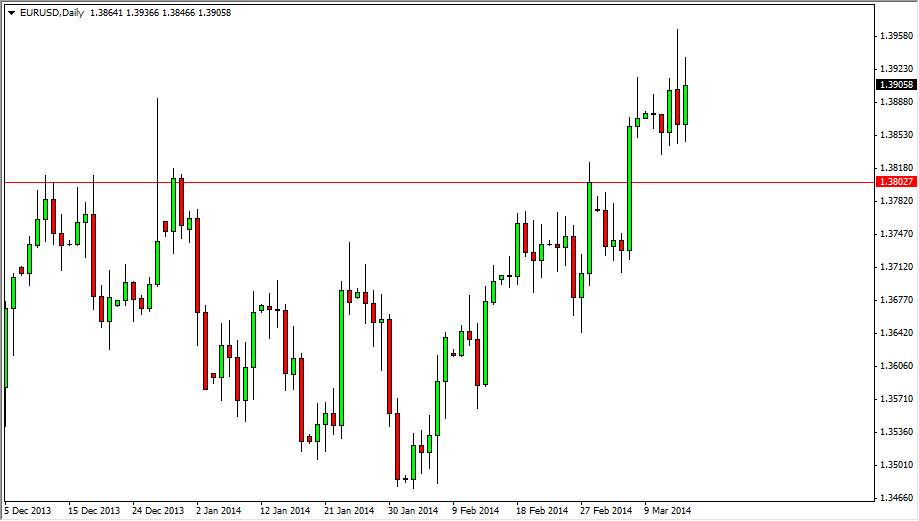

The EUR/USD pair rose during the session on Friday, but stays within the reason consolidation area that we have been. Because of this, I feel that this market will more than likely try to break out to the upside, but have a lot of work to do at the moment. On top of that, we are approaching a fairly significant downtrend line from the monthly timeframe, and as a result it’s going to take something special to break out to the upside.

However, if we managed to break above the recent high, I think that this market could very easily go to the 1.50 level without too many issues. That area is what I’m aiming for as far as a longer-term target is concerned, and as a result on that break higher I would be willing to not only buying this pair, but to continue to bite every time it falls and find support. I believe that it will be a “buy and buy again” type of market going forward.

Plenty of support below as well.

I see significant support at the 1.350 level, the 1.38 level, and the 1.37 level. In fact, it is not until we get below the 1.37 level on a daily close that I would even consider selling this pair, because that would signify a significant break down of momentum. That breakdown of momentum could lead this market to fall as low as 1.28, or even as low as 1.20 if we have enough momentum behind it.

A lot of this is going to come down to the interest-rate differential as per usual, and with the Europeans recently stating that they weren’t going to institute any monetary easing, this, the market little bit off guard and put a bid back into the Euro. With that, I would expect continued buying pressure, but as you know it only takes a few scary headlines give people buying the US dollar again. Given the state of the world at the moment, that’s not a difficult situation to imagine at this point in time.