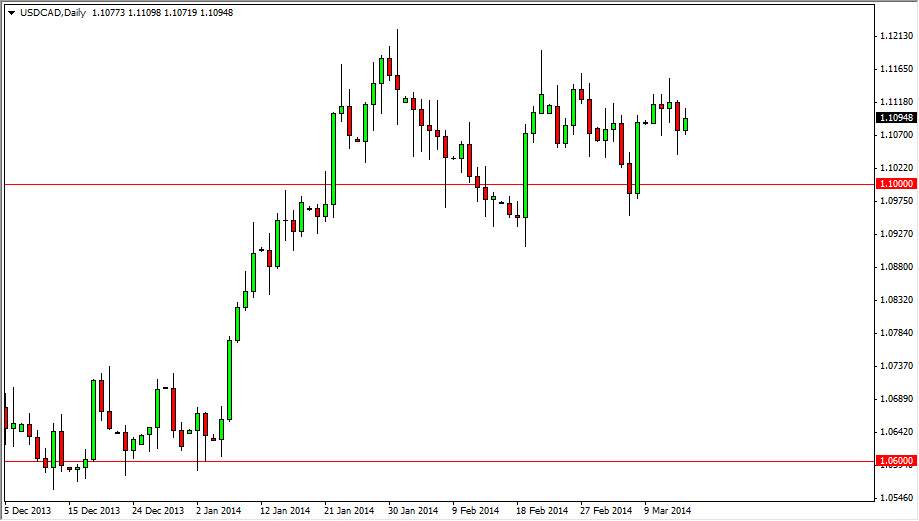

The USD/CAD pair rose slightly during the session on Friday, closing just below the 1.11 level. This level has been a magnet for price, but ultimately we have been consolidating between the 1.09 level, and the 1.12 level. That to me is the essence of the market right now, simply consolidation. This pair has a long history of going sideways like this for extended amount of time, and then breaking out to one direction or the other.

This market looks like one that is simply trying to figure out which direction to go, but I’m pretty convinced that we are going to go higher simply because the oil markets really haven’t been helping the Canadian dollar recently. On top of that, interest rates in the United States should begin to rise over the longer term, and the interest-rate differential between the United States and Canada isn’t that great to begin with. With that, I would suspect this pair will eventually break out.

The 1.12 level remains vital.

I still believe that the 1.12 level remain vital, and will have to be broken to the upside in order to be completely confident of having a large amount of money in this market. However, I think that once we break above there the 1.15 level will be had relatively soon. I also believe that there is a significant amount of support below, and as a result I would be interested in buying supportive candles below, especially near the 1.10 level or the 1.09 level.

The support down there should continue to offer buying opportunities going forward, and I believe that short-term traders will continue to love this market as it seems to be in a fairly well-defined range. I think that short-term traders will continue to enter the market again and again, until of course we finally break out to the upside. If we managed to break down below the 1.0850 level, I think at that point in time the market could fall apart down to the 1.06 handle. However, that’s something that I don’t see a lot of danger of happening.