FXOpen Editor’s Verdict

FXOpen was founded in 2005 and has since become one of the fastest-growing and most impressive brokerages on the market today. Regulated in Nevis, a light regulatory approach combines with technology and a forward-thinking management team.

Overview

It features genuine ECN pricing on the MT4/MT5 trading platforms, is highly transparent, and provides a shining example of a trustworthy, competitive trading environment.

United Kingdom ASIC, FCA 2005 ECN/STP, No Dealing Desk $1 MetaTrader 4, MetaTrader 5

Regulation and Security

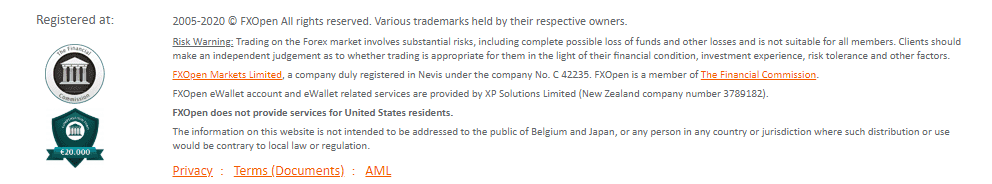

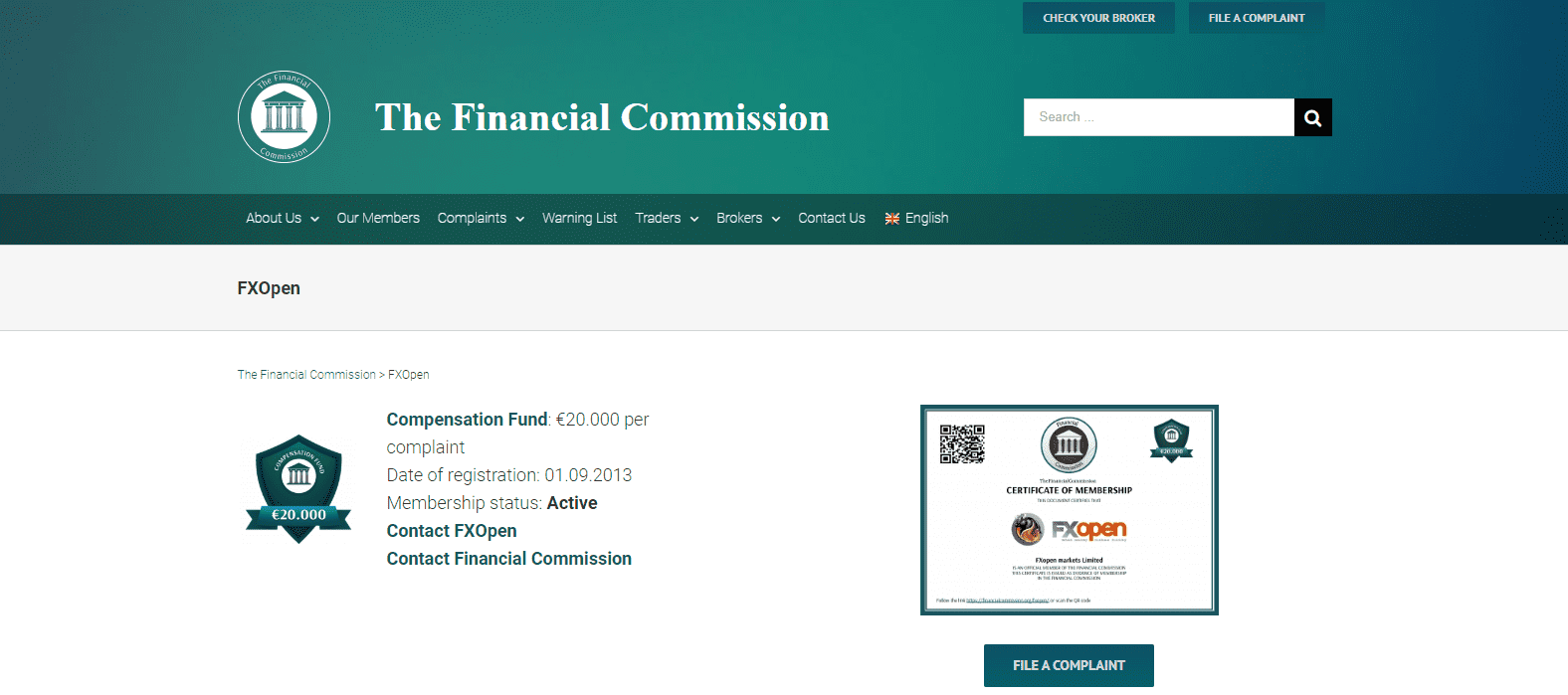

While FXOpen Markets Limited is registered in Nevis as a company, it is not regulated by the Financial Services Regulatory Commission. Instead, it opted for oversight and investor protection by The Financial Commission, based in Hong Kong. It is the first of its kind; an independent self-regulatory organization and external dispute resolution (EDR) body, primarily intended as alternative oversight for Forex brokers. The Financial Commission allows FXOpen to bypass expensive and often counter-productive rules while offering protection to traders. Portfolios are covered up to €20,000 per case, which is on par with CySEC regulated entities. The Financial Commission is gaining traction within the brokerage industry as a genuine solution to uncompetitive regulatory requirements.

eWallet services are provided by a New Zealand registered entity, XP Solutions Limited. Additionally, the Australian and UK subsidiaries operate under the oversight of their respective regulators. Overall, FXOpen has a clean regulatory track record and maintains a safe and secure trading environment.

