By: Andrea Cohen

For many years, a few financial assets have been deemed “safe havens” for investors. These assets tend to maintain their values when economic conditions deteriorate and enjoy a reputation for a safe port to park your money until it is safer to return to the riskier assets (that you fled in the face of uncertainty).

The most notable “safe haven” assets have, historically, been Gold, US Treasury Bonds, and the Swiss Franc. Switzerland, with its service-centric economy, developed banking system, and traditional (or, some would say, stereotypical) conservatism, is considered a market that offers few surprises.

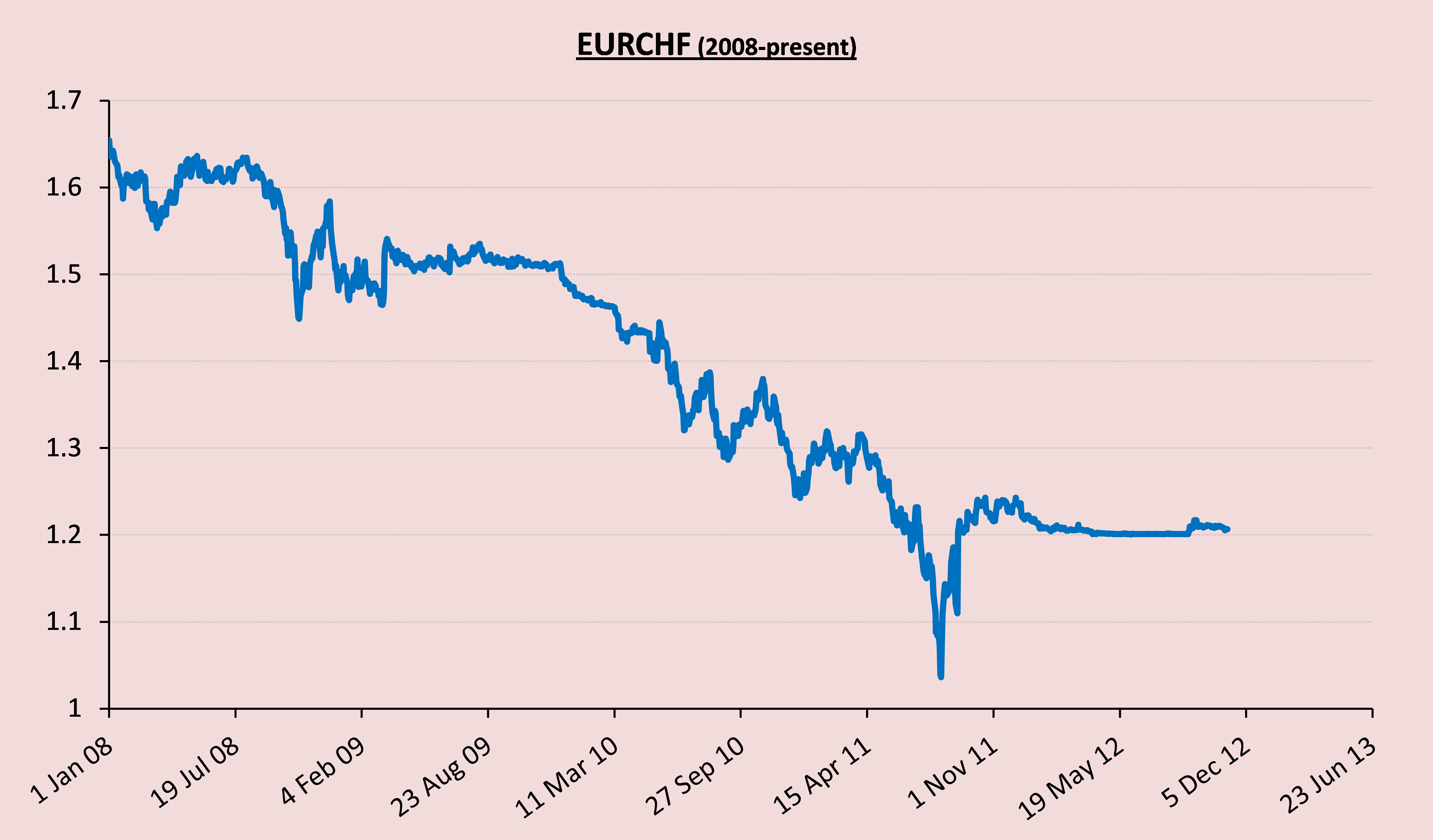

Since the beginning of the European debt crisis, and increasingly so, as fears for the completeness of the union have mounted, investors sold EUR and bought CHF. From a level of above 1.50 (that’s 1.50 CHF for each EUR) at the time of the Lehman Brothers bankruptcy, to above 1.43 in April 2010 (the time of the downgrade of Greek debt to “junk” level), the EUR/CHF saw its historical low in July 2011 – 1.0388.

The Rise in CHF

The flight to safety caused massive demand for CHF and artificially increased its value. The change in rates mentioned above essentially made the Swiss Franc so expensive that it became a serious threat to the Swiss economy as it made Swiss exports very expensive, particularly to Europe. As the situation in Europe continued to deteriorate, the Swiss National Bank (SNB) decided to intervene.

On September 6th, 2011, the SNB announced that it would defend a level of 1.20 as a floor for the EURCHF. As a first step, the SNB bought all the EURCHF offers between then prevailing spot level to 1.20. Then it vowed to buy more Euros to maintain this minimum level. In other words, the SNB told investors: “If you plan to sell EUR/CHF as a hedge against further European turmoil, then don’t expect the EURCHF to appreciate to a level lower than 1.20.” The SNB committed “unlimited amounts” to this end, to make it clear to speculators that an attack on the EURCHF would face stiff resistance.

Since then, more than a year already, the EUR/CHF has maintained its position at 1.20. Mostly it is the market that does the maintenance (indicative is the fact that the level is slightly above 1.20), which means that the SNB threat to intervene at any amount is credible. There are also occasional rumors of the SNB increasing the level of the floor although the SNB itself never really insinuated that it was considering such a move).

Takeaway Lessons

First, we would like to point out that such an intervention is more typical for emerging markets. The SNB move in 2011 caught most of the street by surprise. Traders should always be aware of a possible government intervention that can lead to economically unexpected outcomes.

Second, buying EUR/CHF downside, even in times of uncertainty in Europe, is a rather fruitless act at the moment. The SNB has been very determined to keep the floor and there is nothing to indicate that its stance had changed (at all), so betting that it will all of a sudden drop to 2010 levels is a very far-fetched bet.