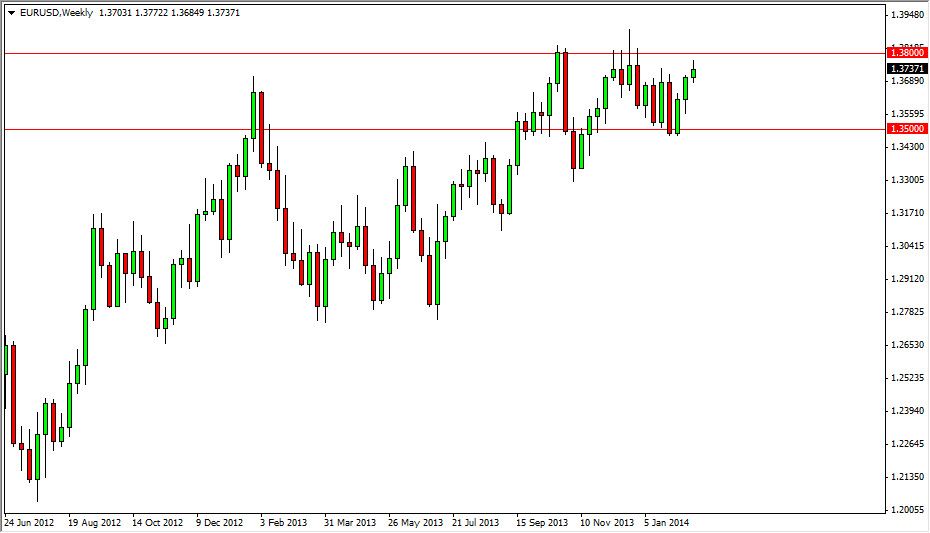

EUR/USD

The EUR USD pair try to rally during most of the week, and although we did end up gaining, we ended up giving up about half of the gains by the time we closed on Friday. Because of this, I feel like this market is probably going to pull back slightly, but regardless it will be difficult for longer-term traders anyway, as there simply is not much room to move at this point in time. Expect continued consolidation, and a general feeling of choppiness in this marketplace.

GBP/USD

The GBP/USD pair fell during the course of the week, but quite frankly that’s not much of a surprise. When you look at the way we just smash through resistance during the previous week, it’s not a big surprise to see this market take a little bit of a pullback. Quite frankly, the buyers need to take a rest, and we need an opportunity for more buyers to step into the marketplace. With that, this pullback should offer that buying opportunity, and I will be looking for supportive candles in order to get involved. I still believe this market goes to the 1.70 handle.

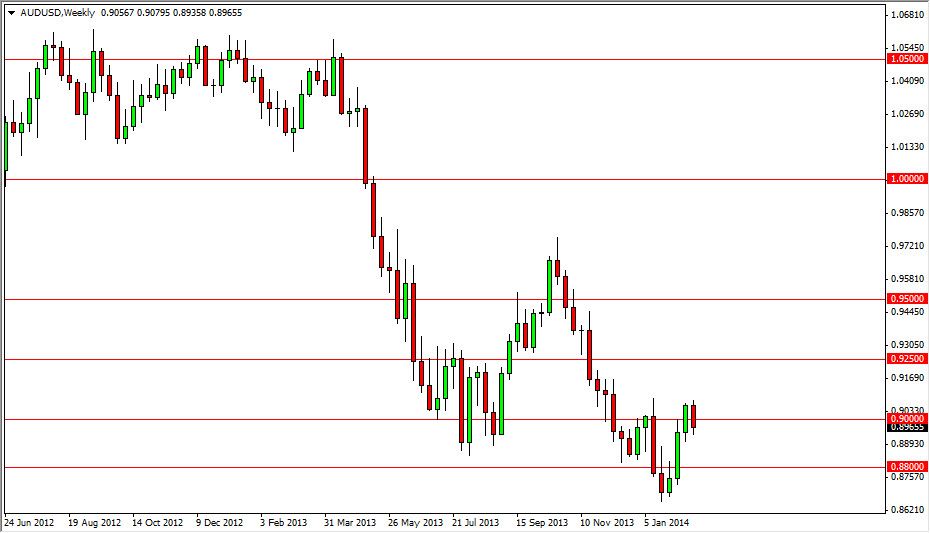

AUD/USD

The AUD/USD pair fell during the bulk of the week, showing that the 0.90 level still will hold some weight when it comes to influencing the market. The pair has had a nice run over the last couple’s, and now it appears that we are turning back down. The truly interesting thing about this is that while the gold markets have been very positive, the Australian dollar hasn’t necessarily been the same way. That obliterates a common correlation that we normally see, and as a result I think that the Australian dollar is in serious trouble, and will continue to grind lower.

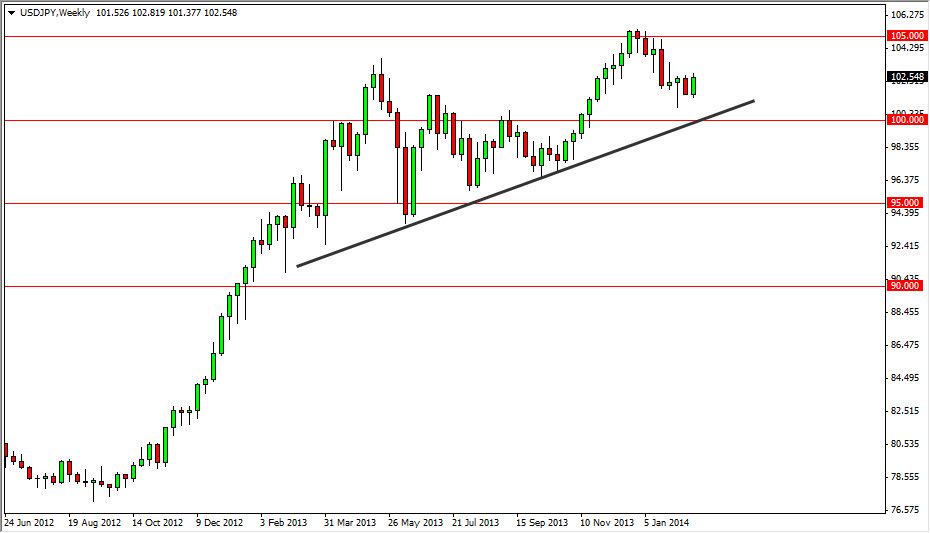

USD/JPY

The USD/JPY pair had a positive week, completely erasing the losses from the previous one. Because of this, it appears that the market is still going to be supported, and that the 102 level might be the epicenter of that support. On a break of the top of the candle, I believe that we challenge the 105 level given enough time. Above the 105 level, we head towards the 110 level. Currently, I have to believe that the 100 level is the “floor” in this market.