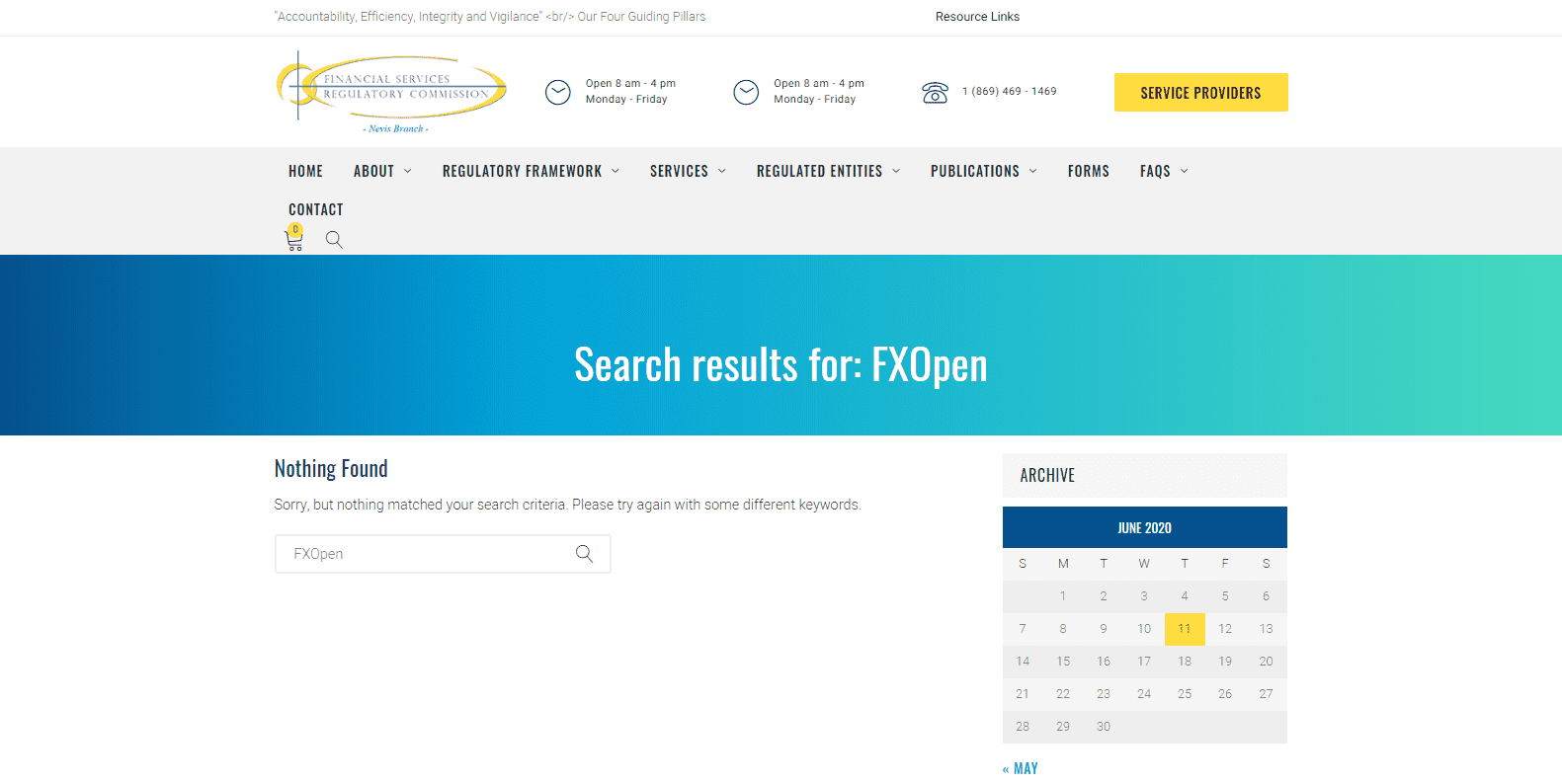

FXOpen Markets Limited is a Nevis registered company.

The Financial Services Regulatory Commission does not regulate this brokerage.

The Financial Commission, based in Hong Kong, provides primary oversight.

