Many Forex traders focus too narrowly on the currency pair or pairs they are trading. While it is important to be focused on a short-term chart if you are trading something on a short-term time horizon, it can help your profitability a lot if you look at the market in a broader way, as part of your process of deciding which currency pair to trade, and in which direction. Although it is possible to do OK by only looking at the Forex market, you could do better by considering what is going on in stock and commodity markets too when you analyze the Forex market. One reason why would be if there were a statistical correlation between the movement of the stock market and certain currencies or commodities. Furthermore, if such correlations can be found, it might be that they become even stronger or weaker under particular market conditions. This should be useful information for Forex traders as it can be used to move the odds in their favor.

What is a Correlation?

Correlation is simply the measurement of how much the prices of two different things have moved in the same direction over the same time. For example, if the prices of A and B always go up or down by the same percentage every day, completely in sync, then A and B would have a correlation coefficient of 1 (perfect positive correlation). If they always move in precisely the opposite directions by the same amount, they would have a correlation coefficient of -1 (perfect negative correlation). If there is no statistical relationship between the price movements of A and B at all, they will have a correlation coefficient of 0 (perfectly uncorrelated). I won’t detail the full formula of how the correlation coefficient between two variables is calculated here: it is enough to note that when such a statistical relationship can be proven over a long time period, we may be able to say that this relationship is likely to continue for some time in the future. However, it is important to understand that there are times when market correlations seem to break down entirely, so it is probably best to use correlation as a filtering tool for trades and not as the basis of an entire trading strategy.

Currency / Stock Market Correlations

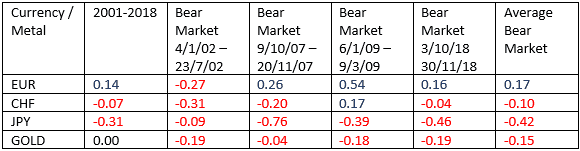

We can best illustrate the concept of using correlation between a stock market and currencies by taking the major U.S. stock market index, the S&P 500, which measures the valuation of the 500 largest publicly quoted U.S. companies by market capitalization and checking its statistical correlation with some Forex currency pairs which are priced in USD. That way, we can easily see the simple correlation between the non-USD currency and the stock market as measured by this index. As an additional step, we can also see whether the correlations were different during bear market periods, which are defined as the periods during which the market falls by at least 20% in value. Bull markets are defined as the periods during which the market rises by at least 20% in value. I used the time period from 2001 to the end of November 2019, a period more than 18 years long. The correlation coefficients between the S&P 500 Index and certain currencies and the precious metal, gold, are shown in the table below.

Historic Correlation Data

So, what does this data tell us? Starting with the leftmost column which shows the correlation over the entire period of almost 19 years, we can see that the strongest correlation between the U.S. stock market and major currencies is a negative correlation with the Japanese Yen, with a correlation coefficient of -0.31. This is a strong negative correlation, and suggests that when the stock market rises, the Yen tends to fall, and vice versa. Now let’s look at the rightmost column, which is the average of the correlation coefficients measured during the four bear markets which have occurred since 2001. Interestingly, the negative correlation is even stronger here, at -0.42. This suggests that when the U.S. stock market is selling off, the Japanese Yen is even more likely to rise in value than it is to fall when stocks are rising. This suggests that the Japanese Yen has tended to act as a “safe-haven”, i.e. something money flows into when stock markets are riled up and selling off, which often occurs during episodes of crisis.

In addition to the Japanese Yen, I also included two other assets typically seen as safe-havens: the Swiss Franc, and Gold. The Swiss Franc has a very slight negative correlation overall with the S&P 500 Index of -0.07, which gets just a little stronger during bear markets. This suggests that the Swiss Franc is maybe not as much of a safe-haven as its often thought to be yet is still has a (small) negative correlation with stocks. Turning to Gold, the case gets stronger: overall, it is perfectly uncorrelated with the S&P 500 Index, but in each of the four bear markets analyzed, there was a significantly stronger negative correlation. Finally, I threw in the Euro just for variety, and it seems to go up when stocks go up, and down when stocks go down, so it doesn’t look like much of a safe-haven over the full period.

Using Currency Correlations in Bear Markets

The first conclusion we might draw from this analysis is that the U.S. Dollar tends to rise during bull markets, and fall more strongly during bear markets, as the greenback is the flip side of the currency pairs here. Secondly, it appears that the Japanese Yen and, to a lesser extent Gold, tend to rise in value when the U.S. stock market is selling off. This means that during periods when the U.S. stock market is in a bear market (which includes the present time, at the time of publication), you might enhance your profits by being extra keen to take short USD/JPY and long XAU/USD trades.

In addition to correlations, there is something else you can observe about bear stock markets and put to good use. Note that in the above table, the bear market periods are relatively short. It is a fact that bear markets in U.S. stocks have tended to be shorter, sharper and faster than bull markets. Put more simply, the stock market index tends to drop by 20% considerably more quickly than it will typically rise by 20%. So, when the stock market is falling, if you are buying Gold, Japanese Yen, and any other safe-haven assets, you can expect that the winning trades will tend to move well into profit very quickly. This means you are likely to get the best results by trading in a way that lets these fast, strong moves play out before taking profits. Yet you should also recognize that these movements tend to be relatively short-lived, and not be overly slow to book profits on swing or position trades. It is usually a good idea to let the move die out and then take profits, instead of setting take profit targets, which will sometimes leave a lot of potential profit on the table.

Bear markets often begin with a sharp increase in volatility and include strong bullish pullbacks. This volatility will often bleed into Forex markets, so remember that bear markets will often cause an unusual level of turbulence in the Forex market, at least during its early stage when a big rise in volatility is typically seen.