FBS Editor’s Verdict

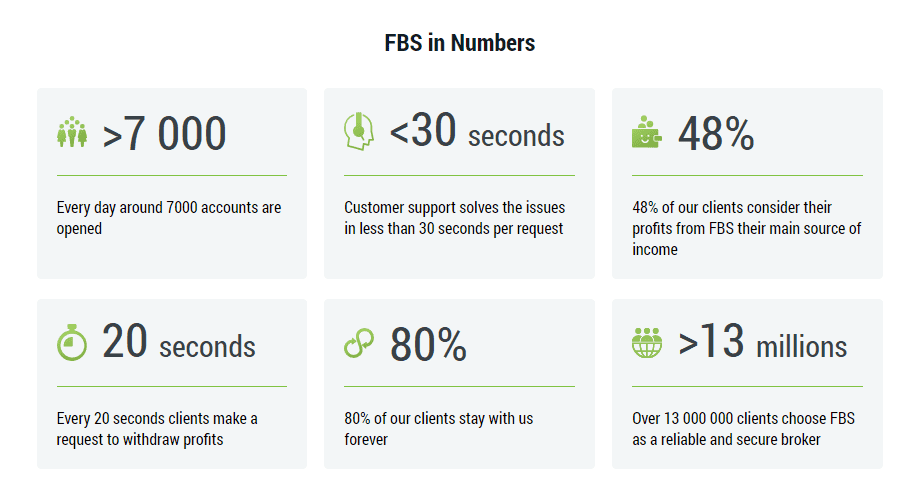

FBS is a Cypriot Forex broker owned and operated by Tradestone LTD headquartered in Limassol, Cyprus. The brokerage was founded in 2009 and is regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 331/17. Since its inception, FBS has received over 40 international recognitions and awards and is home to over 13,000,000 clients. According to the broker, 7,000 new accounts are opened every day and FBS receives and processes one withdrawal request every 20 seconds. 80% of FBS clients remain loyal to the broker and 48% list trading revenues generated at FBS as their prime source of income. As a truly global Forex broker, FBS serves clients in 190 countries and expands its market share on a daily basis. The 24/7 customer service team usually responds to requests in less than 30 seconds and speaks multiple languages.

Overview

Negative balance protection offers another layer of security and protects traders against critical market developments and volatile price swings.

Belize CySEC, FSC Belize 2009 Market Maker $10 for Cent Accont/$100 for Standard Account MetaTrader 4, MetaTrader 5 0.7 pips ($7.00) 1.2 pips ($12.00) $0.05 $0.23 $20.00

