By: Christopher Lewis

The USD/JPY pair continues to push higher over the last few sessions, and as a result I am more and more bullish of this pair each day. The fact is that the pair is in what I believe is a longer-term trend change, and as a result will be one of those “career trades” if you are able to hang onto it. (Granted, this isn’t going to be easy……at least not for some time.) In fact, I see 85 as a very significant point in this chart.

Looking at the recent breakout, there have been many different reasons. For starters, the US economy is actually showing some kind of strength at this point, albeit tentatively. The Bank of Japan is currently buying JGBs (Japanese Government Bonds) hand over fist, and looks to expand the program even more. In other words, they are simply “printing Yen” in order to buy these bonds.

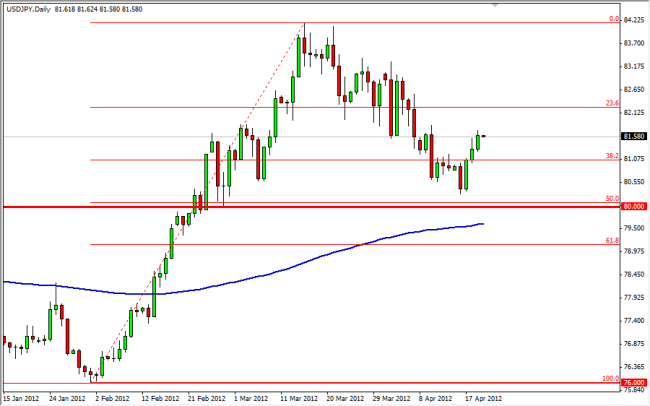

The breakout featured a shot through the downtrend line on the weekly chart going all the way back to the financial crisis, and getting out of the sub-80 range. The 50, 100, and 200 day exponential moving averages have all gone bullish, and as a result it looks like the trend traders are entering the fray as well.

Bounce

The 50% Fibonacci level from the lows has held up so far, as has the 80 level as well. As long as these two levels remain below the market action – I am long of this pair. The main reason I see the 85 level as important is that it is not only a massive and psychologically important handle, but it is also the 50% Fibonacci retracement level from the last major leg down. If that gives way, we are looking at a massive correction.

With the Bank of Japan set to set monetary policy next week, it is likely that there will be even more easing announced, and judging by recent comments from officials, it looks like the central bank is trying to let everyone know. In my opinion, I am willing to buy and add to this position on dips that show supportive action on the 4 hour or higher time frames. Selling isn’t an option to me now.