Editor’s Verdict

Overview

Review

SpeedTrader caters exclusively to active day traders with proprietary trading platforms, extensive order routing, and integrated locates from four sources. SpeedTrader claims to be the broker of choice for demanding active day traders, and I conducted an in-depth review to conclude if it delivers on this bold claim. Should you manage your equity portfolio at SpeedTrader?

SpeedTrader - A dedicated equity broker for active day traders

Headquarters | United States |

|---|---|

Year Established | 1999 |

US Persons Accepted? |

I like that SpeedTrader chose a niche and developed trading platforms specifically for active day traders. Beginner traders might feel overwhelmed by the complexity of SpeedTrader Pro, while the web based SpeedTrader ActiveWeb fails to include Level II data.

SpeedTrader Main Features

Retail Loss Rate | Undisclosed |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Undisclosed |

Minimum Standard Spreads | Undisclosed |

Minimum Commission for Forex | Not applicable |

Commission for CFDs/DMA | $2.49 or $0.002 per share |

Commission Rebates | Yes |

Minimum Deposit | $2,500 to $10,000 (platform-dependent) |

Demo Account | Yes |

Managed Account | No |

Islamic Account | No |

Inactivity Fee | $30 per quarter |

Deposit Fee | Yes + Third-Party |

Withdrawal Fee | Yes + Third-Party |

Funding Methods | 2 |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. SpeedTrader is regulated in the USA by the SEC.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

US | Securities & Exchange Commission (SEC) | Undisclosed |

- The owner of SpeedTrader is Mint Global Markets, Inc.

- Mint Global Markets is a member of the Financial Industry Regulatory Authority (FINRA), the private US corporation acting as a self-regulatory organization (SRO) member brokerage firms and exchange markets.

- The Securities Investor Protection Corporation (SIPC), the federally mandated, non-profit, member-funded, US corporation, protects clients up to $500,000 per net equity or $250,000 for cash claims.

- SpeedTrader operates under a capable and competitive regulatory framework.

- Client deposits remain segregated from corporate funds.

- AXOS Clearing accounts get an additional insurance policy of $99.5 million.

What is missing?

- Greater transparency concerning its corporate owner and core management team.

Noteworthy:

- Mint Global Markets has sixteen regulatory events and one arbitration case on its FINRA record.

SpeedTrader follows the industry standard for US brokers with SEC regulation, FINRA membership, and SIPC protection. I recommend traders read the detailed FINRA report concerning the seventeen regulatory events and determine if they deter them from opening an account with SpeedTrader or ignore them as insignificant to their safety and security.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability.

The SpeedTrader pricing environment consists of four fees:

- Commission Fees

- Software Fees

- Account Fees

- Routing Fees

SpeedTrader remains a rare broker charging commissions for equity traders after many competitors introduced commission-free trading. It is more common for brokers catering to high-frequency traders, like SpeedTrader does, but the costs remain higher compared to many competitors.

SpeedTrader’s commissions are:

- Stocks and ETFs between $2.49 and $4.49 per trade.

- Stocks and ETFs between $0.0044 and $0.0020 per share with a minimum of $2.00 per trade.

- Options between $0.25 and $0.40 per contract with a minimum of $2.00 per trade.

Noteworthy:

- High-volume traders can negotiate discounts.

- SpeedTrader does not advertise its spreads.

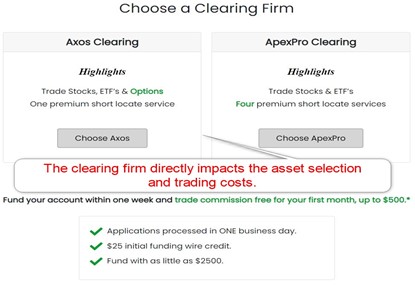

- The applicable costs depend on if traders transact via AXOS Clearing or ApexPro Clearing, the two divisions of SpeedTrader.

Overview of the commission tiers at SpeedTrader

SpeedTrader levies the following software fees:

- $49 monthly for Level 1 users, waived with $199 commissions per month.

- $79 monthly for Level 2 users, waived with $499 commissions per month.

- Up to eight monthly service and data fees, depending on individual needs, with a maximum cost of $234 for non-pro users and $560 for pro users.

- Five optional services for a total cost of $150, which includes fundamental data, news, and trading signals.

Noteworthy:

- Traders designated as professional who accumulate less than $499 in monthly commissions can face software costs as high as $789.

- The initial minimum deposit is $10,000.

- Account fees consist of 39 charges ranging from $4 to $850.

- Routing fees depend on the provider traders use and include costs for adding or taking liquidity and for outbound share transactions, applicable on a per-share basis.

- A Section 31 regulatory fee of $0.0000218 of the total dollar amount of securities sold.

