By: John Ursus

Timeframe: H4

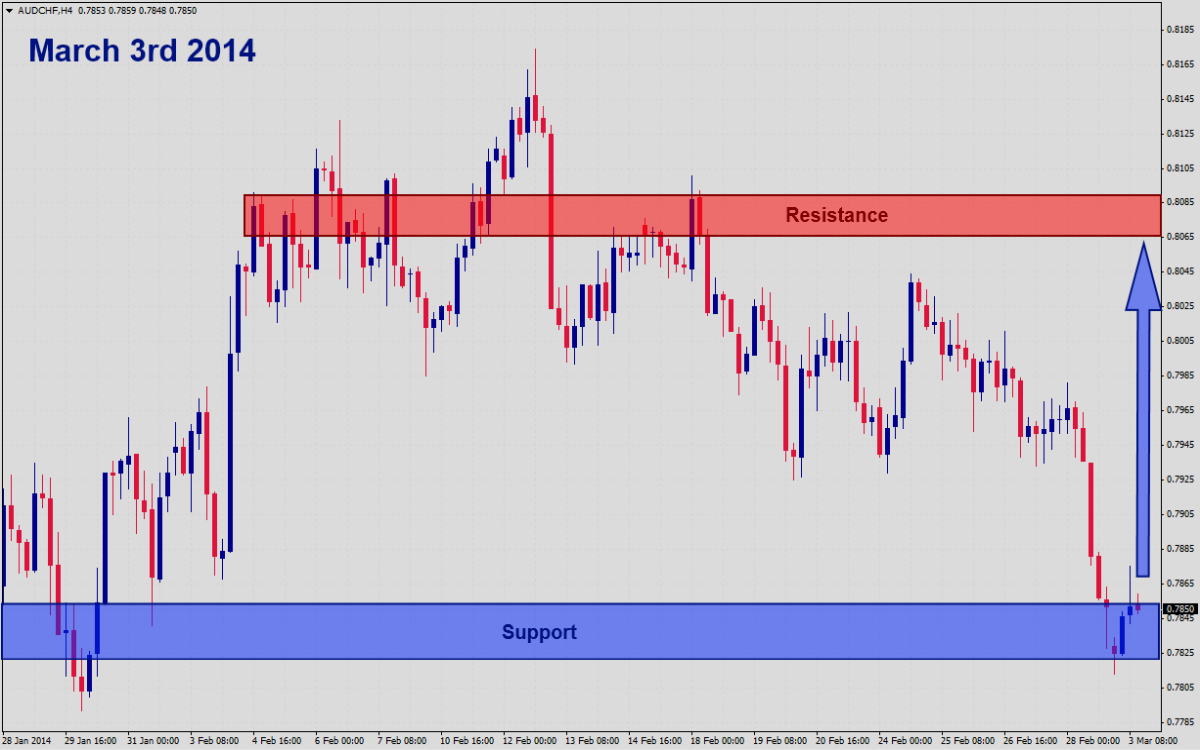

Recommendation: Long Position

Entry Level: Short Position @ 0.7825

Take Profit Zone: 0.8000– 0.8025

Stop Loss Level: 0.7750

The AUDCHF has broken down below previous support and accelerated a sell-off which was partially fueled by weaker than expected economic data out of Australia as well as a worse than expected economic slowdown in China. Australia is heavily dependent on Chinese economic growth as it fuels demand for Australian commodities, the backbone of the Australian economy and driver behind strength in the Australian Dollar.

This currency pair has now dropped down to a very strong support zone and forex traders are advised to seek out long entry positions inside this support level. Price action has briefly dropped to the low end of this support level before selling pressures faded rather fast which allowed bulls to step in and push the AUDCHF above the most recent lows. Trading may be volatile around the current support level, but bulls should be able to force a breakout from current level which could lead to a stronger rally.

Economic data out of Australia has shown to stabilization in the Australian economy which could further assist a bullish move in the Australian Dollar. The Ukrainian problems have temporarily boosted the Swiss Franc as forex trader’s flock to what they regard as a safe haven trade until more clarity out the geopolitical landscape emerges. The pending rally in the AUDCHF could accelerate after a period of sideways trading which may lead the AUDCHF to test an intermediary descending resistance level.