By: Christopher Lewis

EUR/USD has been a frustrating pair for many traders lately. The pair has been the epicenter of mass confusion and occasional bouts of “hopium” by the markets. The news flow out of the European Union has been back and forth, but it appears that the market may have gotten a bit exhausted by all of the pessimistic news flow as it has shot up over the last several sessions.

The Federal Reserve has announced that the almost non-existent interest rates will remain until the end of 2014, further escalating their war on the value of the Dollar. In fact, it seems that in a world where there is a real race to the bottom by central banks, the Americans are winning. The Dollar may find itself in real trouble going forward, but I would be remiss if I were to ignore the problems in Europe because of the incredibly easy monetary policy in Washington.

Crossroads

The EUR/USD pair has been running straight up, and even managed to eclipse the 1.30 area that I had been watching for some time now. The charts are providing many reasons to still be somewhat weary of trading this pair, and it makes sense as the fundamental situation between the two economies is quite murky at best.

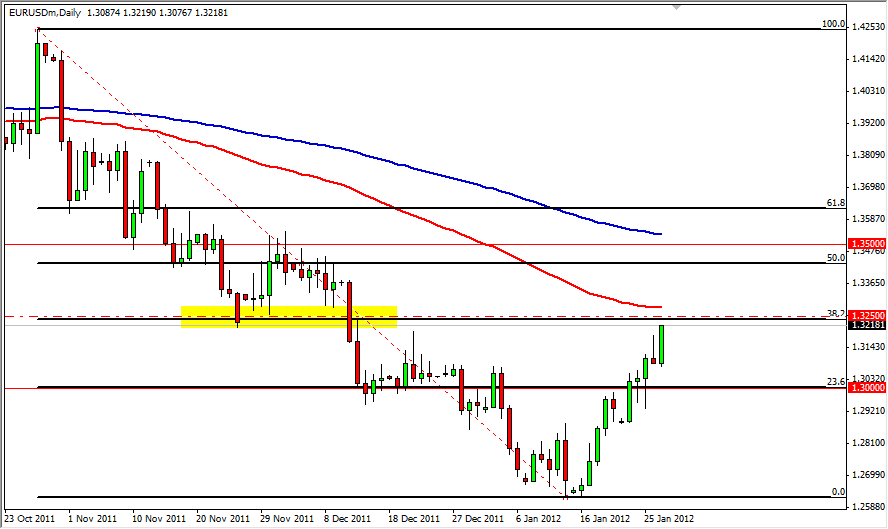

The 1.3250 area can be thought of as a minor resistance area, but it is half way between two larger ones. These areas can often be good places to use for stop loss management, (This is a whole massive lesson in itself.) but in this case, there is massive confluence going on, and it would be foolish not to be aware of it.

The level is the 38.2% Fibonacci retrace level, it is the “half way mark” between two major areas, and it is also the spot where support had come into the market previously. Adding to this is the fact that the 100 day EMA is just slightly above, and you have many reasons to think that perhaps it won’t be such a straight shot to 1.35 like many seem to think at the moment.

With this in mind, I may not even bother trading this pair. However, there is a signal to be had at this point: A daily close above 1.3250 would show that perhaps we are going straight to 1.35, but a weak candle in this area could suggest a pullback to 1.30 or so, at which point in time I would have to rethink the situation. Truthfully, this pair looks like it is going to continue to be trouble overall for the foreseeable future.