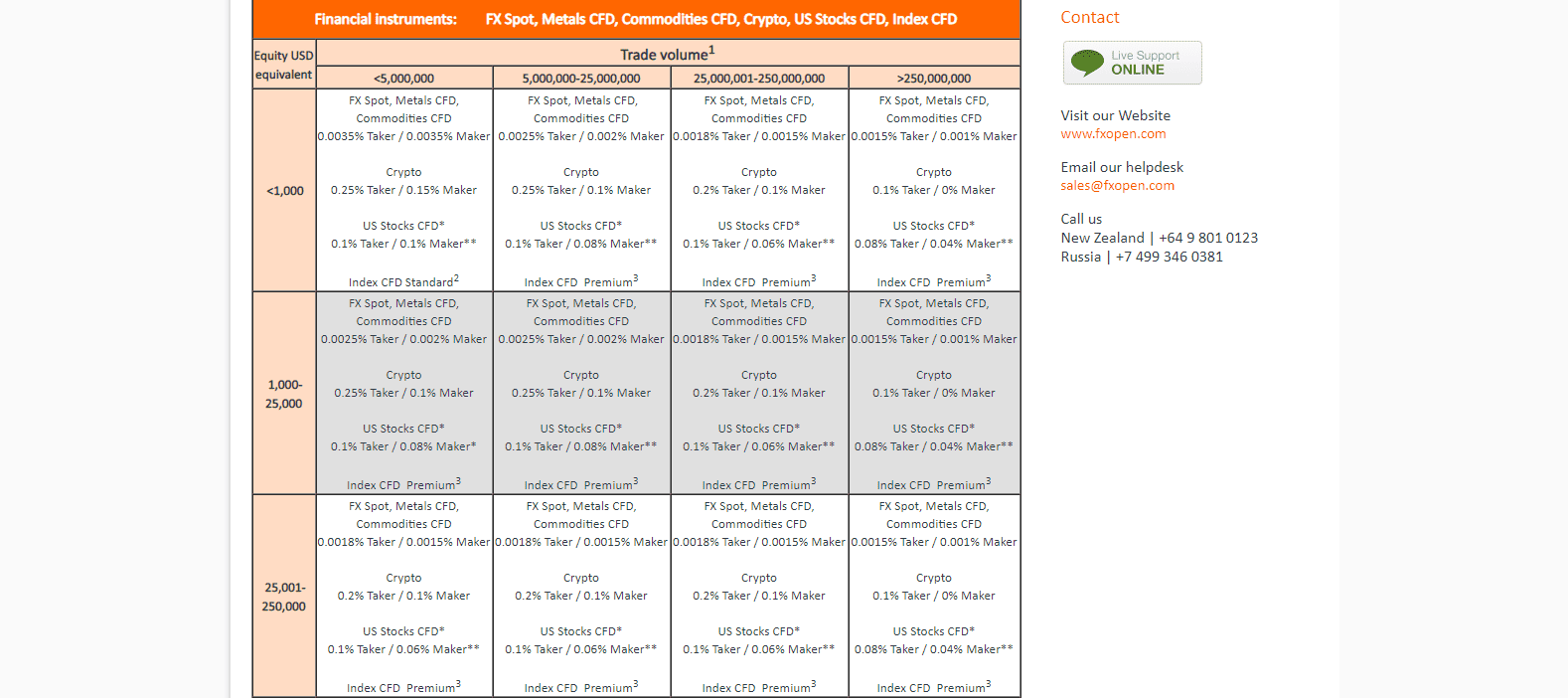

Fees

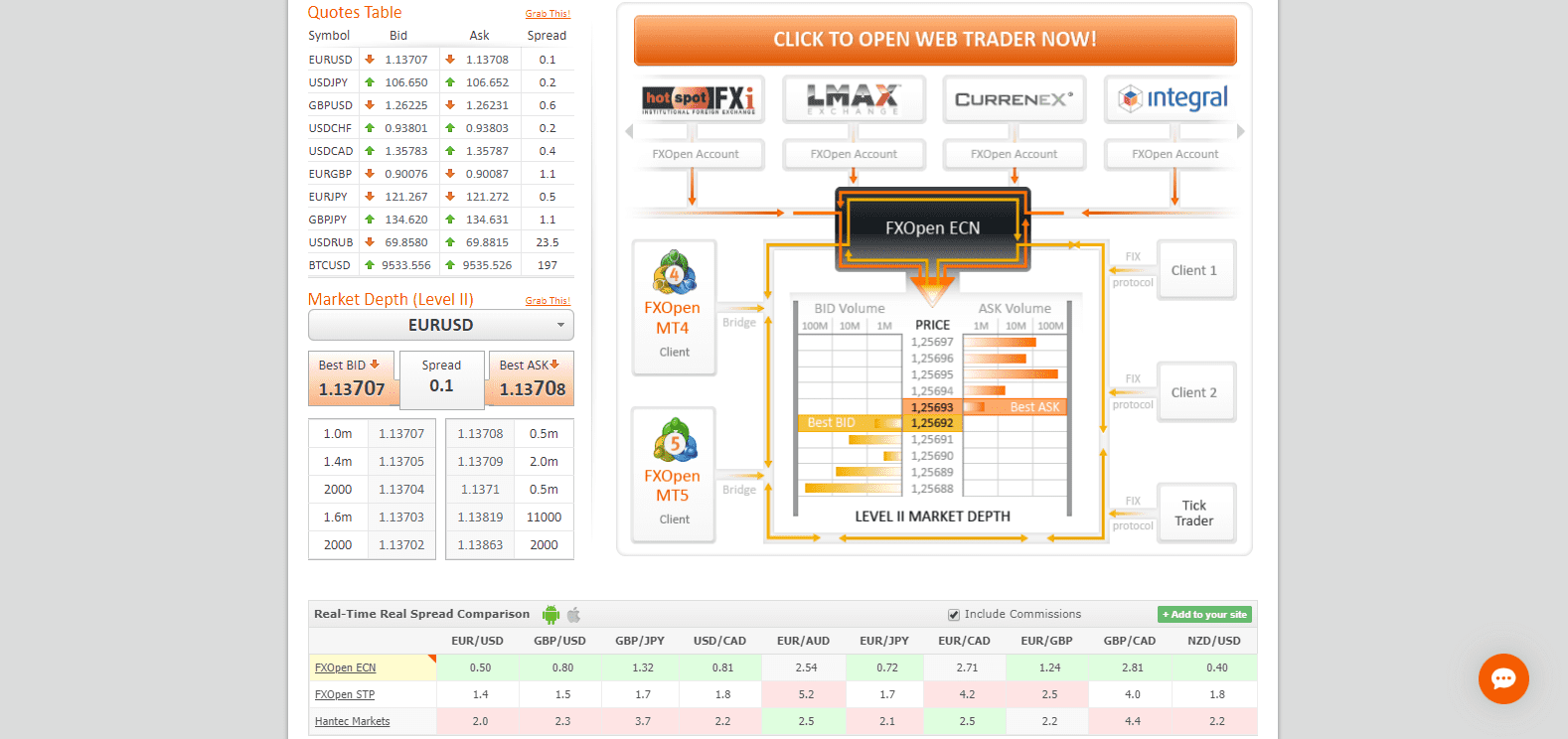

Traders have a choice between a commission-free STP account or the competitive ECN account. The lowest identified spread in the STP version was 1.1 pips. The ECN alternative features a spread as low as 0.1 pips with a commission of merely $1.50 per lot. Swap rates on overnight leveraged positions apply, and third-party withdrawal fees exist. Corporate actions such as dividends and mergers impact equity and index CFDs; how they are processed remains unclear.