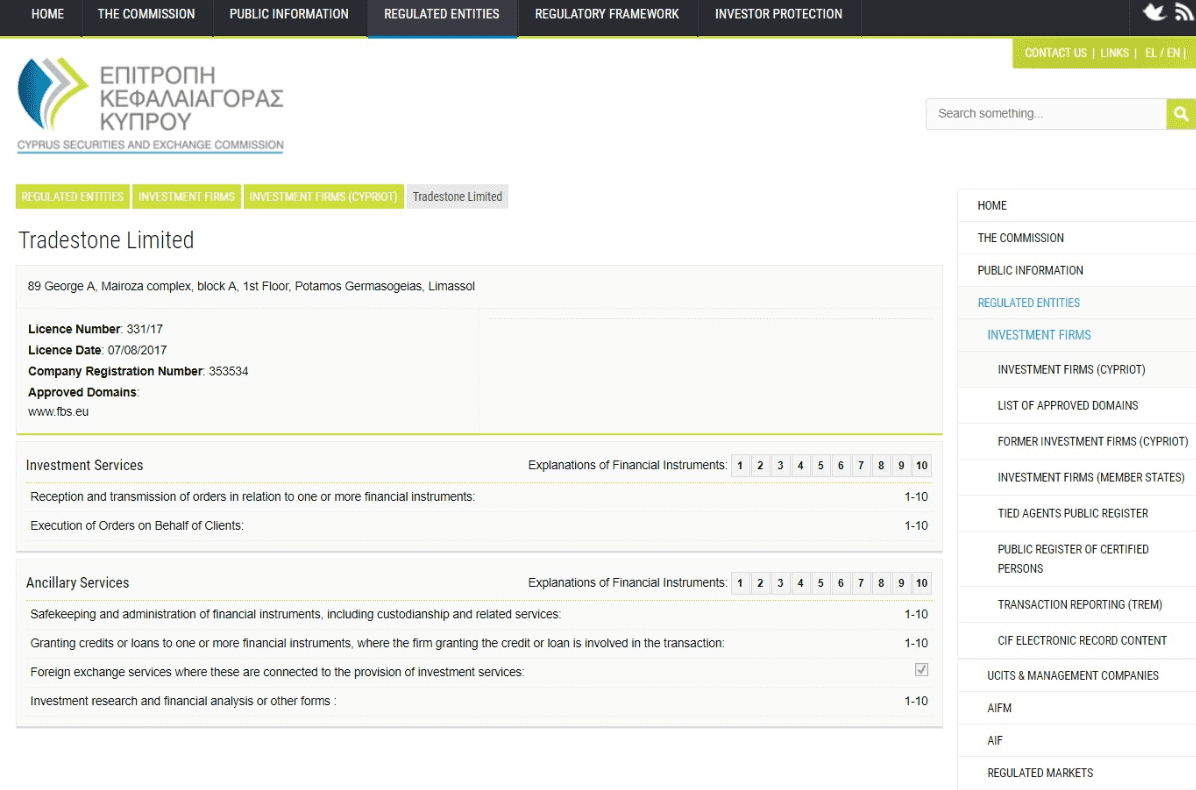

Regulation and Security

Tradestone LTD is an investment firm registered in Cyprus (Company Registration Number 353534) and is regulated by the Cyprus Securities and Exchange Commission (CySEC License Number 331/17). Cyprus is part of the European Union and offers a great mix of regulation and freedom to operate as a global financial firm. Prior to acquiring the CySEC license, the firm was offering its services from its Belize registered subsidiary and was well known for its aggressive market expansion. Since the acquisition of the license, traders can rest assured that their funds are safe and that the regulator ensures that FBS will comply with the directives of the legislative and regulatory framework.

Since Cyprus is a member of the EU, FBS is under the regulatory framework as set out in the Markets in Financial Instruments Directive (2004/39/EC) or MiFIID. It has been in effect since November of 2007 and aims to create and maintain a high degree of harmonized protection for investors in financial instruments. MiFID II came into effect in January of 2018 and was designed to further strengthen investor protection and increase transparency.

In June of 2015 the EU released its 4th Anti-Money Laundering Directive which represents the most stringent AML legislation across Europe. All EU member states have been complicit since June of 2017 and FBS adheres to the rules as outlined in the directive. In addition, FBS is a member of the Investor Compensation Fund (ICF) which ensures eligible retail clients will get reimbursed if their broker fails to comply due to financial difficulties as outlined in the fund.

Fees

Average Trading Cost EUR/USD | 0.7 pips ($7.00) |

|---|---|

Average Trading Cost GBP/USD | 1.2 pips ($12.00) |

Average Trading Cost WTI Crude Oil | $0.05 |

Average Trading Cost Gold | $0.23 |

Average Trading Cost Bitcoin | $20.00 |

FBS generates its revenue primarily from spreads which is the difference between bid and ask prices as well as swap rates charged on holding positions overnight. FBS doesn’t offer ECN accounts and therefore is not charging trading commissions. Spreads start as low as 1.0 pip and increase depending on the liquidity of the currency pair. The broker offers “Swap Free Islamic Accounts” accounts in order to offer their services to Muslim traders who are prohibited by their faith to accept or be charged interest.

Forex traders may activate this type of account while other traders can check the exact swap rates from inside their MT4 platform by following these steps:

1. Right-click on the desires symbol in the “Market Watch” window and select “Symbols”.

2. Select the desired currency and then click on “Properties” located on the right side.

3. Scroll down until you see “Swap Long” and “Swap Short”

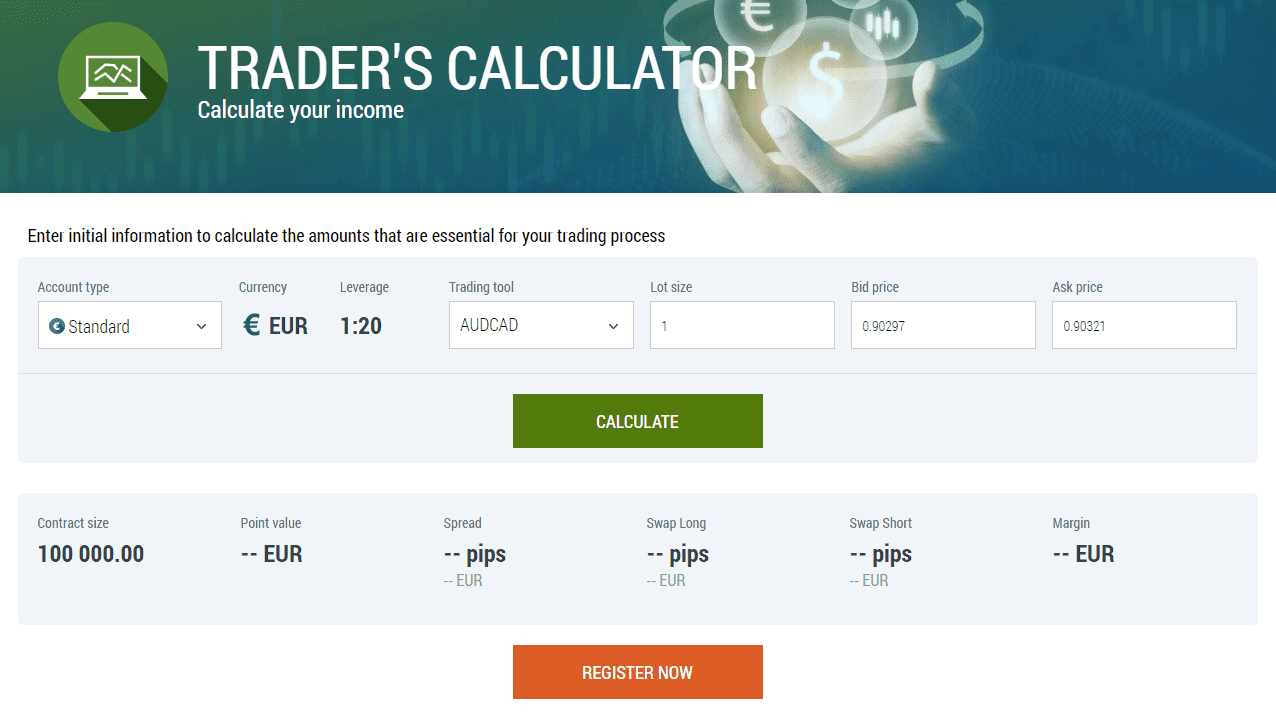

In addition, Forex traders can use the FBS Trading Calculator to get full information on a trade before entering it.

According to FBS, it doesn’t charge traders for deposits or withdrawals which represents an added service to Forex traders and reduces the overall cost per trade. This will have a big impact for frequent retail traders as well as professional outlets where costs play an important role.

