Interest Rate on Hold at 25bps

The Bank of Canada released its monthly rate statement yesterday, surprising few by holding its interest rate steady at a historically low 0.25%. The Bank also committed to maintaining its QE (quantitative easing) program, which has been a mainstay of the policy of most major central banks for some considerable time and allows banks to effectively prop up asset values in capital markets artificially.

Although the Bank says in its statement that Canadian economic growth over the first quarter of 2021 seems to have exceeded its expectations of a few months ago (pointing to the buoyant Canadian real estate market as evidence), it has resisted any pressure to accordingly dampen down its highly accommodative monetary policy.

The key long-term policy commitment in the statement upon which the Bank’s credibility is effectively hinged, is the commitment to maintain the low interest rate of 0.25% until the economy is seen as fully recovered from the 2020 coronavirus economic shock and Canadian inflation approaches its target of 2%.

If this story sounds familiar, that is because it is – several central banks are saying the same thing, holding steady, and seeking a target inflation rate of 2%. You hear almost identical policy language and targets from the Banks of England and Japan, to name but two examples. The relative lack of international divergence on monetary policy is probably the major reason Forex markets have become comparatively less volatile in recent years, except during periods of breaking crisis.

The Bank of Canada Fears Coronavirus

While the takeaway headlines present a rosy, complacent picture of the Canadian economy, the Bank’s statement elaborated on one major potential pitfall for the desired scenario of stability: the development of the coronavirus pandemic in Canada, which remains as a factor which could cause yet more and intense economic damage.

One reason for the Bank’s concern in this area is the relatively slow pace of the Canadian vaccination program. As of 10th March 2021, Canada has given only 6.8 shots per hundred people – well below the European Union average, which itself is lagging the average rate in the world’s most advanced economies. This leaves Canada relatively vulnerable to longer and harsher lockdowns and potentially problematic virus mutations.

Although the slow vaccine program sounds problematic, it is important to remember that Canada has been hit less harshly by coronavirus compared to other industrialized nations. Although its pattern of waves of infection resembles that of the U.S. and the European Union, it has suffered considerably fewer cases and deaths per head of population – in terms of total deaths per capita, it is ranked approximately 50th in the world. While this is good news for health and human life, it is a fact that the economic damage from coronavirus comes mostly from lockdowns and fear inhibiting economic behavior, and Canada has had plenty of lockdown.

Bottom Line: What Does This Mean for the Loonie?

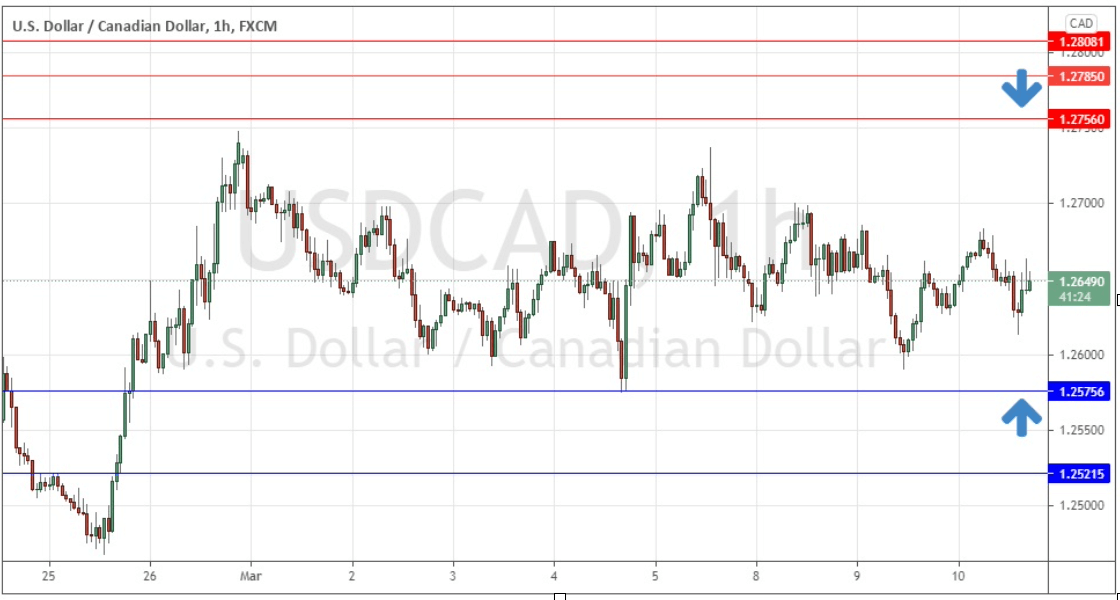

Forex traders will be looking for a key takeaway – what does all this mean for the Canadian Dollar? The short answer is, not much, as the Loonie hardly reacted to today’s release. After advancing against the U.S. Dollar over a period of months, the USD/CAD currency pair is well-established within a consolidation pattern between 1.2750 and 1.2575, as shown in the hourly price chart below. In this environment, supported by monetary policy and sentiment, traders might be well advised to look for long trades from any bullish bounce at 1.2575 or short trades from any bearish bounce off 1.2750. The level at 1.2750 is likely to be the stronger one.

USD/CAD Hourly Chart Feb-Mar 2021