FXOpen offers ECN pricing.

What Can I Trade

Forex traders have access to 50 currency pairs, providing acceptable coverage of the sector. While five commodities are inadequate for proper diversification, the fact that this non-crypto brokerage offers 39 cryptocurrencies is outstanding. The 535 US equity CFDs account for the bulk of assets, complemented by nine index CFDs. The overall selection is acceptable for most traders but is lacking in breadth for genuine asset management firms.

FXOpen has a wide range of assets to trade.

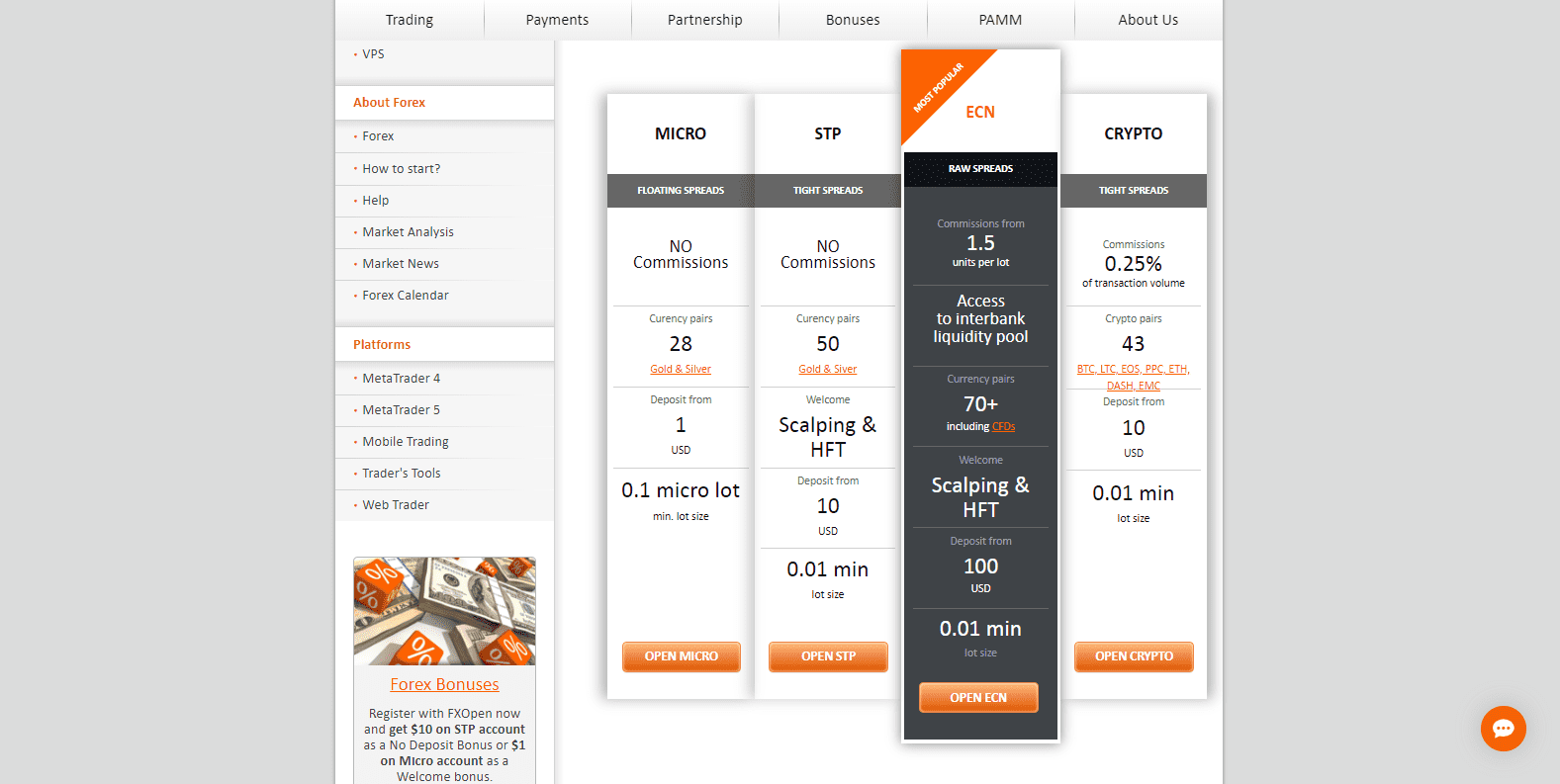

Account Types

The STP account is the most suitable choice for low-frequency traders, while the ECN account caters to high-frequency traders and professional outlets. Raw spreads for a commission of just $1.0 per lot generates a highly competitive trading environment. New traders will benefit from the Micro account; a unique cryptocurrency account is also available. Account management is supported via PAMM, Islamic accounts are available on request, and social trading is possible via Myfxbook and ZuluTrade.

FXOpen offers traders a wide range of account types.

