The USD/JPY pair has been one that everyone's talking about recently, and with good reason. Simply put, this marketplace is where most of the action in the Forex markets has been over the last couple of months, and quite frankly I believe it will continue to be.

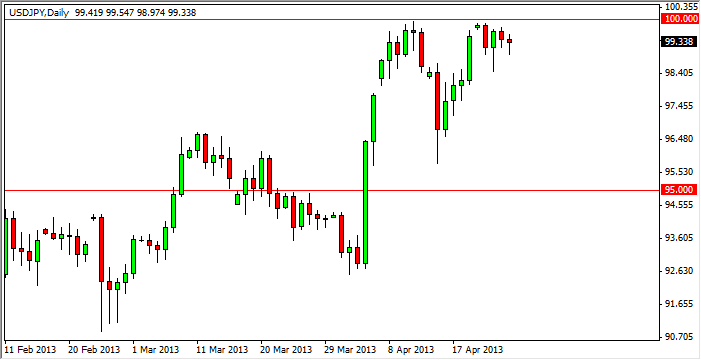

As you can see by the chart, we are currently butting up against the 100 level. This level for my money is one of the largest ones on the chart. Simply put, it is what will make the difference between whether or not this was a beautiful dead cat bounce, or the beginning of a long-term uptrend. I truly believe that it is the latter of the two options, and I fully expect to see this market hit the 110 level sometime in the next nine months or so.

Everybody knows that the Bank of Japan is trying to devalue the Yen. The central bank even got the "green light" from the other economies in the G 20 recently, and as a result there seems to be almost nobody out there that is willing to criticize the Japanese. The only thing that was said was that they need to be careful not to damage other economies in the process. In other words, as long as this is somewhat orderly, nobody is stepping in the way.

Bank of Japan this morning

There is a monetary policy statement coming out of Tokyo this morning. While there really isn't much room for them to move on the interest rate part, it will be interesting to see how the statement is worded and whether or not they continue to show the kind of aggression that we've seen recently. With that being the case, I fully expect to see the Japanese essentially "will the Yen above the 100 level" during the statement. However, whether or not the market actually listens could be a different story.

I firmly believe that we will eventually break that level, but a pullback should not be discouraging to you. In fact, it should be looked at as a buying opportunity. That is exactly how I'm going to trade this pair, buy the dips.