What Can I Trade

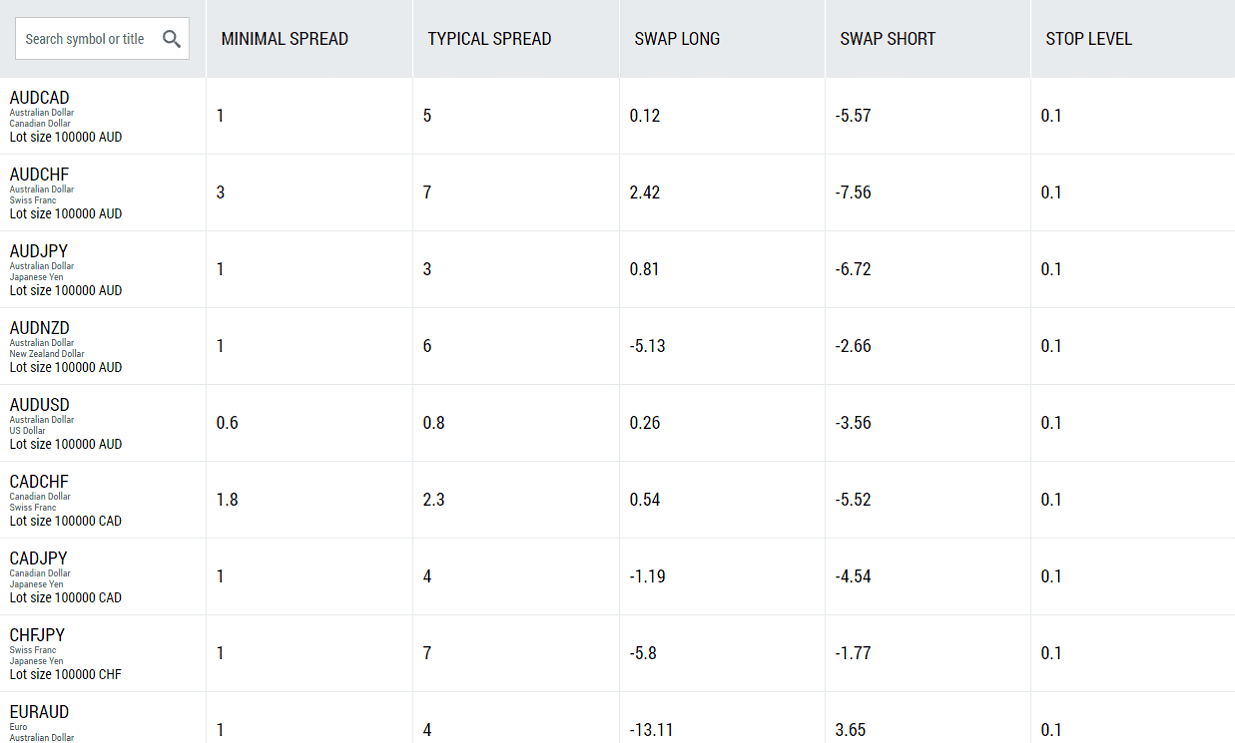

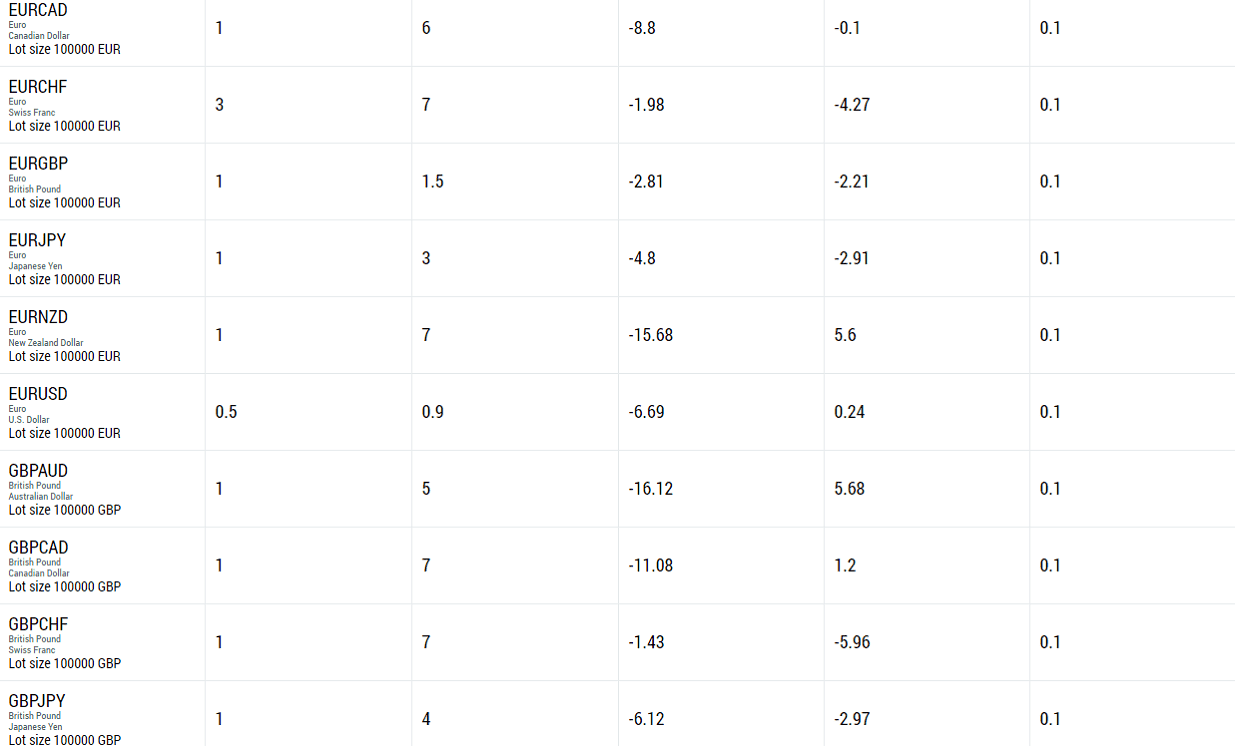

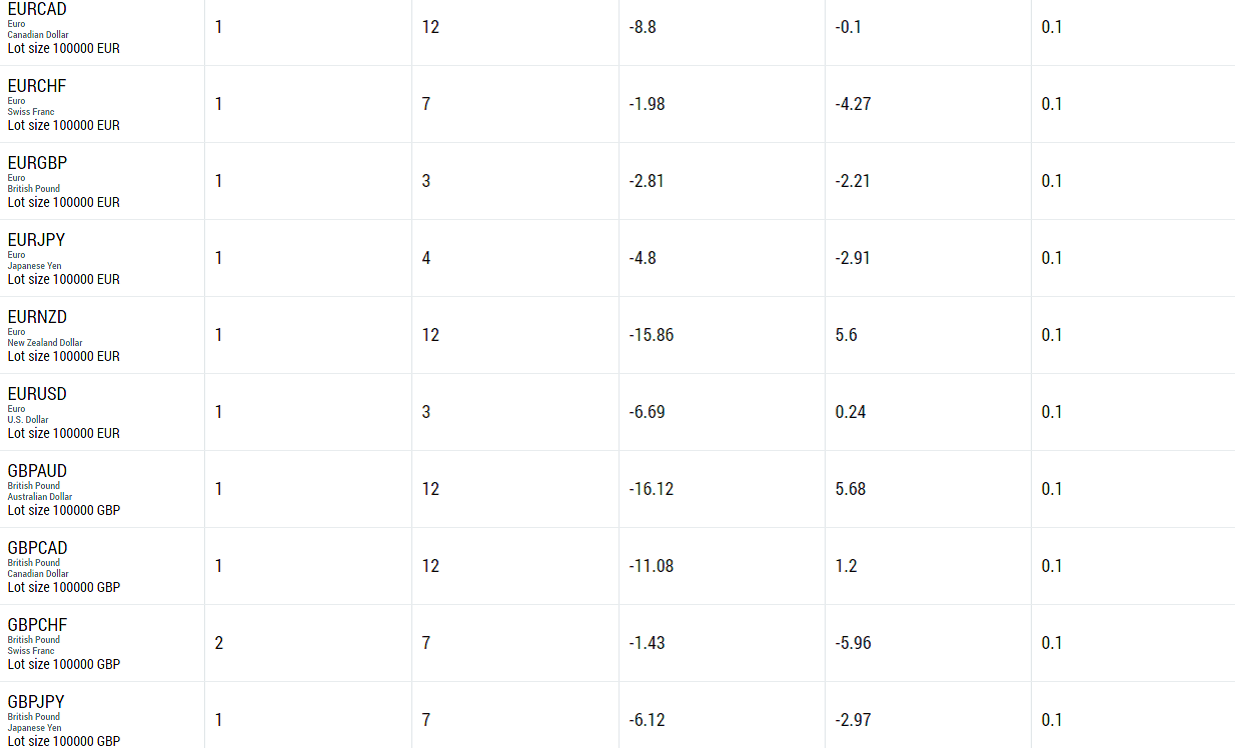

FBS offers a rather limited selection of assets with only 28 currency pairs and two metals. The contract specification differs for their Standard Account and their Cent Account. The overall selection should be viewed as bare minimum and is not adequate for professional clients.

Contract Specifications Forex Standard Account

Contract Specifications Metal Standard Account

Contract Specifications Forex Cent Account

Contract Specifications Metal Standard Account

The lack of more currency pairs as well as metals is unfortunate, FBS also lacks CFD’s on equity and indexes as well as cryptocurrencies. While it provides the basics for a Forex trading account, true diversification cannot be achieved which makes it unsuitable for traders who seek cross-asset trading opportunities.