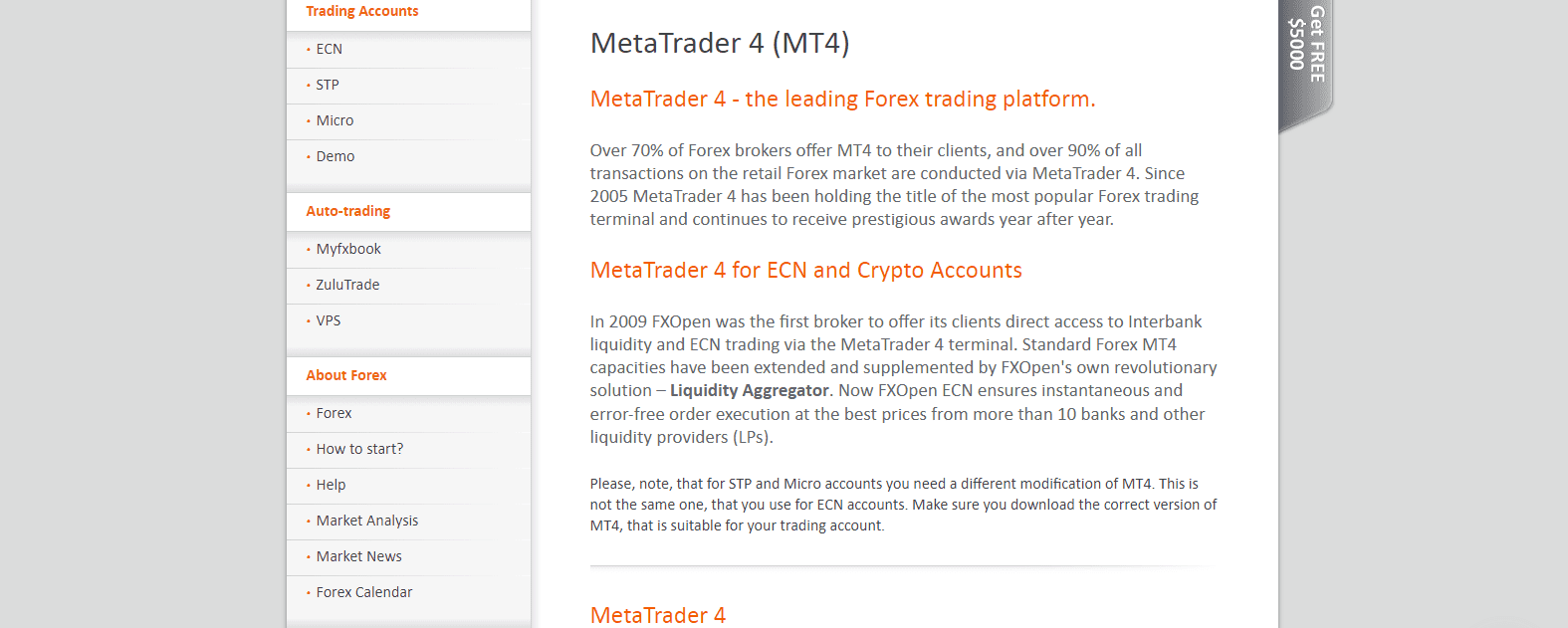

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

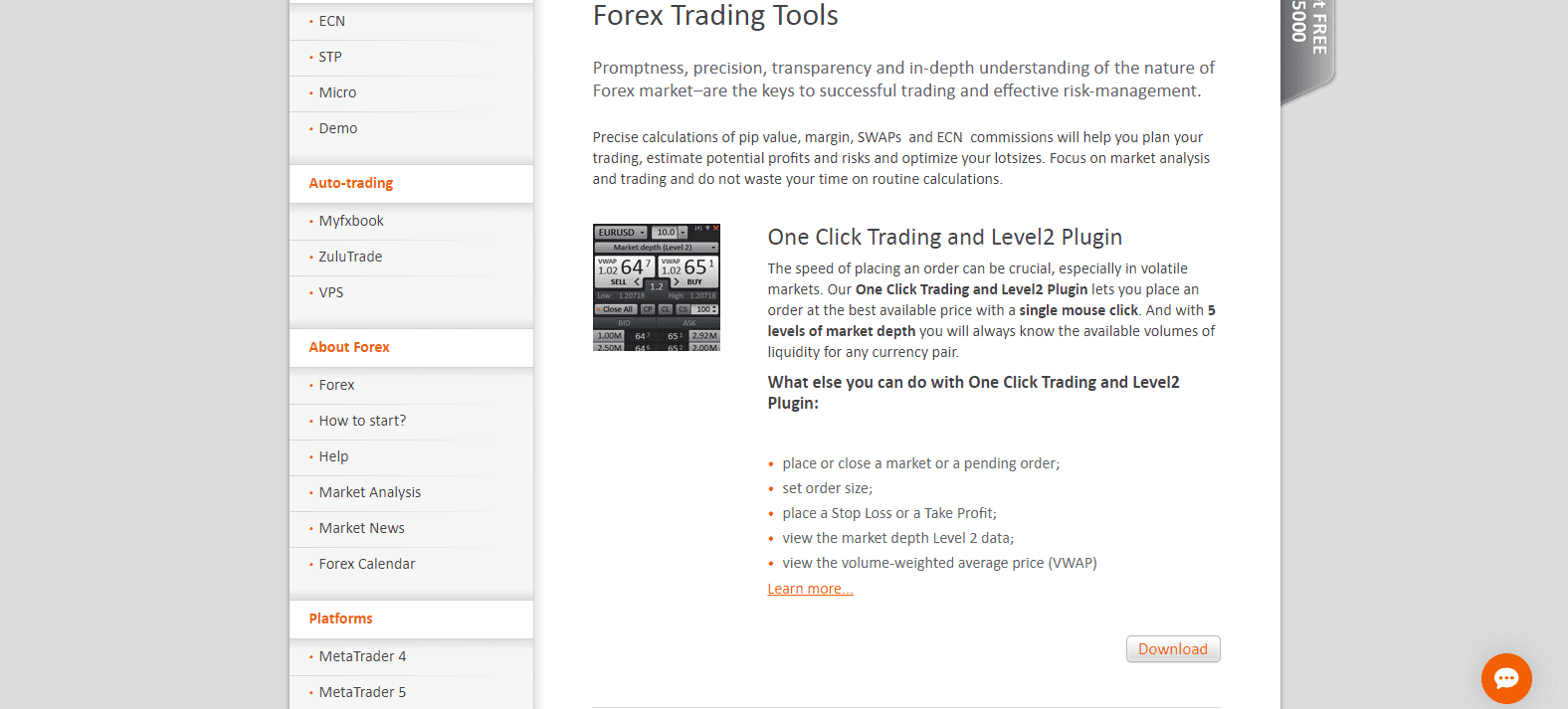

The MT4 and MT5 trading platforms, including mobile versions and webtrader versions, are available only as the most basic versions. FXOpen developed the One-Click Trading and Level2 plugin, which enhances order placement. Regrettably, third-party plugins that are required to unlock the full functionality of the MT4 platform and improve the trading environment are not available.

FXOpen offers the retail favorite, the MT4 trading platform, or its failed successor, the MT5.