- A FINRA TAF Fee $0.000119 per share of securities sold with a maximum of $5.95 per trade on sell orders and $0.0002 per option contract.

- The $30 quarterly inactivity fee applies if traders place less than 15 trades per calendar quarter.

- Margin trading is available, but SpeedTrader fails to transparently note financing costs, with some traders reporting them as high as 6.00%.

I recommend the following:

- Each trader should check the costs applicable to them while familiarizing themselves with all existing fees.

- While 25+ routing providers exist at SpeedTrader, and the resulting deep liquidity should result in tight spreads, traders should monitor them closely and weigh them versus commission-free competitors.

What is missing at SpeedTrader?

- A margin table, where SpeedTrader lists the average costs, as they change with market conditions.

Additional comments concerning trading costs at SpeedTrader:

- Option traders get competitive costs at SpeedTrader.

- Overall trading costs are above average but decrease with monthly trading volume.

- ECN discounts are available.

What Can I Trade?

While SpeedTrader does not provide details, it allows traders access to US equity markets, options, bonds, and mutual funds. Judging on the order routing providers, traders get access to assets listed on the NYSE, the NASDAQ, the OTCBB, and the BATS.

Noteworthy:

- I like to see more information outlining available trading instruments, with a bare minimum the number of equities on each exchange.

- As an equity-only broker, other assets are unavailable, which is understandable.

- SpeedTrader only offers US equity and options trading online.

Asset List and Leverage Overview

SpeedTrader Leverage

By default, all trading at SpeedTrader is unleveraged. Margin trading is available on request, but SpeedTrader does not disclose public information about this. It likely structures each offer on a case-by-case basis.

SpeedTrader Trading Hours (EST)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Not applicable | Not applicable |

Forex | Not applicable | Not applicable |

Commodities | Not applicable | Not applicable |

European CFDs | Not applicable | Not applicable |

US CFDs | Monday 04:00 | Friday 20:00 |

Noteworthy:

- Equity markets open and close each trading and are not operational continuously like Forex and cryptocurrencies.

Account Types

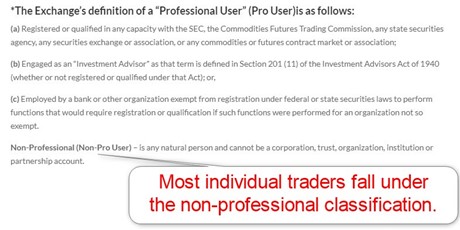

SpeedTrader does not have account types in the traditional sense but offers subsidiaries, two trading platforms, and two trader classifications. The combination of those six variables has a direct impact on trading costs and available assets.

Traders must choose between the following account types:

- AXOS Clearing versus ApexPro Clearing

- SpeedTrader ActiveWeb versus SpeedTrader Pro

- Non-professional or professional trader

My observations concerning the SpeedTrader options:

- The minimum deposit for SpeedTrader ActiveWeb is $2,500, and $10,000 for SpeedTrader Pro.

- Options trading is only available at AXOS Clearing.

- A 5,000 shares-per-order maximum exists at ApexPro Clearing.

- Most individual traders qualify as non-professional traders, but monthly costs can reach $463 plus trading costs.

SpeedTrader Demo Account

A free demo account is available on request, and SpeedTrader does not list any time limitation. I find the $100,000 account balance excessive, as it fails to accurately showcase live trading results for most traders and may promote wrong trading behavior. It is best-suited to learn how the trading platforms function.

My recommendation:

- The trading platforms are proprietary, and I recommend new traders should familiarize themselves with the trading functions in a demo account.

Trading Platforms

SpeedTrader offers its lightweight HTML5-based SpeedTrader ActiveWeb trading platform for less demanding traders. It requires a minimum deposit of $2,500. The SpeedTrader Pro is its desktop platform catering to active day traders and high-volume, high-frequency clients. Traders must deposit at least $10,000.

DAS Inc., an industry leader in direct access trading technologies, is the developer of both trading solutions. A mobile app is also available.

SpeedTrader ActiveWeb features include:

- Real-Time Level 1 Data

- Live Streaming News

- Online Trading History

- Real-Time Stock Charting

- Options Chains

- Account Management

- Twitter Feeds

- Custom Watch Lists

- Risk Management Tools

- Profit/Loss Display

SpeedTrader Pro features include:

- Advanced Charting with Multiple Chart Types

- Real-Time Streaming Level 2

- Account Management with Portfolio and Positions

- Fast Trade Executions

- Direct Access order Routing

- Real-Time Stock Charting

- Advanced Order Types

- Point-and-Click Trading

- Hot-Key Support

What is missing?

- Algorithmic or API trading

- Third-party developer support

My observations:

- Traders who can afford the $10,000 minimum deposit requirement should opt for SpeedTrader Pro, as it features order placement from the Level 2 screen.

- Neither trading platform has a user-friendly design but delivers the necessary functions for manual day trading.

