*Last updated on June 27, 2017*

By: Adam Lemon

Candlestick patterns and moving averages are hardly new as tools for Forex traders. However, there is a way to use moving averages and candlesticks together in a way that is quite different to what most traders are doing. The “Flying Buddha” pattern has been around for a number of years and remains very effective and profitable as a Forex trade entry technique. It can be used in all markets, but is especially suited to Forex.

Please note that I did not invent or name this pattern, and I certainly intend no offense to anyone of the Buddhist faith, which incidentally provides a great mindset to tame emotions of fear and greed which can make trading more challenging than it should be.

What is the “Flying Buddha” Pattern?

The “Flying Buddha” pattern is quite simple. Simply set up a candlestick chart with two moving averages: the 5 period exponential moving average (EMA) and the 10 period simple moving average (SMA), both applied to the closing price. It is a good idea to make sure that both of the moving averages are drawn in strong and different colors that stand out easily from the colors of the candlestick chart.

A “Flying Buddha” is any candlestick which:

1. Has a LOW above the 5 EMA, when the 5 EMA is above the 10 SMA (a bearish “Flying Buddha”); or

2. Has a HIGH below the 5 EMA, when the 5 EMA is below the 10 SMA (a bullish “Flying Buddha”).

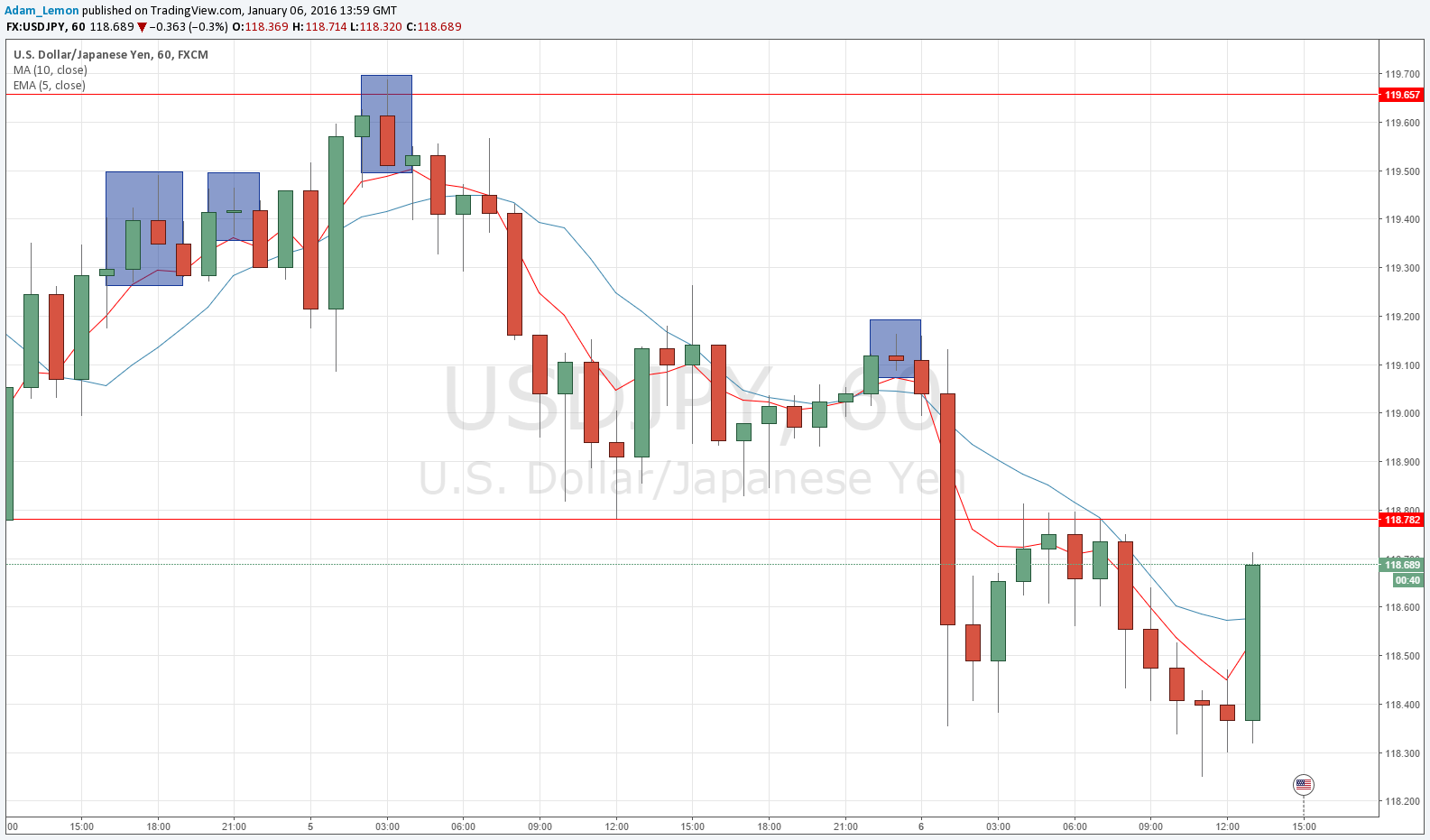

Here is a chart showing highlighted examples of bearish Flying Buddhas. There are a total of five candlesticks which qualify:

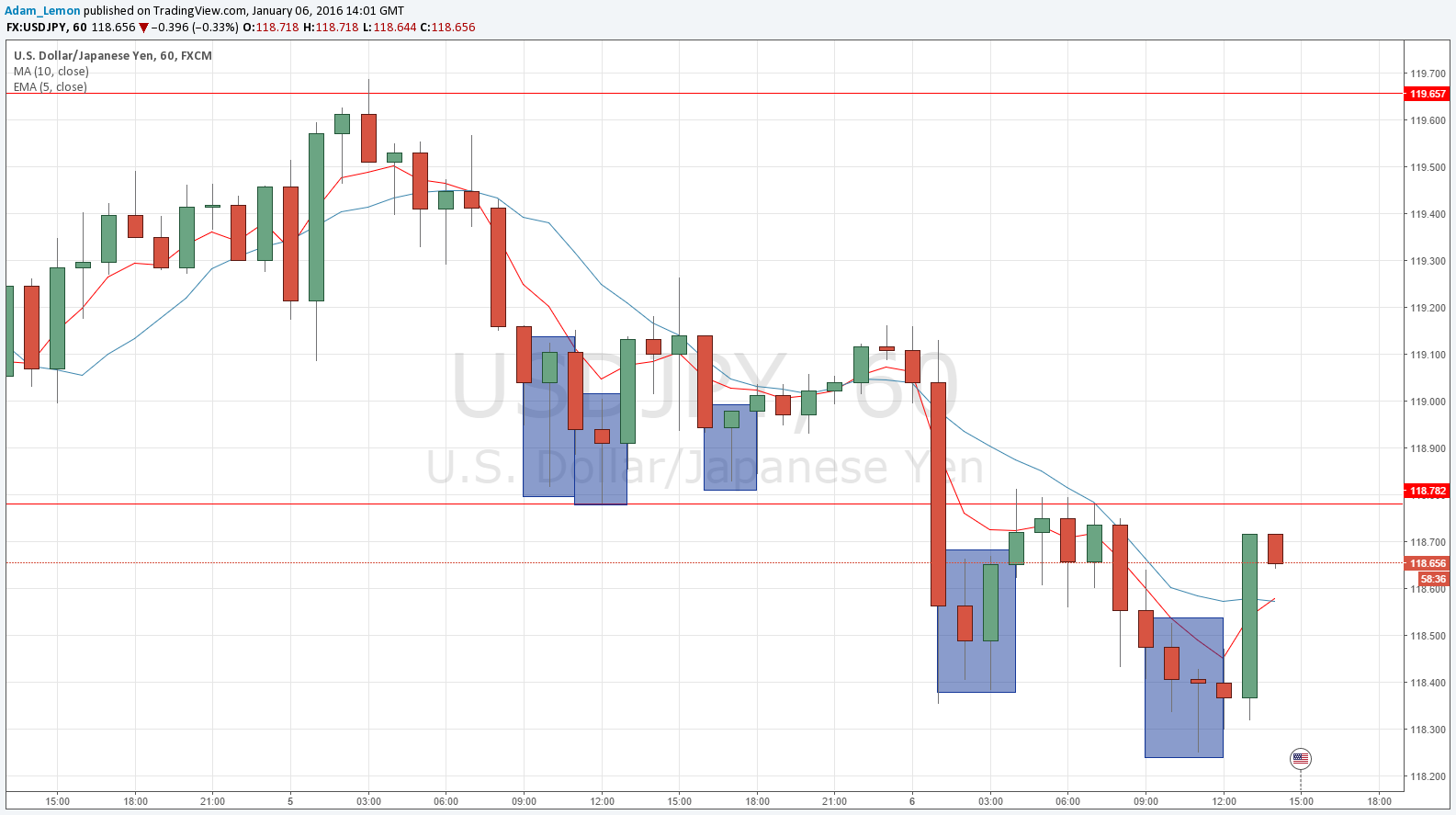

Here is the same chart, but this time it shows highlighted examples of bullish Flying Buddhas. There are a total of seven candlesticks which qualify:

Note that you might get more than one “Flying Buddha” candlestick in a row.

How You Can Trade a “Flying Buddha” Candlestick

If you are looking for a long trade, for example, and you see a bullish “Flying Buddha” candlestick appear, when the candlestick closes you can put an order for a long trade just above (e.g. 1 pip) the high of that candle. You can also place a stop loss just below the low of the candle.

If the price hits the stop loss before the entry is triggered, you can remove the entry order, as the candlestick has not “worked” as signifying a turn in price. The whole point of the Flying Buddha is to get you into a turn in price very early, which allows an entry with a tight stop loss, which should make your trade more profitable.

What if during the next candle neither the stop loss nor the entry price are reached? Personally, I cancel the trade entry order when this happens, because I think the turns in price that happen quickly and strongly usually make the best trade. However, there is no reason why you cannot leave the entry there, and just wait until either the entry is reached, or the stop loss is reached first, in which case you can cancel the trade entry order. If you do, don’t forget about it! You might want to set an alert to your phone to let you know when either price is reached if you are going to be away from your trading screen.

Why Use the “Flying Buddha” Pattern?

In order to reach a good answer to this question, let’s start by considering the nature of the Forex market. Most of the time it ranges, instead of trending, especially on shorter time frames. What this means is that if the price goes up one day, it is more likely to go down the following day than go up again, and vice versa. Additionally, one thing you notice from watching Forex markets long enough is that if the price goes up a long way very quickly, it is more likely to fall back to where it started than it is to keep on going up.

Once you see the truth of these two statements, you begin to see why “Flying Buddha” candlesticks can be great indicators of a turn in price, as the price usually has to have moved up or down quite quickly and with some force in order to form such a candle. The entry method described previously gets you in once the turn shows some sign of already being underway, i.e. the “reverse” side of the candle is broken first.

