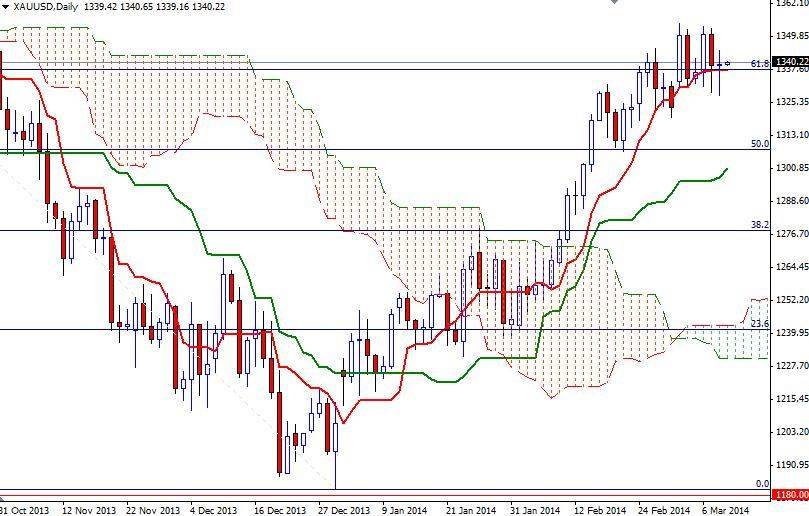

The XAU/USD pair initially fell during yesterday’s session but bounced enough to close just above the 1337 support level where the Fibonacci 61.8 retracement level and Kijun-sen (twenty six-day moving average, green line) on the daily chart coincide. Yesterday, the pair traded as low as $1328 an ounce as a series of weaker than expected data out of China raised concerns about country’s economic growth this year but heightened geopolitical worries gave the bulls another chance to push prices higher.

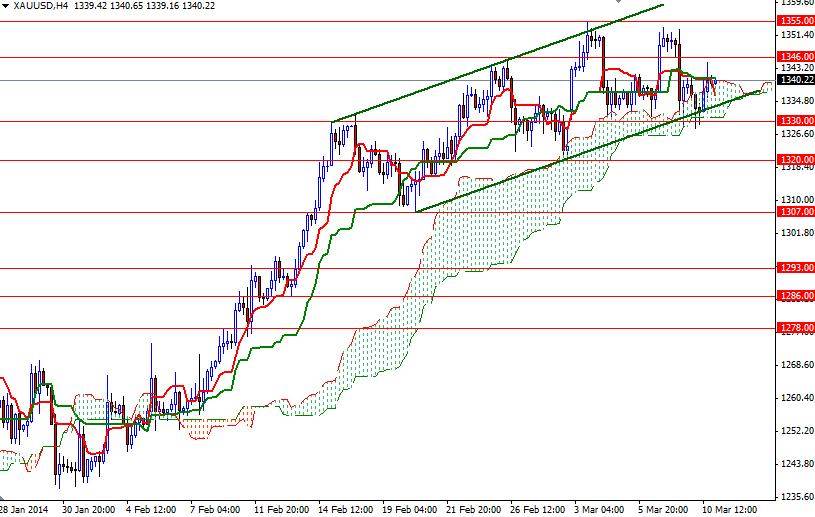

The Ukrainian crisis has been reinforcing the precious metal's safe-haven status lately but the bullish side of the boat is so overcrowded. With that in mind, I will be following the ascending channel on the 4-hour time frame.

From a technical perspective, unless the pair makes a sustained break below 1330, it might be too early to consider a top formation. If the channel pattern holds, we could see the bulls marching towards 1355 again but in order to gain enough momentum, they will have to push prices above the 1346 resistance level first.

Breaking through the 1355 level would indicate that the market will be targeting the 1361.76 resistance level next. If the bears take over and prices drop below yesterday's low, it is likely that the XAU/USD pair will test the 1320 support level. A daily close below 1320 would shift things to the bears and increase selling pressure. In that case, the next support to pay attention will be the 1307 level.