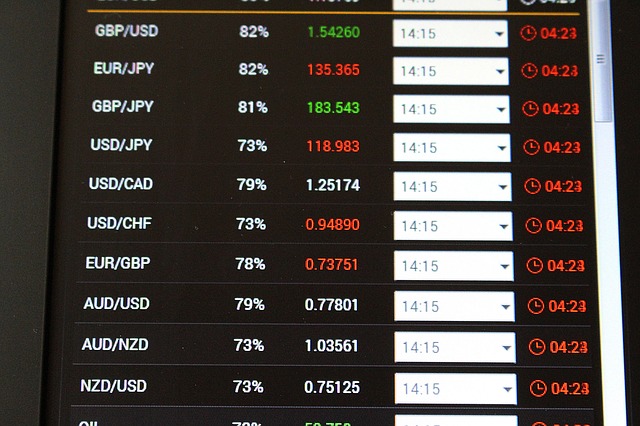

This can be expected to be a busier week than recent weeks, with a lot more going on and more volatility. It will be an especially important week for the USD, the AUD, and the GBP, with key central bank input also due regarding the JPY. It is likely that the U.S. and Australia will be the key focus, with Japan and Canada also coming into the picture right at the end of the week on Friday.

U.S. Dollar

This will be another very busy and important week for the USD with the highlight coming on Friday with the release of Non-Farm Payrolls data. The greenback’s week begins on Monday with a release of ISM Manufacturing PMI data, followed on Wednesday by the ADP Non-Farm Employment Change, Trade Balance and ISM Non-Manufacturing PMI releases. On Thursday we will get Unemployment Claims numbers.

Australian Dollar

This is going to be a big week for the Aussie, with a lot of data coming. Monday is a public holiday in Australia, so we kick off on Tuesday with Retail Sales and Trade Balance data, followed by the announcement of the Cash Rate with the RBA’s Rate Statement. Finally, Friday will see the RBA’s Monetary Policy Statement. For the Australian dollar, weeks do not come much bigger than this.

British Pound

It is going to be a busy and significant week for the British Pound, beginning on Monday with Manufacturing PMI data. Tuesday will see Construction PMI numbers, followed by Services PMI on Wednesday. The big day comes on Thursday with the release of the Bank of England Inflation Report presented by the Governor of the Bank of England, the Official Bank Rate, and the MPC Votes on the Bank Rate. There will also be a release of the MPC Rate Statement and Manufacturing Production data.

Japanese Yen

The Bank of Japan releases its Monetary Policy Statement on Friday.

New Zealand Dollar

On Tuesday there will be a release of GDT Price Index data. On Wednesday we will get Employment Change and Unemployment Rate numbers.

Canadian Dollar

Monday is a public holiday in Canada. The Loonie’s week begins on Wednesday with the release of Trade Balance data. On Friday we will get Building Permits, Employment Change, Unemployment Rate and Ivey PMI data releases.

Euro

There are no high-impact events scheduled for the Euro this week at all.