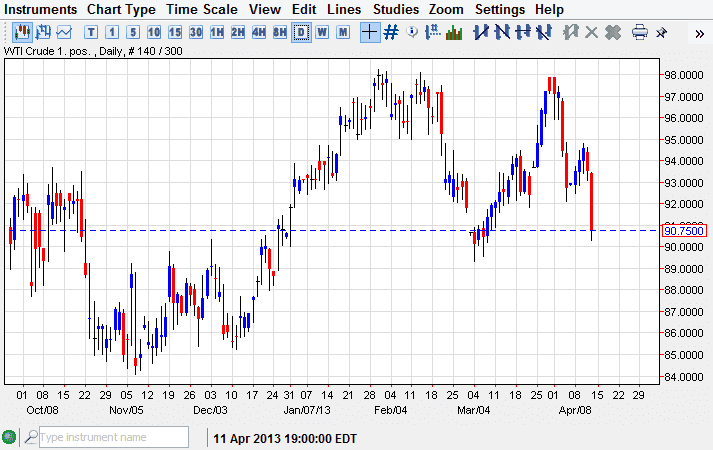

The WTI contract fell rather drastically during the session on Friday, as commodities in general got whacked. This is a recurring theme throughout the commodity sector, and as a result we saw several staples of the commodity markets collapse. Gold broke through the $1500 level finally, and silver is testing the very bottom of it support at the moment. This is much the same way that I see the oil markets right now, very similar to silver.

Going forward, the $90.00 level absolutely has to hold a support in order to continue any type of bullish action at this point. I still think that there is a very strong chance that we are trying to carve out some type of range, but I have also pointed out recently that the longer-term charts look like they are trying to form some type of symmetrical triangle as well. Remember, it doesn't count as a triangle until it's actually broken out of. Sometimes, markets will simply drift right through the end of the triangle, essentially negating the entire set up. At this point time, we have no real indication one way or the other, but if the Friday action is any sign, the support may come completely undone soon.

Federal Reserve monetary policy

One of the biggest variables in the oil market right now is the Federal Reserve and its monetary policy. If there is serious concern that the Federal Reserve may raise rates sooner than later, commodities in general will have to be repriced. There have been recent murmurs coming out of the Fed that the various members are starting to think that perhaps monetary policy should be normalized much sooner than the markets had originally anticipated. If that's the case, we could start to see serious declines in the commodity markets around the world. After all, one of the things that have been pushing the markets higher has been the idea that money will be cheap for the foreseeable future. However, I will be watching this general area as I believe $90.00 will be vital. The Monday close is going to be very interesting, and very well could set up the next move.