- The absence of algorithmic trading places active day traders at a distinct disadvantage.

Overview of Trading Platforms

MT4 | No |

|---|---|

MT5 | No |

cTrader | No |

Proprietary/Alternative Platform | Yes |

Automated Trading | No |

Social Trading / Copy Trading | No |

MT4/MT5 Plugins | Not applicable |

Guaranteed Stop Loss | No |

Negative Balance Protection | Undisclosed |

Unique Feature One | Deep liquidity via 25+ routing providers |

Unique Feature Two | Customized for high-speed, high-volume trading |

Unique Features

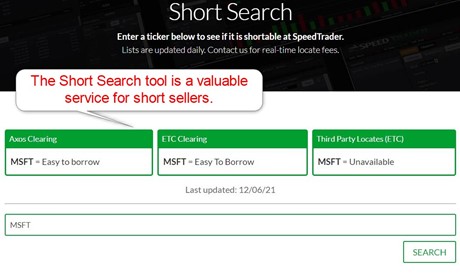

I like the Short Search tool at SpeedTrader, allowing traders to check if an asset is available for short selling. SpeedTrader also provides access to four third-party locate services at ApexPro Clearing for access to a more comprehensive list.

Research and Education

While SpeedTrader does not have a dedicated research or educational section, it maintains a blog with high-quality content. It covers many topics beginner traders can use for learning purposes.

The blog covers the following categories:

- Chart Patterns

- Day Trading

- Day Trading Starter Guide

- Fundamental Analysis

- Level 2 Strategies

- Market Recaps

- Options Trading

- Short Selling

- SpeedTrader Updates

- Stockbrokers

- Stock Market

- Swing Trading

- Technical Analysis

- Technical Indicators

- Trading Platforms

- Trading Psychology

- Trading Strategy

- Trading Tips

- Webinars

SpeedTrader also provides a signal service for a $40 monthly fee, but does not provide further details, besides listing it under Optional Services within its Software Fees section.

My takeaways:

- The blog is a high-quality source of information, especially for newer traders, while seasoned ones will also find interesting content to read between trades.

- SpeedTrader does not offer beginner traders a dedicated educational platform, which is fine, as SpeedTrader does not cater to first-time traders.

- 20 video tutorials explain core functions of the trading platforms, flattening the learning curve for traders who have not used DAS trading platforms before.

My recommendations:

- Traders may access research online free of charge since SpeedTrader does not provide it.

- Beginner traders should source in-depth educational content elsewhere before trading at SpeedTrader.

- The webinars feature occasional educational content.

Customer Support

Website Languages |

|---|

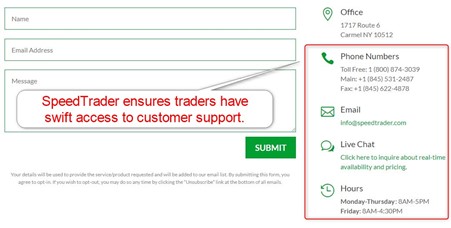

Customer support at SpeedTrader is available Monday through Thursday between 0800 and 1700 and on Friday from 0800 to 1630 local US time. Traders may call, e-mail, fax, use the webform or the live chat function.

My observations:

- The FAQ section offers answers to a few of the most common questions.

- Dedicated support for financial transactions, where most traders may face issues, is not available.

- Live chat pops up frequently when navigating the website, which I found annoying.

- I recommend live chat for non-urgent matters.

- Phone support is ideal for urgent questions.

Bonuses and Promotions

New traders who fund their accounts within one week of registration get one month of commission-free trading limited to $500. SpeedTrader also maintains a small affiliate program, with a $100 payout per funded referral, paid at the beginning of each month.

