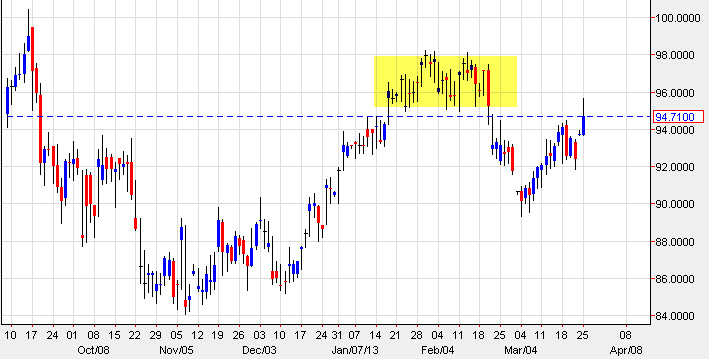

The WTI Crude market had a strong showing during the Monday session, and had at one point attempted to take on the $96.00 level. That area is the beginning of a significant cluster, which of course I think will cause a bit of resistance. Because of this, it wasn't surprising to see the market pullback a little bit at the end of the session. However, I have to admit that I'm a little bit surprised that we fell back below the $95.00 level.

This may be because of the "risk off" attitude of a lot of the markets around the world on Monday, as the Cypriot bank bailout isn't quite as benign as many people would've helped. A lot of the senior bondholders for those banks are about to take a massive cut, and as a result the US dollar did get a boost. So having said that, it makes sense that it takes less of those Dollars to buy barrels of oil.

The candle shape is a little bit like a shooting star, but I see far too much in the way of support below the $94.00 level to start shorting at this point in time. In fact, I simply think this will be a "buy on the dips" type of market in the near-term. I think that a move to the $98.00 level is very likely sooner or later, but I also believe that we will be stuck in a range for some time.

$90.00

For me, I believe as long as we stay above the $90.00 level, this market should be rather orderly and range bound. I think that's short-term traders will learn to love this market, and it is of course very technical and its nature. As a result, it makes sense that traders look to the larger "round numbers" such as the $92.00 level and try to find some type of supportive candle to start buying.

I think we could fall to that level in the near-term, and I would be very interested in buying down there. However, to expect that candle to appear on a daily chart is probably asking a bit much in this choppy type of environment, and going forward I believe that this market will be one that I will have to take in small chunks, trading for $1.00 or maybe $2.00 at a time.