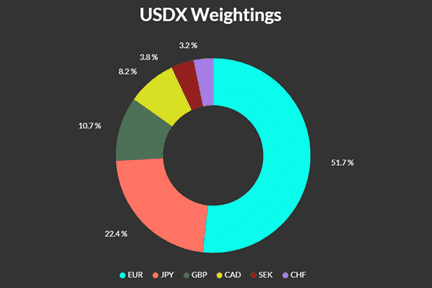

On Friday 4th December 2020, the U.S. Dollar Index (DX-Y.NYB) hit a two-year low price at 90.48, after trading in a long-term downwards trend since 20th March 2020 when it made a long-term high at 102.99. This means that in less than nine months, the U.S. Dollar has lost more than 12.14% of its relative value against a differentially trade-weighted basket of six major currencies which constitute the U.S. Dollar Index.

USDX Weightings

The U.S. Dollar Index is the most important global market measure of the U.S. Dollar, although the individual currency pairings with the U.S.’s two major trading partners, represented by the EUR/USD and USD/JPY currency pairs, are also closely watched as important barometers of the health of the U.S. Dollar.

The 12.14% fall in the value of USDX within a nine-month period is big by historical standards. While stock markets will often fluctuate with comparable volatility, it is relatively unusual to see a major currency such as the U.S. Dollar change in value by so much this quickly.

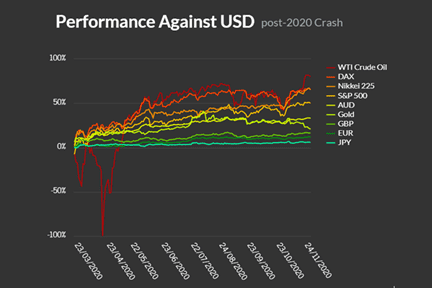

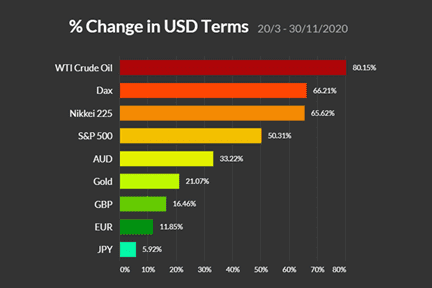

Almost every important asset in speculative markets has risen in value against the U.S. Dollar since 20th March 2020. The charts below show the relative performances in U.S. Dollar terms of several major currencies, stock indices, and commodities. Note that due to the depreciation of the U.S. Dollar, the performances of stock markets priced in other currencies are even higher in real terms rather than nominal terms.

Assets Against USD post-2020 Crash

Assets Ranked Against USD post-2020 Crash

What Does this Mean for Traders?

The appearance of a persistent long-term trend in the U.S. Dollar breaking to new lows is something traders should take note of. Several facts about the U.S. Dollar tend to be underappreciated within the Forex community:

Approximately 85% of all foreign exchange transactions globally involve the U.S. Dollar, meaning it is by far and away the main driver of foreign exchange rates.

During the entire retail Forex era since 2001, the U.S. Dollar has shown a far higher propensity to trend than any other major currency. This means the easiest profits have been earned by trend traders following the long-term direction of the U.S. Dollar Index.

Many assets which are typically seen as uncorrelated actually show a strongly positive correlation against the U.S. Dollar, especially when unusually high volatility is seen in financial markets, as has been the case over 2020.

Although the Japanese Yen, Gold, and the Euro tend to be seen as the classic “safe haven” assets, it is actually the U.S. Dollar which is the ultimate safe haven, which is why the U.S. Dollar is falling even against assets such as the Euro. During the February/March 2020 coronavirus panic, the U.S. Dollar rose against both Gold and the Euro and was mostly unchanged against the Yen. This has important implications for risk management and the breakdown of asset correlations during world crises.

WTI Crude Oil is seen by some analysts as the “anti-Dollar”, i.e. the most natural asset to trade against the dollar when it is losing value. This viewpoint is arguably validated by the fact that since March 20th 2020, WTI Crude Oil has risen by more against the dollar than almost any other major asset or stock market index.

Although Forex is seen as an inherently high-risk asset class, the volatility of major currencies is consistently lower than what is exhibited by stock indices.

What is the Future for U.S. Dollars?

Will the dollar continue to fall? By all technical measurements, the downwards trend in the U.S. looks strong, with solid momentum, and seems likely to continue. This suggests that trading against the dollar will be the smart trade over the short term. This can be supported by some fundamental cases, such as the huge increase of approximately 25% in the U.S. national debt in 2020 alone, and an apparent weakening of the dollar’s positional as the global reserve currency. However, there are arguments in favor of the view that the dollar will shortly begin to strengthen and reverse its trend, which center on the fact that President Trump did everything he could to publicly talk the dollar down, while President-Elect Joe Biden intends to appoint Janet Yellen, former Chair of the Federal Reserve, as his Treasury Secretary. Yellen is seen as favoring a dovish but stable monetary and fiscal policy, willing to use every tool at her disposal to prevent the dollar from depreciating while simultaneously presiding over monetary expansion – no easy feat. President Clinton’s former Treasury Secretary Larry Summers appeared to urge her along this course last month when he advised that she avoid “an actively devaluationist or indifferent” attitude toward the greenback.

Final Thoughts

Regardless of the intentions of the next President and Treasury Secretary, it is difficult to see support for a scenario where the dollar appreciates consistently. The economic impact of the coronavirus pandemic will continue to trouble the U.S. and the world for many more months regardless of vaccine rollouts, and the temptation to buy political strength in return for currency debasement when you are the keeper of the world’s reserve currency, will be very strong. Traders should think extremely carefully before betting in favor of the greenback during the first quarter of 2021.