Unique Features

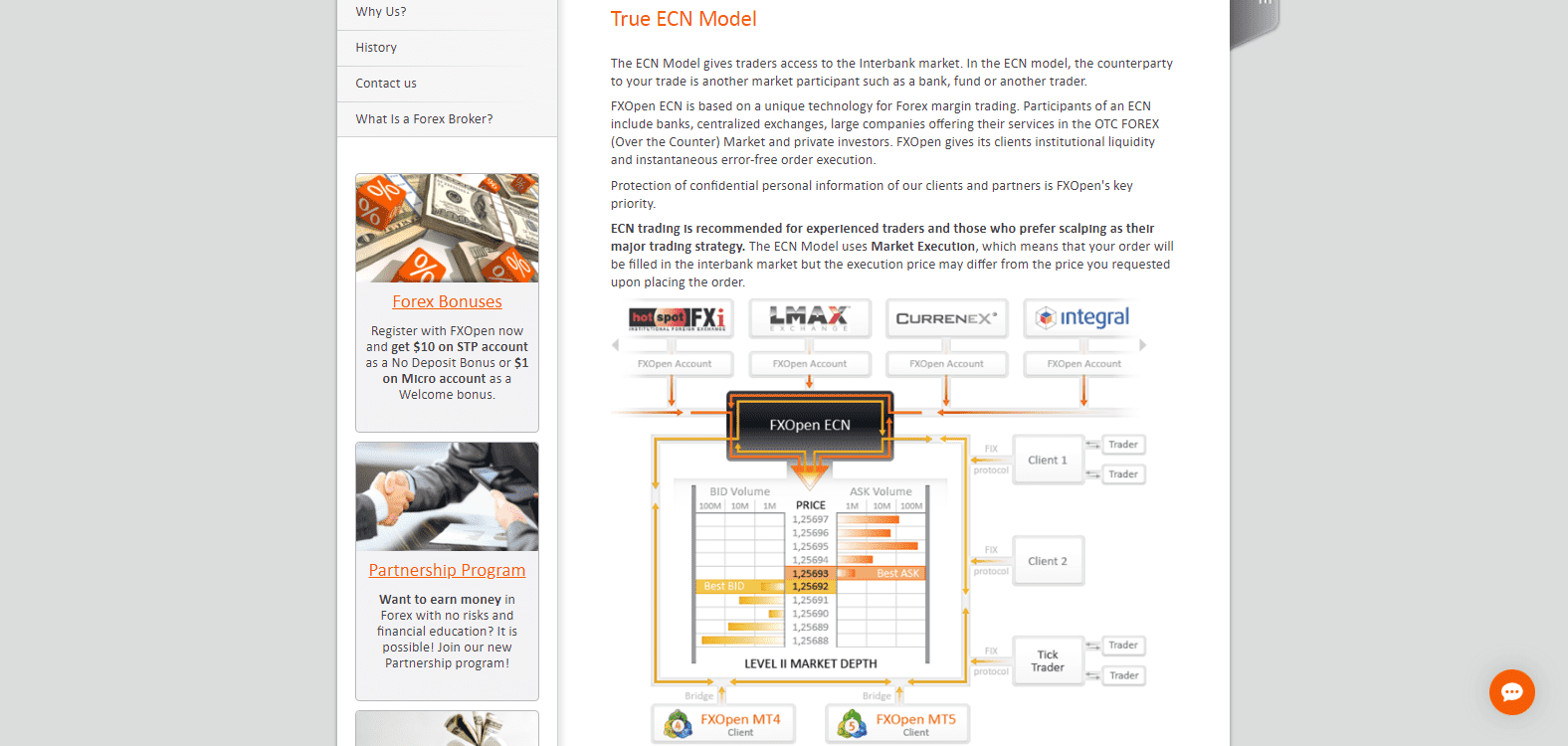

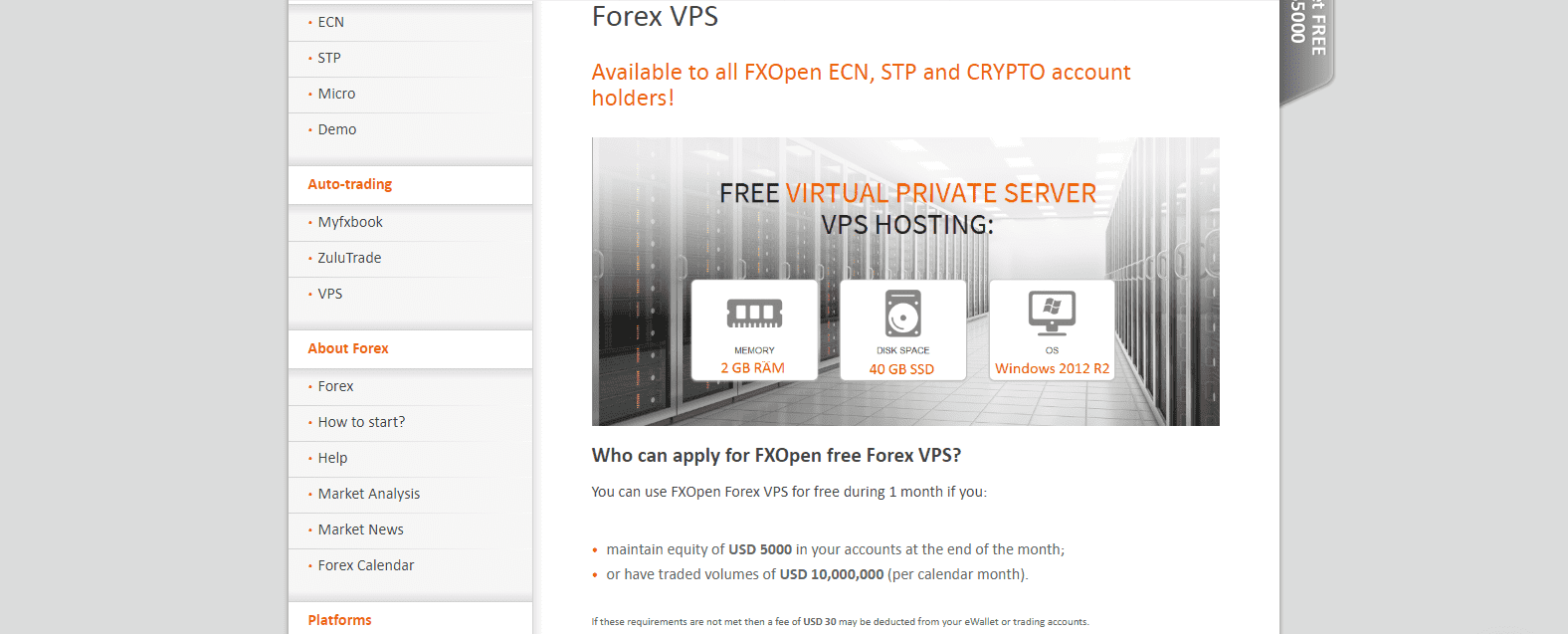

FXOpen developed an ECN bridge for the MT4 trading platform in 2009, becoming the first Forex broker to do so. It offers traders access to institutional liquidity and remains a primary asset of this broker. The One-Click Trading and Level2 plugin complements the ECN capabilities. The free VPS service further supports automated trading solutions; all accounts with equity above $5,000 or trading volume that exceeds $10 million per month can apply for this service. For a $30 monthly fee, traders who do not meet those requirements may also apply for the VPS service.

The True ECN Model provides traders with a distinct advantage.

The One-Click Trading and Level2 plugin displays five levels of market depth.

VPS is free of charge (provided minimum conditions are met) or for a $30 monthly fee.

Research and Education

Research and educational content are provided on the FXOpen blog, which features a more modern design than the website. The daily analytics are presented well and consist of written content and charts. Cryptocurrencies populate a dedicated section, while educational articles are available under the Strategies category. A unique program for new traders to learn about trading is notably and regrettably missing. FXOpen's main website also streams live news, which offers little value. FXOpen's overall approach to research and education is acceptable, but ranks far behind its competitors and begs for a major overhaul.

The FXOpen is where research and educational content is published.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |              |

