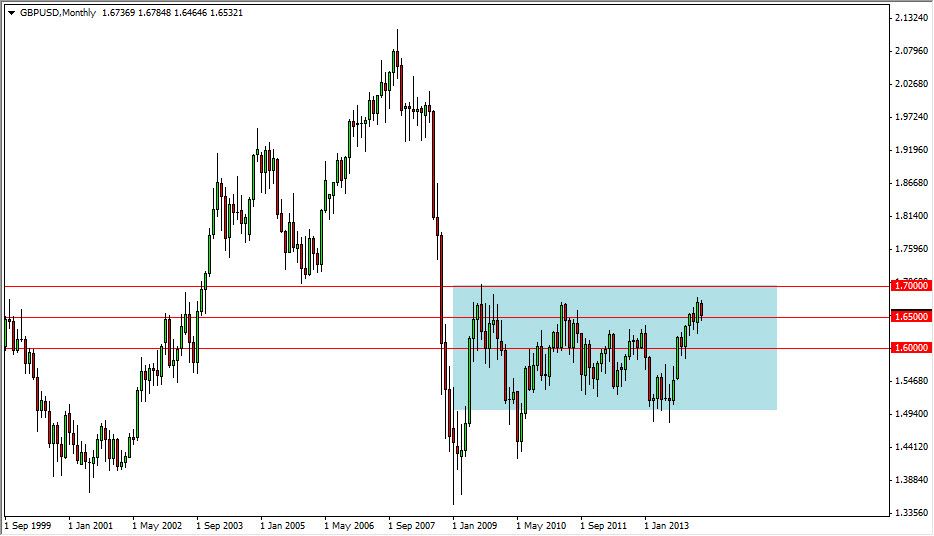

The GBP/USD pair has been relatively bullish of the last several months as you can see on the attached monthly chart, but we’re still essentially in consolidation. This brings up an interesting conundrum, as I believe that the 1.70 level is in fact a major spot on this chart. After all, it is the top of a consolidation area that goes all the way back to late 2008. If we were to break above the 1.70 level, this would in fact be a massive change of events.

With that being said, I have to ask myself that there’s a reason why the British pound would break out to the upside. Granted, the British pound of course is being influenced by the fact that the central bank seems to be a situation where it cannot loosen monetary policy much more, and that of course by default will give the British pound a little bit of buoyancy in the currency markets.

Two scenarios.

Speaking more from the technical analysis side, I believe that this market will in fact test the 1.70 level fairly soon. The real fight is there. My question then becomes whether or not it can continue higher. Quite frankly, if this market closes on a weekly candle stick above the 1.70 handle, I think it is the beginning of a massive uptrend that will eventually see is hit the 2.00 level, albeit down the road. With that being the case, even a losing trade or two trying to place a short position in this market based upon that resistance would easily be made up, as you would have a chance to pick up 3000 pips if I’m correct.

On the other hand, if we continue much lower, I believe that this market could stay in the consolidation area, and therefore move down to the 1.50 level. With that, we would have significant enough space to make a serious money on the downside. However, I would suggest that the pair has been grinding away for some time now, but the latest move over the course of the last year or so has been much sharper. Because of this, I do think we will break out to the upside, but the real question is whether or not we can do it in the next couple of months? I will be watching, and again, if we can get above the 1.70 level on a weekly close, I would be in buy-and-hold mode at that point in time.