EUR/JPY

The EUR/JPY pair did very little over the course of the previous week, but remains above the vital 140 level. Because of this, I am still bullish of this pair, but recognize that the market is stalling a bit. A break above the top of the range for the week would be enough to convince me that we are going to the 143 level, and then onto the 145 level. Eventually, I believe this pair heads to the 150 level this year.

USD/CAD

The USD/CAD pair rose during the week, and more importantly – broke above the 1.12 level. This area was a “trigger” of sorts for me as I think it sets us up to rise to the 1.15 level. This pair has been very bullish, and we even had a Bank of Canada governor suggest that “a rate cut isn’t out of the realm of possibility” this past week. This should continue to hurt the Loonie, especially since the Federal Reserve is already in the process of tightening. I think we continue the bullishness over the next few weeks.

EUR/USD

This pair fell during the week, failing at what I see as a major downtrend line. This line is from the monthly chart, and extends all the way back to the beginning of the financial crisis. In other words, it is about as important as it gets. I believe the “line in the sand” for the ECB is now the 1.40 level, and because of this I think this pair continues to have a negative bias to it, but as per usual – the Euro will be choppy, because that’s what it does now it seems. I have a negative bias, but to be honest can think of several other markets I would prefer to be involved in.

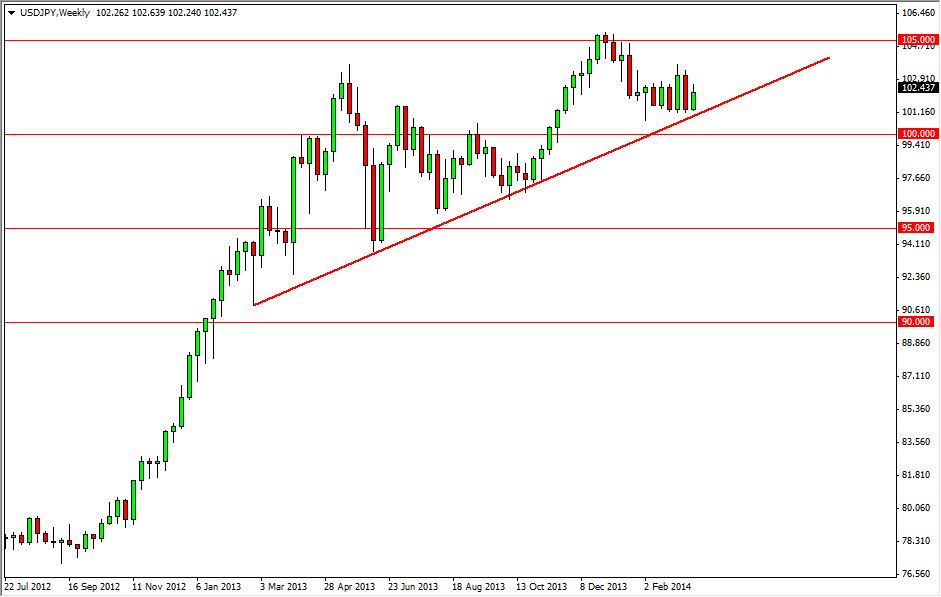

USD/JPY

The USD/JPY pair rose during the previous week, but as you can see didn’t necessarily take off. However, there is a nice trend line just below, and as a result I think we should continue to see bullish pressure overall. The pair should try to reach the 103 level first, and once we break out above it, goes to the 105 level. The 105 level should offer significant resistance, but I still believe we will go higher than that given enough time. The reality is that the interest rates differential should continue to favor the US, and as a result we should continue to see this pair rise over the long-term.