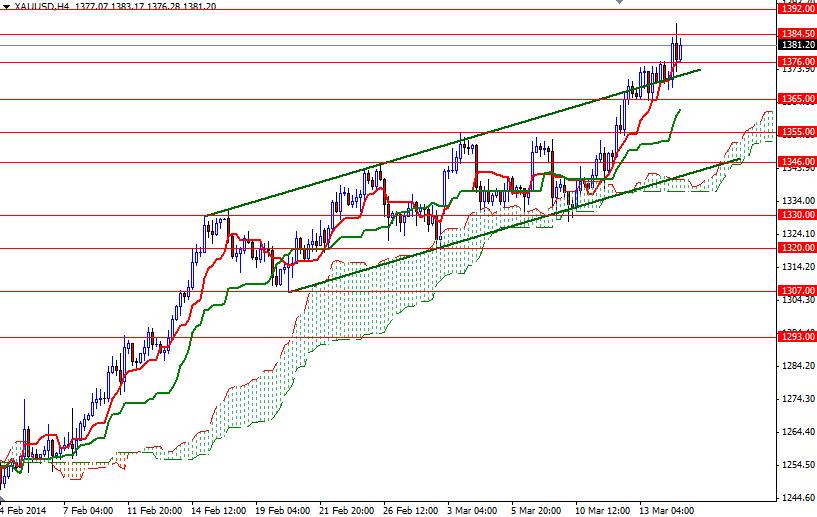

Gold prices rose 3.15% over the course of the week as safe-haven demand continued to lure more investors back into the market. The XAU/USD pair (Gold vs. the American dollar) traded as high as $1387.84 an ounce after the bulls managed to break through the 1376 resistance which I earlier pointed out as a key to higher levels.

Lately, there has been a constant upward pressure on the precious metal as investors have become more anxious about growing tension between Ukraine and Russia but dollar weakness is another reason gold is firmer now. In the latest economic data, the University of Michigan's consumer sentiment index came in at 79.9, down from the previous month's 81.6 and below expectations for a reading of 81.8.

Friday's data from the Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 118890 contracts, from 115166 a week earlier. If the situation doesn't stabilize, I think market players will continue to flee from equities and flock to gold. But if the crisis is resolved and fear factor is removed from the market, gold can lose its gleam quickly.

From a technical perspective, trading inside the Ichimoku cloud on the weekly time frame suggests there will tough challenges waiting the bulls. If the XAU/USD resumes its bullish sentiment and leaves the 1384.50 resistance level behind, I will look for 1392/8. Once the pair clears 1400, more resistance will be waiting at 1416. If the bulls run out gas, expect to see some support at 1376. Closing below this support would indicate that the pair is heading back to 1365.

A heavy slate of key economic indicators will be released next week, including Empire State manufacturing index, industrial production, building permits, consumer price index and existing home sales.