By: Fadi Steitie

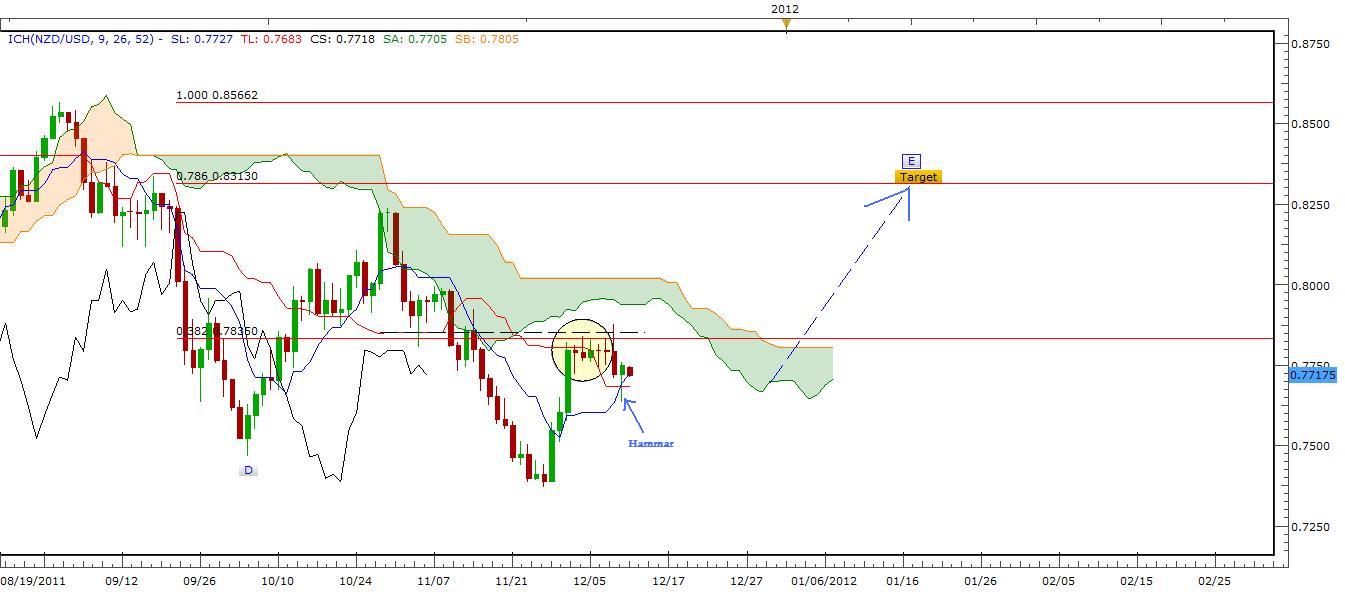

Currency: NZD/USD

Trend Expected Direction: Up

Strategy: Ichimoku Kinko Hyo

Description: With a drop in 52 days Senkou B (Orange) gives an indication of losing resistance power on general trend. We also notice that Tenkan (Blue) moved above Kijun Red which gives a good positive sign for a Bull movement. On the other hand, in term of Japanese Candle Sticks, We can see a strong green candle just above Tenkan hits Kijun followed by a range of small sessions ends with a drop on Tenkan bounced with a clear Hammer that indicate a strong bullish session coming on the way. With all the above info, I would buy the pair waiting for a bull to take action. Final note, we need to keep eyes on 0.78045 level and once price close above this level, 0.83130 is going to be our limit.

Action: Long

Target Area:Open

Stop Loss:0.75800

Risk: N/A