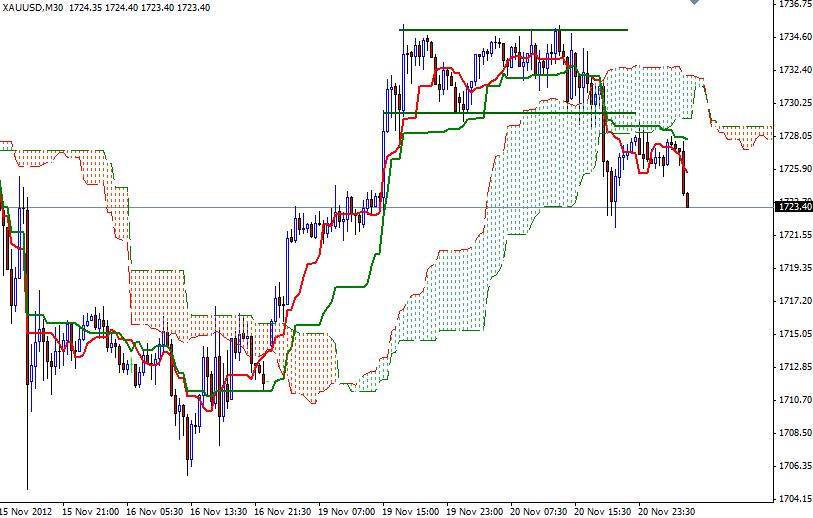

XAU/USD closed lower than opening after a Hamas official said that both sides had agreed to a ceasefire, easing fears of a wider conflict stemming from Israel and Gaza. The American dollar was also supported by better-than-expected U.S. housing data. Prices broke out of a consolidation zone roughly between 1735 and 1729 after the release of the data. The pair bounced off of the 1722 level and climbed to 1728 again. However, we have seen another sell-off during the Asian session after the European finance chiefs failed to reach any solid agreement on the next tranche of loans to Greece. German Finance Minister Wolfgang Schaeuble said “Since the questions are so complicated we didn't come to a final agreement, so we'll meet again”. Meanwhile, IMF head Christine Lagarde said “Eurogroup made some progress, although more work is needed”. EZ finance ministers will continue talks on Monday. On the 30m time frame, there is a bearish outlook as prices struggle to climb above the Ichimoku Cloud. Tenkan-sen line (nine-period moving average, red line) is below the Kijun-sen line (twenty six-day moving average, green line), which is another bearish sign.

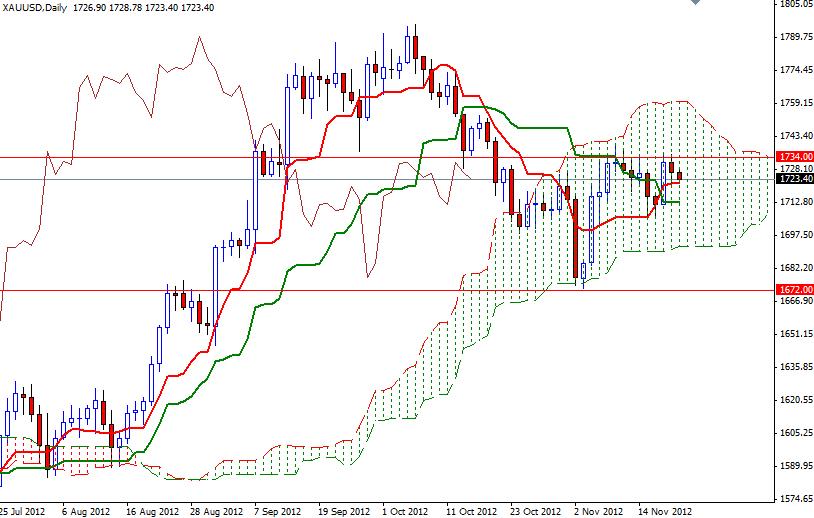

On the daily time frame Tenkan Sen (1721.30) and Kijun Sen (1713) lines looks supportive. If prices break below 1721.30, there is an interim support at 1716.10. If XAU/USD finds support and turns north, resistance will be found at 1725/26, 1730.30 and 1734.80.