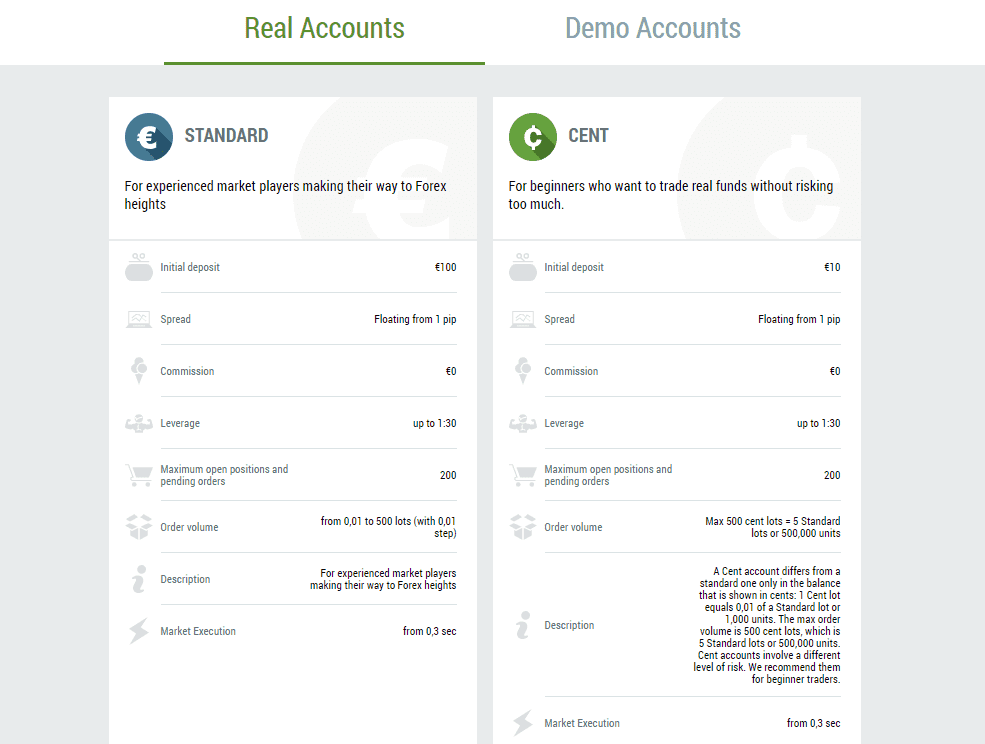

Account Types

FBS extends its limitations to trading accounts where it offers two types, a Standard Account and a Cent Account. The main difference between both is the minimum deposit which starts at $/€10 for Cent Accounts and at $/€100. The minimum spread in both is a floating one which starts at 1.0 pip and the maximum leverage is 1:30. The Cent Account also comes with a maximum order volume of 5 standard lots (1 standard lot is equal to 100,000 units) where the Standard Account sees this limit increased to 500 standard lots. The maximum amount of open/pending positions is set at 200 with a starting execution speed of 0.3 seconds.

The Cent Account is basically an entry level account for new Forex traders to get started with micro deposits and best suitable to create and test new strategies, but fairly irrelevant as the Standard Account has a very small minimum deposit requirement. FBS doesn’t offer special trading conditions to traders with higher balances or more frequent trading activity, a feature which is another unfortunate miss for this Forex broker.

In addition, FBS offers a demo account.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

FBS extends its limitation to just the MT4 Trading Platform for Windows, Apple macOS, Android, Apple iOS and FBS WebTrader. While MT4 remains the most used trading platform for Forex traders, FBS makes no effort to offer traders something which is not included with the standard operating license for the MT4 Trading Platform. Many Forex brokers don’t even pay for the full license and can obtain their trading platform under a White Label partnership through another Forex broker at a fraction of the cost.

Popular choices, especially for new traders, such as social trading or copy trading remain absent as FBS once again sticks to its minimalistic approach and offer the bare minimum in order to operate as a Forex broker. Features listed are part of the MT4 Trading Platform and should not be credited to what FBS offers.

Unique Features

During the course of this FBS review we found that there were few unique features available to the brokerage’s traders. FBS does very little outside normal operating procedures, but it does those things rather well as evident by the awards the brokerage received.

