The race for the White House is on, and running against the unconventional incumbent will be a huge task for the Democratic party’s nominee. Four contenders have emerged as leaders in the crowded field for Democratic leadership, each offering a very different deal for the United States and global financial markets.

Facing President Trump in the November election will be either a moderate liberal: former Vice President Joe Biden or South Bend Mayor Pete Buttigieg; or a further-left progressive: Vermont Senator Bernie Sanders or Massachusetts Senator Elizabeth Warren.

And what do the polls show? That it’s a race between Biden and Sanders: or stability vs revolution.

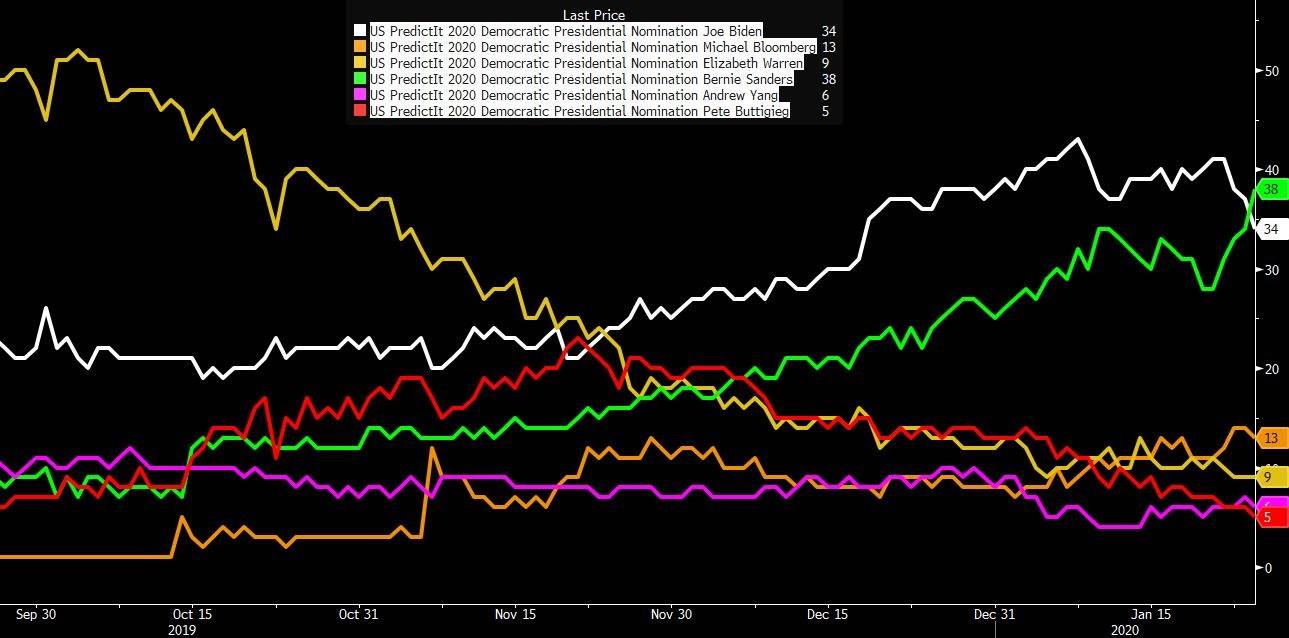

Source: Bloomberg, PredictIt

The latest from PredictIt markets puts Sanders ahead for the first time, at 38%. Biden has dropped to 34%, Warren 9% and Buttigieg 5%.

A Biden administration would be the Democratic status quo. Biden talks of continuing “our” work, promising a continuation of the Obama era. He offers a softer approach to China, to reverse Trump’s “excessive” corporate tax cuts, and to be fairly friendly to Wall Street. Markets could work with this.

On the other hand, a Sanders administration would be a radical shift left. He speaks an anti Wall Street message, calling for a new wave of financial and wealth taxes, and to break up the big tech companies which have been a significant boost for the booming US stock indices. Interestingly, Sanders could be an even harder ticket for China.

The primaries will soon decide the Democratic nominee, and it all begins with Iowa on 3 February

Iowa has only 3.1 million and is 90% white, so in no way a sample of America’s diversity. Yet the small state could set the tone for the rest of the primaries, giving its nominee a first-movers’ advantage.

