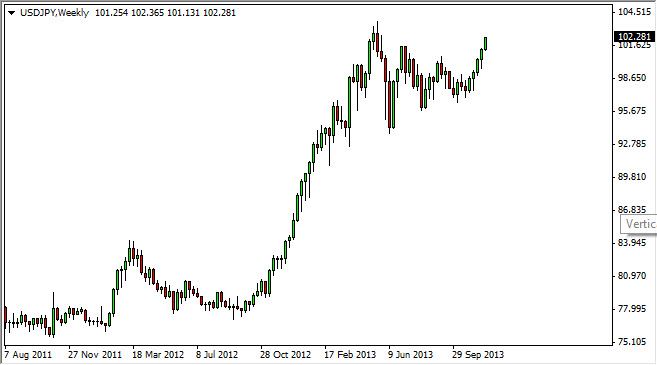

The USD/JPY pair will more than likely be the place to be most of the next year or two. The reason I say this is that you will not find a more blatant example of central bank interaction than you will see in this pair. After all, the Bank of Japan is without a doubt going to stay as loose as possible with their monetary policy, while the Federal Reserve looks like it might be the first major central bank to tighten their policy.

Granted, the “tightening” would involve something like a decrease of bond buying, but this should increase the yields in the Treasury markets, and will widen the differential between Japanese and US bonds. This of course will drive money from Japan to America, and thus increase the value of the Dollar.

“Fed speak”

The biggest thing to pay attention to is the so-called “Fed speak” that we may see over the next month or two. Nonetheless, the market looks convinced that they will tighten, but the day that a member admits that they are seriously considering it, the pair will shoot straight up. That day will make the bulls in this market a lot of money.

The one thing that could cause an issue is if the Fed suddenly backtracks on its plans, and admits that loos policy will continue indefinitely. The jobs market is the biggest concern, and as long as we see improving numbers in America – this pair goes higher over the longer-term. This should prove to be a great “buy and hold” situation, and I am sure there are a lot of traders out there getting ready to make their careers with this trend.

However, be aware that the month of December suffers from a lack of liquidity, and as a result can produce some strange moves. The trend higher should continue, but there will be a certainly amount of “position squaring” in the month as well, and this could produce sharp pullbacks. When these happen though, I will be looking for supportive candles to expand my long position.