Another good reason to use these candles for entries is that they are often quite small. Therefore your risk in terms of potential reward can usually be kept very small. Too many traders focus on trying to make gains without stopping to consider how much better off they would be if they also gave as much thought to keeping their losers very small. In simple terms, what I am trying to say is that it is great to make 100 pips, but if you can do that by only risking 10 pips you are far better off – (five times better off in fact!) than by risking 50 pips. Getting into trades very early can be psychologically difficult, but it is actually problematic to wait too long for confirmations of the move you are looking for, because by then it is either too late, or you have to risk far too much for the reward.

Does the “Flying Buddha” Pattern Still Work?

A closer look at a historical back test I have run on this pattern shows me something worrying: the results have deteriorated in recent years, particularly at the lower expectancies. For example, from 2014 to 2016, the positive expectancy using a profit target of 1 to 1 or 2 to 1 is significantly lower, although still profitable. How concerned should we be about this? Well, in Forex trading, the highest expectancies are usually achieved by aiming for large profit targets, so maybe it doesn’t matter. Yet it’s a fact that even the best money management strategies tend to require that partial profits are taken at lower reward to risk ratio targets, in order to achieve a compounding effect which ensures a smoother equity curve and better overall results. It is also true that a trading systems which makes all its profits from only a handful of trades, some of which may not occur over an entire year, is not only extremely psychologically challenging, but also dangerous, as should a single one of the trades me missed or botched, then the whole strategy can become seriously unprofitable. Despite these concerns, I still believe that the “flying buddha” remains a valid trade entry strategy, as although the profitability is less, it is still present and statistically significant.

Conclusion

In the next article, we will look at methods you can use to trade only the best “Flying Buddha” candlesticks in order to make sure your trading is profitable.