So the notion that this state could be so influential in the primaries seems far-fetched, but believe it or not, since 1976, in all but two cases, the Democratic winner at Iowa has gone on to lead the party into the presidential election. Iowa’s nominations include Hilary Clinton, Barack Obama (twice), John Kerry, Al Gore… I could go on.

As the first state to vote, the Iowa caucuses gain considerable media attention and are propelled into the national spotlight. Iowa can legitimise a campaign, particularly if an underdog wins. Take 1976, when the underdog peanut farmer Jimmy Carter rode an Iowa win all the way to the Oval Office.

So the Iowa caucuses aren’t held first because they’re important, rather they’ve become important because they are held first.

Assuming the race is between Biden and Sanders, let’s consider how each outcome might move markets.

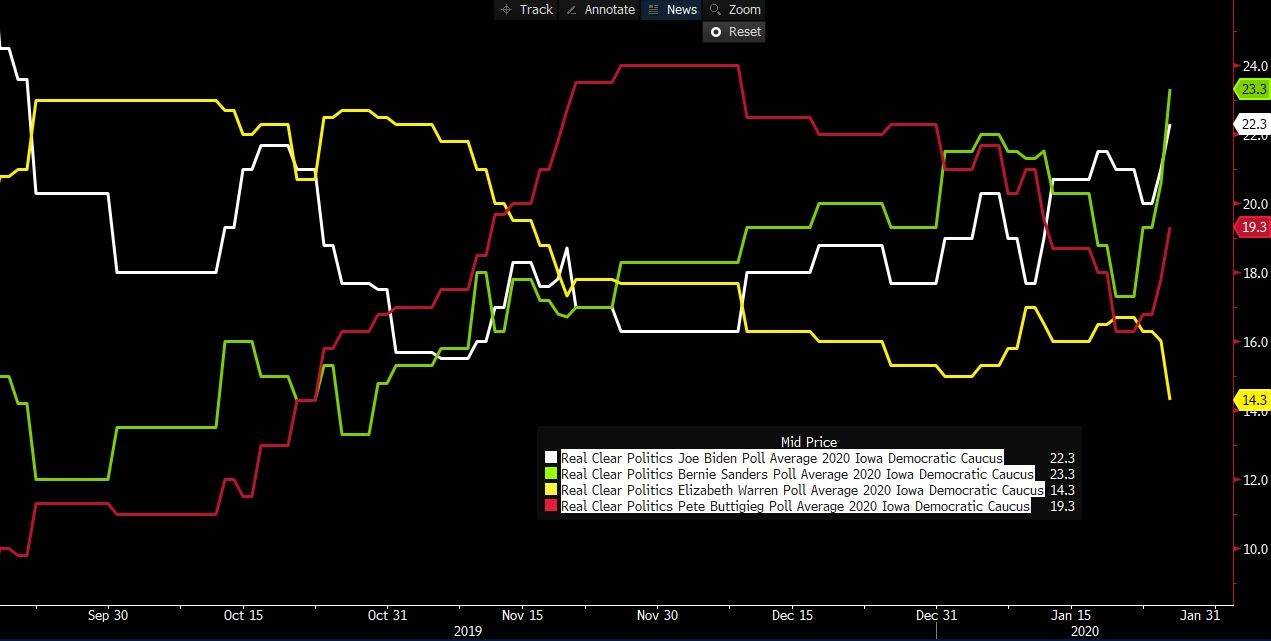

Source: Bloomberg, Real Clear Politics

If Biden reigns supreme in Iowa, don’t expect much of a reaction. He’s the moderate liberal, Democrats-as-usual candidate, predictable. Markets know what to expect if he wins, and know that although it’s a change from the Trump administration, it isn’t too risky. It’s also just way too early in the campaign for any meaningful market reaction.

But if Sanders wins the Iowa nomination, expect investors to take a step back and reconsider risk. Markets shouldn’t start to sell-off just yet, however they’ll prepare themselves to pull that trigger when and if they need, especially if Sanders proceeds to win New Hampshire as expected.

Down the track, if a Sanders presidency begins to look possible, which could happen if the early states add momentum to his campaign, we would expect gold, JPY, and CHF to be bid up, and the strong USD to sell off.