Gold declined for the first time in six sessions on technical selling and signs of stabilization in the risk environment. Stocks also rose yesterday, giving less reason for investors to buy gold, following a series of better than expected data out of the world's biggest economy and the limited sanctions on Russia announced by the United States and European Union. Data released by the Federal Reserve showed that industrial production increased 0.6% in February after having declined 0.2% a month earlier.

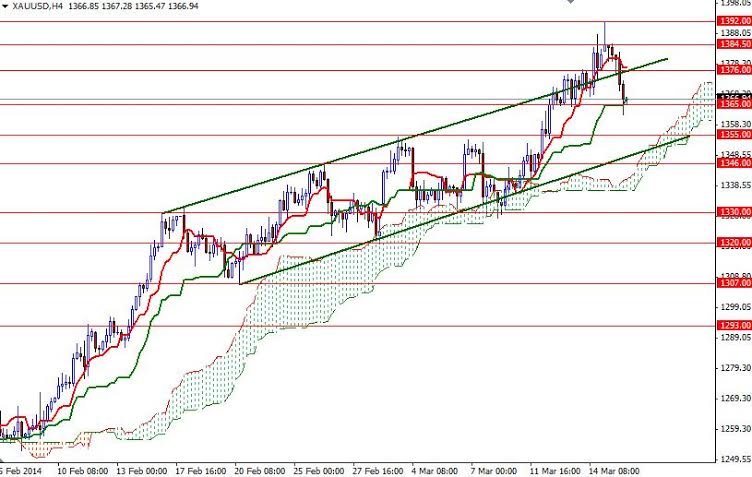

The New York Fed reported that manufacturing in the region climbed to 5.6 this month from 4.5 in February and the National Association of Home Builders' sentiment index came in at 47, slightly up from the previous month's 46. The XAU/USD pair retreated to 1365 support level after it found strong resistance at the 1392 barrier.

The pair is trying to hold above this level during the Asian session today but yesterday's bearish engulfing pattern indicates that higher prices are being rejected by traders. That means if the bears increase downward pressure and drag prices below this support at 1365, it is likely that the pair will test the 1355 level which was the top of the previous consolidation area.

If that is the case, I would expect to see some support between 1355 and 1345. But if that support can't hold the market, I think the bears will be aiming for 1333/0 next. In order to maintain the control, the bulls will have to push the XAU/USD pair above the 1376 resistance level at least. Only a close beyond 1384.50 could give the bulls another chance to test the 1392 resistance level again.