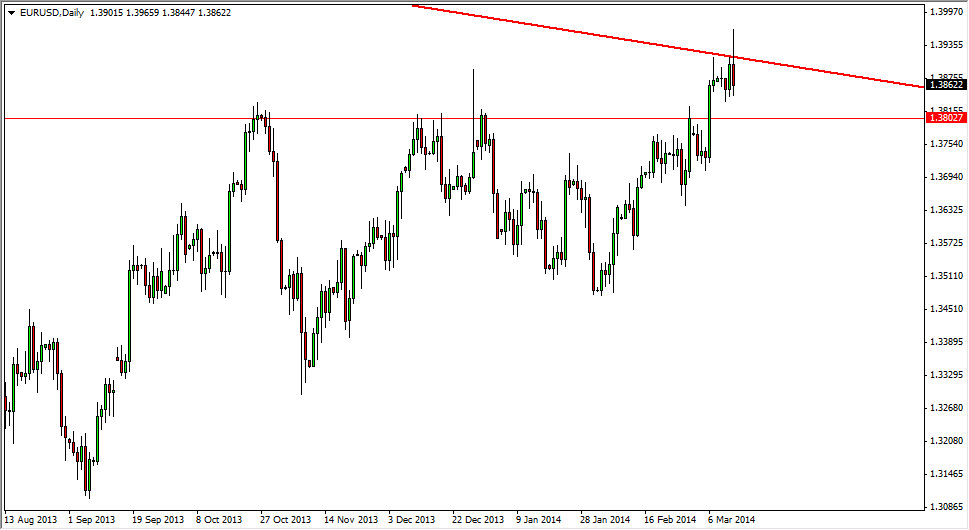

The EUR/USD pair try to rally during the session on Thursday, but as you can see struggle to get above the 1.39 level for any significant amount of time. With that, I believe that this market is and a very important inflection point. After all, there is a downtrend line just above that is from the monthly timeframe, and the top of a down trending channel that has been in effect since the beginning the financial crisis. With that, the market looks as if it is at an area of that could determine the next 1000 pips or so, given enough time.

I believe that if we managed to break above the top of the shooting star, it could signal that the market is going to head to the 1.50 level. It seems that level could be a bit high, but as you can see from a longer-term chart, we have certainly been there before. The question then will be as to how long it takes to get there. I would suspect that this would be a long-term move, and therefore pullback should offer buying opportunities over and over again.

However, there is the possibility of bearishness.

Looking at this chart, the fact that we formed a shooting star at this area does in fact make me think that possibly we could move in the other direction. I would feel much more comfortable below the 1.37 level though, as it would show a real significant decline in the upward momentum. With that, I would be very bearish and then as well, but I recognize that there are enough support areas below that could cause quite a bit of supportive bounces here and there.

If we do fall lower like that, we could go as low as the 1.28 level, but again this would be just like the move higher, it would be one that would be over longer term trading and would have plenty of hiccups along the way. Nonetheless, I do think we are at an area where we should start to see some type of significant move fairly soon.