Research and Education

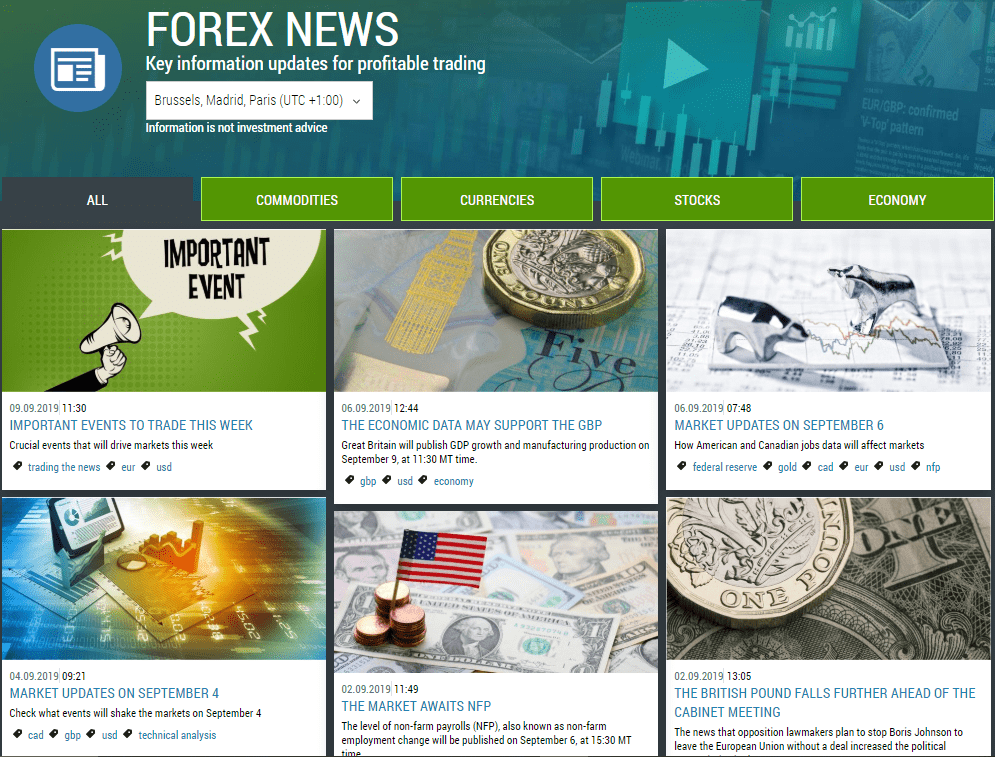

It is nice to note that FBS does offer a range of research, analytics and educational aspects which are beneficial to new traders. The market analytics section is broken down into three parts: Forex News, Daily Market Analysis and Forex TV. The educational section comes divided into five categories: Forex Guidebook, Tips for Traders, Webinars, Video Lessons and Glossary.

Forex News

Traders get access to Forex news and have the option to filter the articles by commodities, currencies, stocks and economy. Since FBS doesn’t offer CFD trading, the stocks sections appear out of place and more for marketing purposes and SEO than for the benefit of its trader base.

Daily Market Analysis

The FBS Daily Market Analysis is broken down into technical analysis and fundamental analysis and may offer the best feature this broker offers. Forex traders can easily navigate the research, but the extent of each analysis is rather limited and refined to a few basic aspects of technical analysis summed up in one paragraph. The fundamental analysis is a bit more detailed and offer Forex traders basic coverage of key topics.

Forex TV

The Forex TV section is broken down into Weekly Insights, Daily Trading Plans and Webinars and FBS has spent the most attention on this part. It is a great feature and offers Forex traders the best service. The Weekly Insights section may be the most relevant which walks traders through important events as marked in the economic calendar. New traders may find the Daily Trading Plans to be useful, especially if they don’t have their own trading strategy developed yet. It would be nice to see FBS expand their current approach and make better use of technology in order to allow traders to act on what they view.

Forex Guidebook

The Forex Guidebook is filled with educational content and covers the entire spectrum of technical as well as fundamental analysis. New traders will find this course very useful and it is broken down into four sections: Beginner, Elementary, Intermediate and Experienced. This may be the most beneficial feature to new traders which is offered by FBS and the perfect starting point for those who are serious about learning how to trade. It is easy to navigate and filled with examples which makes it easy to understand.

Tips for Traders

This section is for more advanced Forex traders who are in the process of developing their own trading strategy or trying to decide which trading strategy to follow. It is filled with different trading strategies with quick explanations of how to deploy them. FBS could spend a bit more time and effort to describe the strategies more in depth, especially for new traders to get a better picture of what each strategy is about.

Forex Webinars

Webinars have gained in popularity and more Forex brokers are using them in order to engage with their traders. FBS offers free webinars, but registration is required in order to participate. It appears that FBS attempts to how one webinar every two weeks, but this could be subject to change at the discretion of the broker.

Video Lessons

FBS has made an effort to create interesting video lessons which are broken down into different categories. The lessons can be multi-part and are divided in FBS related topics such as account opening tutorials, general Forex topics which touch on basic aspects of trading and MT4 tutorials. Overall this is a rather well-rounded offer to Forex traders and was a welcome find during this FBS review.

Glossary

A glossary can be accessed from the FBS website and while some trader may revert to it in order to get clarity on certain terms, most traders are unlikely to use it as they find their information online and faster.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |

Customer service is not something most traders will ever use, but FBS has a multi-lingual support staff available 24/7. Since the Forex market is closed on weekends, it is unclear why support staff would be available or if it indeed is. E-mail support certainly remains available at all times.

Bonuses and Promotions

The CySEC regulated branch of FBS doesn’t offer any special bonuses or promotions to traders in keeping with regulatory policy.

Opening an Account

Forex traders should be able to open an account online in a few simple steps which has become the norm in today’s Forex industry. The regular verification documents are required and FBS needs to satisfy AML and KYC requirements as mandated by its regulator CySEC. The registration part should only require a few moments before traders can access their back-office from where further documents can be uploaded.