Opening an Account

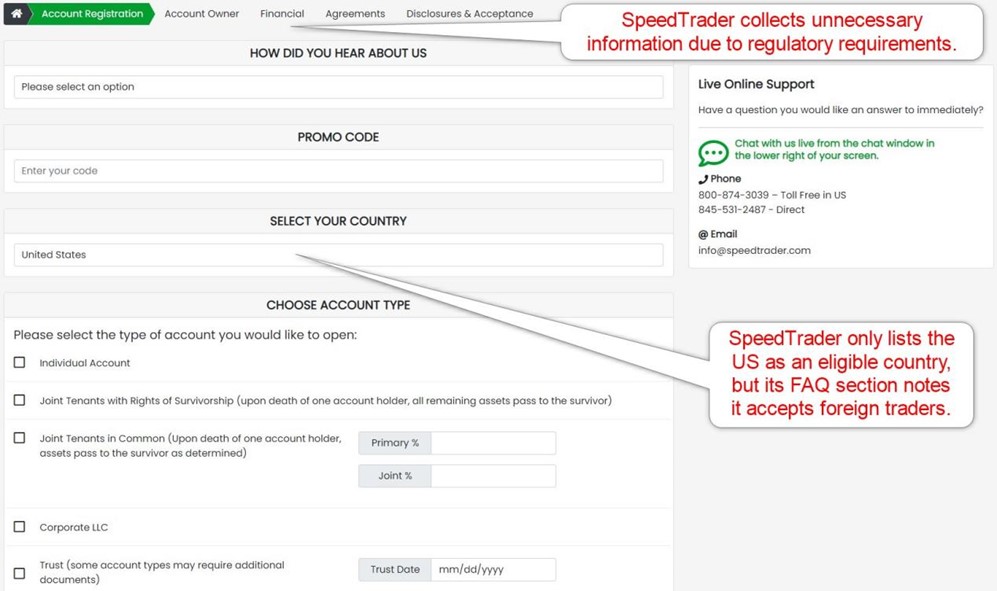

Opening an account at SpeedTrader consists of several steps. New clients start by providing an e-mail and password. Then they must choose their clearinghouse in the next step, AXOS Clearing or ApexPro Clearing. Following the selection, the account opening process starts, including financial information.

Some traders may find this intrusive, but since SpeedTrader does not ask for verification, they may answer as they see fit. It is one reason this line of questioning remains unnecessary.

Account verification is mandatory, but SpeedTrader does not mention the required documents. Most traders should satisfy AML/KYC rules by sending a copy of their driver's license or passport.

Minimum Deposit

The minimum deposit for SpeedTrader ActiveWeb is $2,500, and for SpeedTrader Pro, it is $10,000. Pattern day traders must have a minimum account balance of $30,000.

Payment Methods

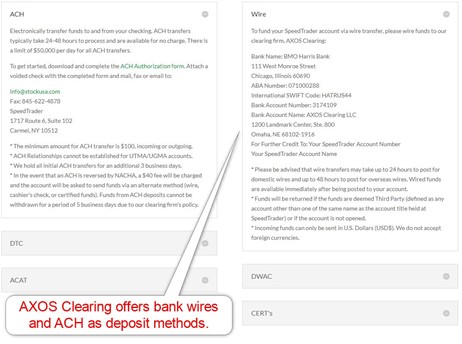

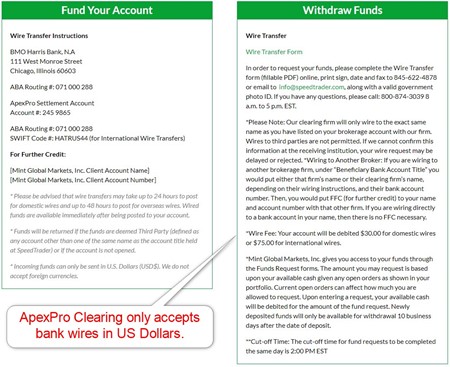

SpeedTrader offers bank wires and ACH plus a few broker-to-broker transfers.

Accepted Countries

SpeedTrader primarily caters to US-based traders but notes on its FAQ that it accepts clients resident in some countries outside the USA, including the UK.

Deposits and Withdrawals

All financial transactions take place in the secure back office of SpeedTrader. The options are severely limited, and I am missing the flexibility of multiple payment processor options, but this is typical for US-based brokers. Domestic fees are $30, international fees are $75.

My observations:

- ApexPro Clearing only transacts via costly bank wires.

- AXOS Clearing offers ACH plus three stock-based or broker-to-broker transfers.

- Traders may request a cheque as a withdrawal option.

- Wire and ACH transfers typically take 24 to 48 hours.

- The minimum ACH amount is $100.

- Traders cannot request withdrawals of ACH funds for five business days.

- SpeedTrader only accepts deposits in US Dollars.

- Traders must fill out withdrawal forms.

- The deposit and withdrawal processes are out-of-date.

My recommendations:

- It is ideal to use an option besides the bank or credit/debit card used for day-to-day financial operations.

Trading Platform

The Bottom Line

I like the trading environment at SpeedTrader for high-frequency and high-volume traders based in the US with portfolios of $30,000 or more. International traders have notably superior choices. SpeedTrader maintains an expensive monthly fee structure plus commission-based trading costs. I appreciate that SpeedTrader picked a niche and caters exclusively to qualifying traders, but the deposit and withdrawal process is dated. I miss support for algorithmic trading, a feature its core trader base requires to maintain an edge. SpeedTrader operates under the regulatory framework of the SEC. It is also a FINRA member and offers traders protection under SAIC. AXOS Clearing traders get an additional $99.5 million third-party insurance underwritten by Lloyd's of London. SpeedTrader is an expensive broker with monthly fees as high as $463 for non-professional clients and $789 for professional ones, plus trading costs on each transaction.FAQs

Is SpeedTrader regulated?

Is SpeedTrader free?