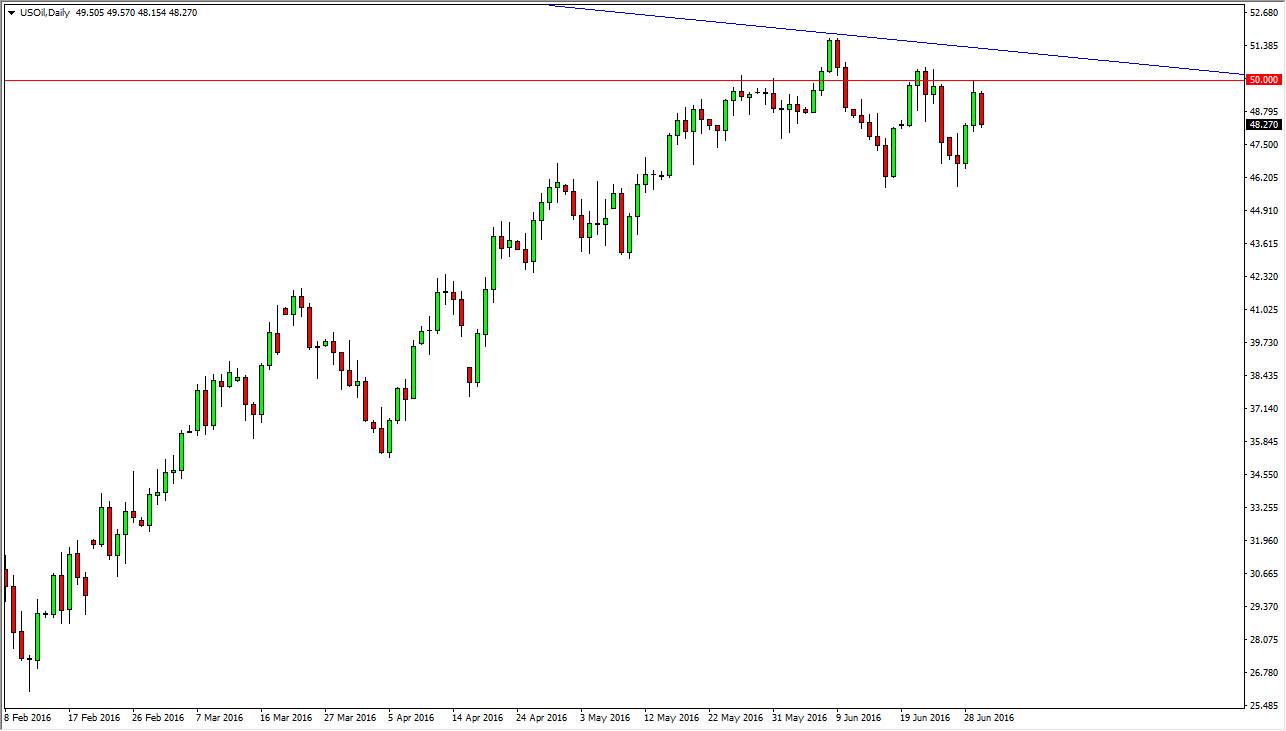

The WTI Crude Oil markets fell during the session on Wednesday as we continued to test the lows of the consolidation area that has contained the markets for a few months now. This market continues to grind away sideways as there is no real driving factor for direction. The value of the US dollar will continue to determine where the price of oil goes, and in that respect we are essentially trading the currency markets at the same time.

The Federal Reserve declined to taper off of quantitative easing, and now the Dollar should continue to fall, making the commodity markets rise over time, oil of course being especially sensitive to value the greenback. The Middle East will continue to cause potential headline risk, and as a result the markets will continue to volatile going forward.

Federal Reserve

Keep watching the headlines out of the Fed in the near term as the direction of easing will be the biggest factor going forward. With Janet Yellen being the most likely candidate for Federal Reserve Chairman after Ben Bernanke, easy policies should continue as she is known as a dove on the FMOC. The monetary policy could remain loose for the foreseeable future.

The shape of candle indicates that there could be continued weakness in the market, but the support below runs all the way to the $100 a barrel mark. Because of this, I believe this market will remain in the consolidation pattern that we have seen over the course of summer, and therefore I believe the bulls will step in and take control in the near term as we try to get to the $110 level. This area has been very resistive in the past, and I believe that the resistance will run all the way to the $112 level, which was the high of the summer before the selloff in August.

With this in mind, I believe that the short-term trader will continue to enjoy profits in this well-defined range, and long-term players are probably on the sidelines at the moment.