Deposits and Withdrawals

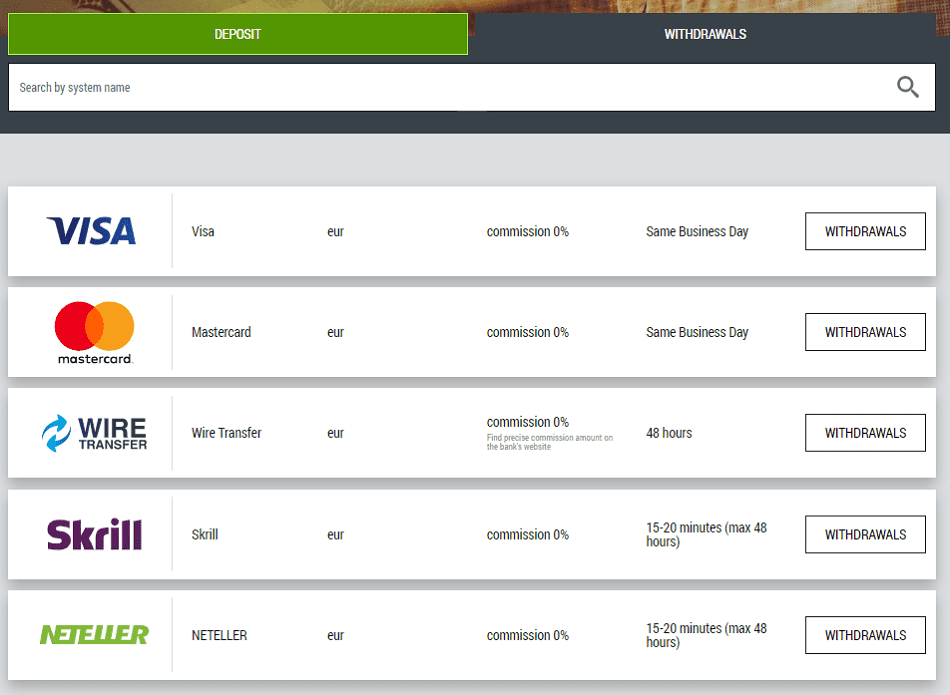

When it comes to deposit and withdrawal options, once again FBS sticks to the basics. Forex traders have the choice of credit cards, bank wires and Skrill or Neteller which are both regulated in the EU. All deposit fees are waived which is standard industry practice and the deposit time is listed as instant with the exception of wire transfers.

Withdrawal options are the same as deposit options and Forex traders are required to request a withdrawal with the same method the deposit was conducted. This is also common practice in the Forex market. The positive for FBS is that they also waive all withdrawal fees, but Forex traders may still face charged by the payment processor. Withdrawal requests for credit cards are handled the same business day, bank wires within 48 hours and Skrill or Neteller requests between 15-20 minutes with a maximum of 48 hours.

Summary

FBS is a regulated Forex broker in Cyprus and enjoys the regulatory body of the EU. Clients can trade with confidence knowing their funds are protected and FBS complies with all regulatory requirements. Spreads are competitive and start at 1.0 pips in a standard account, but the lack of assets available for trading is a disappointment. FBS offers the bare minimum to traders both in terms of trading assets, platforms and deposit options, but what it does offer it offers well; an effort has clearly been made when it comes to education of new traders as well as video content. FBS offers no special bonuses or promotions and sticks to essentials, which can help new traders focus on their core trading strategies without the distractions. The secure back office of FBS handles all financial transactions, and traders must verify their accounts before requesting withdrawals. FBS is a market maker and can act as the direct counterparty to trades placed by clients, meaning it will also directly profit from their losses. The FBS bonuses are for trading only, and while traders may withdraw all profits, the bonuses are non-withdrawable. FBS became operational in 2009. FBS has no restrictions on Indian traders and accepts them as clients. FBS processes withdrawal requests for credit/debit cards the same business day, bank wires within 48 hours, and Skrill or Neteller between 15-20 minutes with a maximum of 48 hours. Beginner traders should consider FBS for its wealth of educational content ideal for beginners to learn the fundamentals of trading. It also offers in-house trading recommendations, which can aid new traders until they develop their personalized trading strategies. FBS is a reliable broker operating since 2009 with oversight from two global regulators, the IFSC in Belize and the CySEC in Cyprus.FAQs

How do I withdraw money from FBS?

What kind of broker is FBS?

Can I withdraw FBS bonus?

How old is FBS broker?

Is FBS legal in India?

How long does it take to withdraw from FBS?

Is FBS good for beginners?

How reliable is FBS?