There is a lot of talk at the present time as to whether the economy of the United States is going to enter a recession any time soon, and we have previously covered this question quite recently. There are only two reasons for the debate: firstly, because the major U.S. stock market index, the S&P 500, has fallen by more than 12% in value since the start of the year; secondly, because the United States has not been in a recession for about 5 years now and it tends to be an event that is expected to happen every few years as part of the natural economic cycle within a capitalist system.

Before we look at the question as to whether the U.S. is heading for a recession, we should first explain what a recession is.

What is an Economic Recession?

The widely accepted definition of an economic recession is when a country’s economy experiences two consecutive quarters of negative economic growth as measured by GDP (Gross Domestic Product). As soon as there is a quarter with positive economic growth (i.e. positive GDP), the recession is deemed to be over.

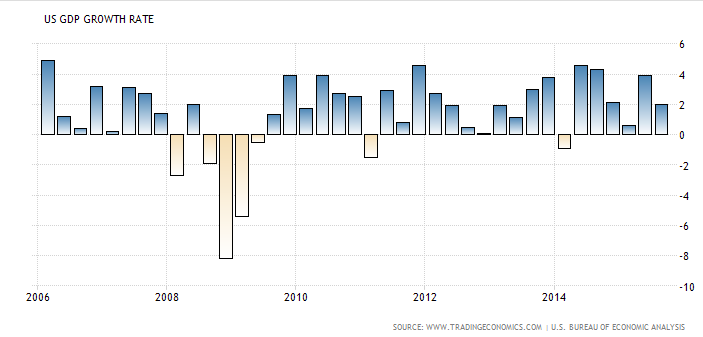

The chart below shows U.S. GDP growth by quarters over the past ten years:

We can see that there have not been two consecutive quarters of negative GDP since the start of 2009, six years ago. The most recent quarterly GDP was reported at about 2%. Although the chart does seem to show GDP tailing off somewhat, it looks as if we have some way to go before we will spend two quarters in negative territory.

Fundamental Factors Which May Decrease GDP

Perhaps the current fear is due to a valid concern that economic fundamentals are looking poor, and may shortly drag the GDP into negative territory. Let’s take a look at the areas of greatest concerns. The Federal Reserve has embarked upon a course of fiscal tightening, which will raise the cost of borrowing, dampening demand and investment. However they have stated they are going to raise rates very sensitively.

Consumer sentiment is actually rising and has been for a while.

Real wage growth has been stagnant and this is not a new development.

The US dollar has been increasing in value against other currencies and this will make exports more expensive and threaten the overall GDP. Commodity prices, in particular the price of oil, have been falling, and although the United States economy is by no means a manufacturing-based economy, this is a beneficial factor for GDP.

A serious banking crisis like the one that occurred in 2007/08 could cause a dramatic fall in GDP. While there are many concerns about the banking sector in general, there is no obvious crisis that seems eminent.

So overall, although we can find some areas of concern in the short-term economic fundamentals, there is nothing that stands out as a combination of factors that looks as if it is likely to put a strong brake on recent economic growth in the near future, and send the U.S.A. heading for recession.

The Stock Market and GDP

The true reason for the concern over the GDP comes from the widespread belief that the performance of the stock market and the measurement of economic growth both affect each other. If we take the idea that the level of economic growth will affect future stock prices, this seems perfectly logical. However what if fluctuations in the value of the stock market can also affect GDP? This can also seem logical when you consider that a falling stock market tends to cause falling asset values within the economy, as holdings of stocks decrease in value. Furthermore, strongly rising or falling stock prices can easily affect confidence levels which can then influence decisions regarding consumption and investment.

It is certainly true that the last recession in 2009 was preceded by a very sharp fall in the S&P 500 Index. It is probably this similarity with the current state of the index that prompts fears of a repeat slide in GDP. However, that can be seen as an exceptional period, as there was an enormous crisis of solvency within the banking system.

Historical surveys have shown a highly positive lagged correlation between GDP and the S&P 500 Index in both directions, although the statistical lag averages about two to three years. Therefore it is not possible to conclude that this month’s double-digit percentage fall in the stock index is going to send the U.S.A. heading for a recession any time soon!

U.S.A. Recession in 2016?

There is no question that a plausible argument can be made to support the idea that the U.S. economy is heading for a slowdown. However there is no factor which stands out as likely to tip the economy into a full-blown recession. This could change if some kind of shock arrived, such as a war driving the price of oil right back up to previous highs, or another serious banking crisis. Furthermore, if the stock market continues its fall at a similar rate and we find ourselves with 25% or more wiped off the market

capitalization of the 500 biggest publicly quoted companies before the end of February, then this could generate a chain reaction and tip the U.S. economy into recession. Without some kind of further free-fall or unexpected catastrophe, it is difficult to see the U.S. economy entering a recession during 2016.