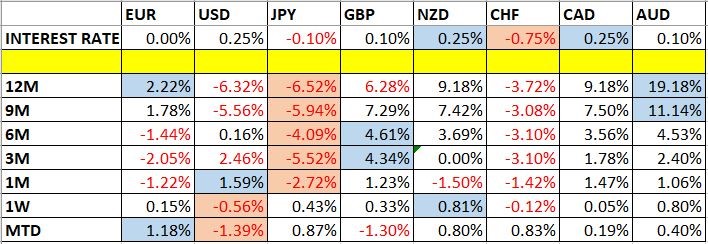

Investors’ speculation is growing once again, with expectations high that the United States Federal Reserve Bank is moving closer to hiking interest rates. James Bullard, the president of the St. Louis branch of the Fed, said yesterday that the Fed might even consider a September rate increase. That helped to push the US Dollar broadly higher in European trading, with the US Dollar Index striking a fresh 3-month peak and individually, a 5-week peak versus the Japanese Yen.

As reported at 11:23 am (BDT) in London, the USD/JPY pair was trading higher at 124.3450 Yen, near to the mid-point in today’s trading range of 124.2550 and 124.4850. The US Dollar Index had been trading at its 3-month high at 98.151 .DXY before edging down recently to 97.831 .DXY.

Kiwi and Aussie Dollar Edge Higher

Commodity-linked currencies got a breather following Monday’s slide in gold prices. The Aussie Dollar, however, continues to be under some pressure on expectations that the RBA is likely to ease further. The RBA’s release of its most recent policy meeting minutes suggests that more depreciation for the Aussie Dollar is a likely scenario. In contrast, the Prime Minister of New Zealand helped to provide support for the Kiwi Dollar recently. The AUD/USD pair was trading higher at 0.7373, a small gain of 0.09%, while the NZD/USD was trading at 0.6615, a solid rise of 0.89% and only a few pips from the session peak.