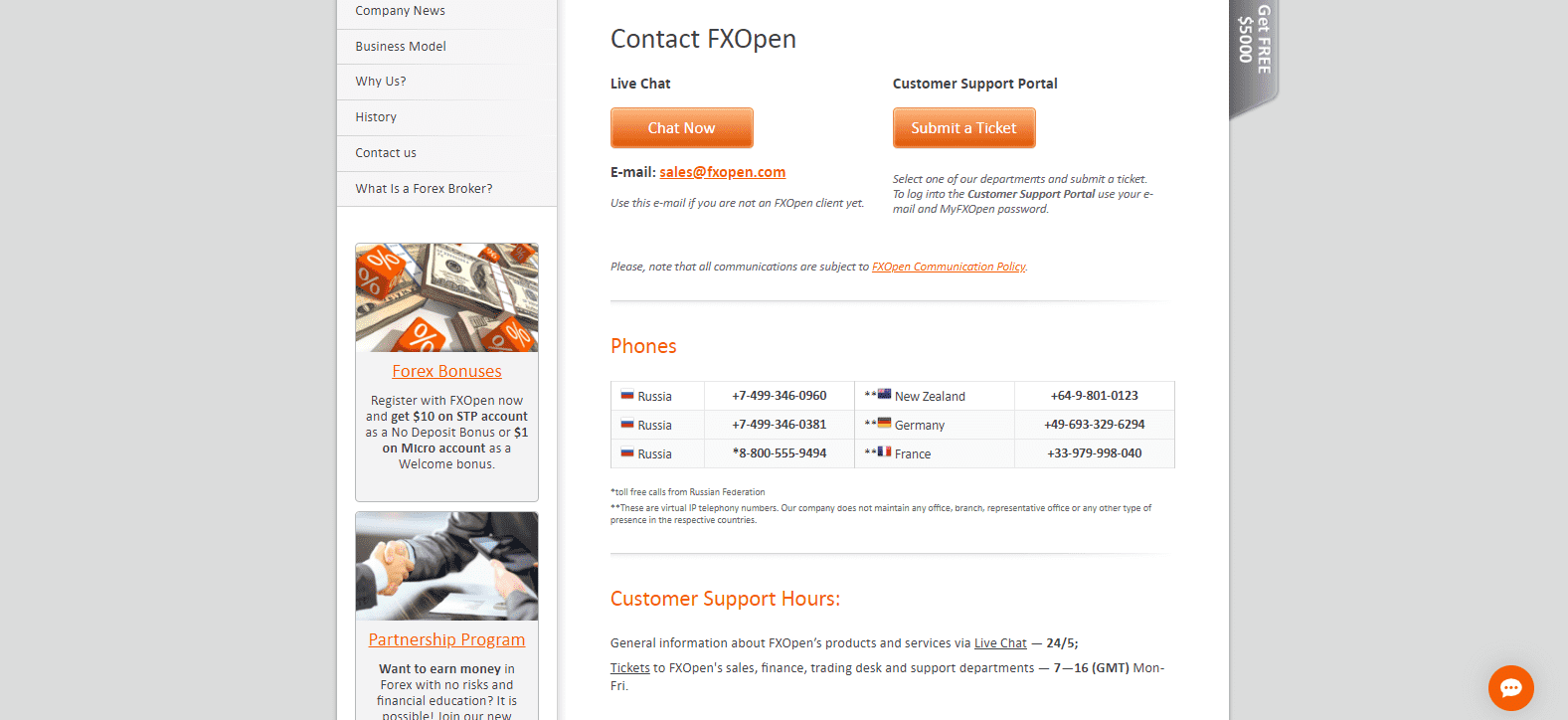

Customer support is available 24/5 via live chat, while support tickets are answered Monday through Friday between 7:00 and 16:00. Clients may also call any of the provided phone numbers or send an e-mail. The knowledge base of the Help Centers answers the most common questions.

Customer support can be accessed in various ways.

Bonuses and Promotions

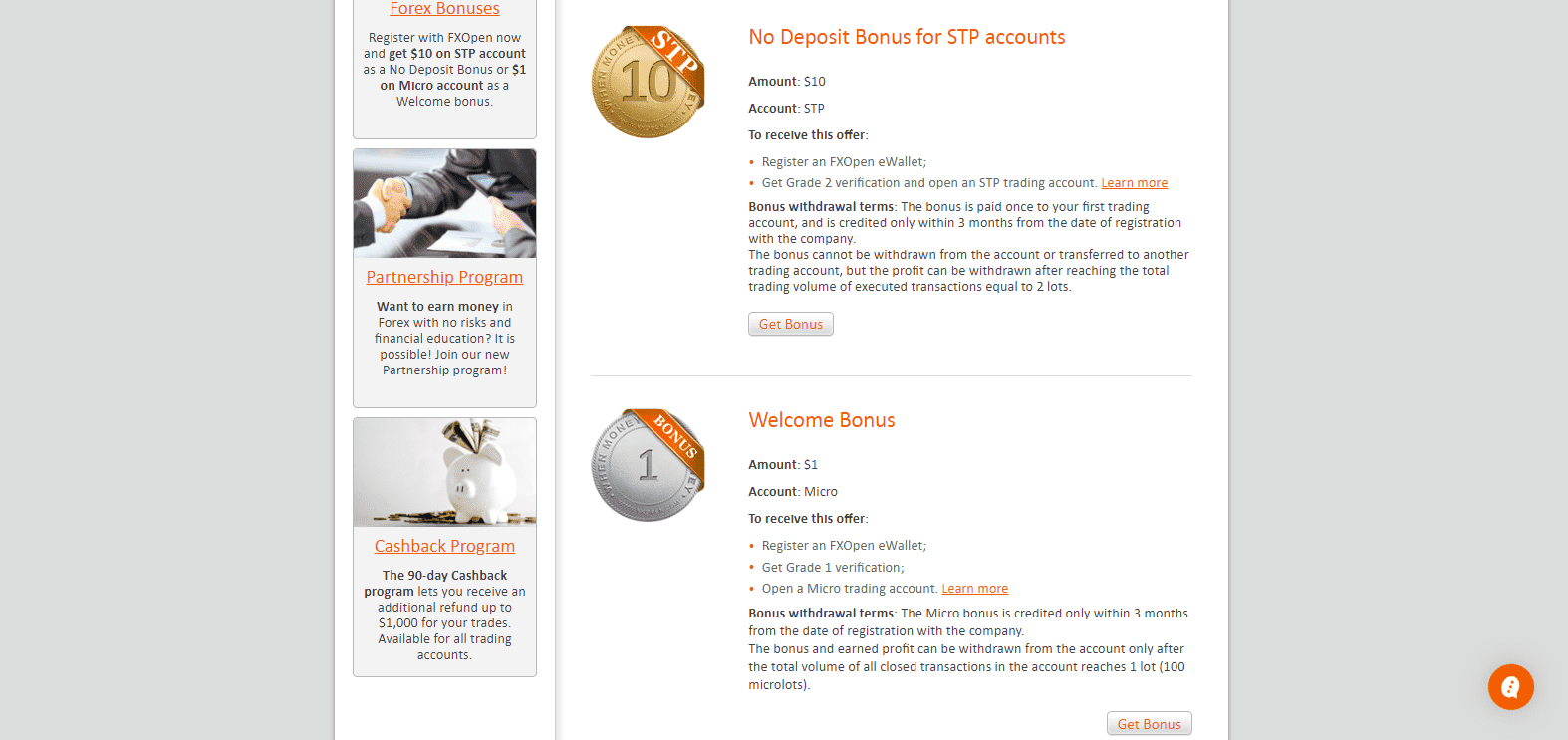

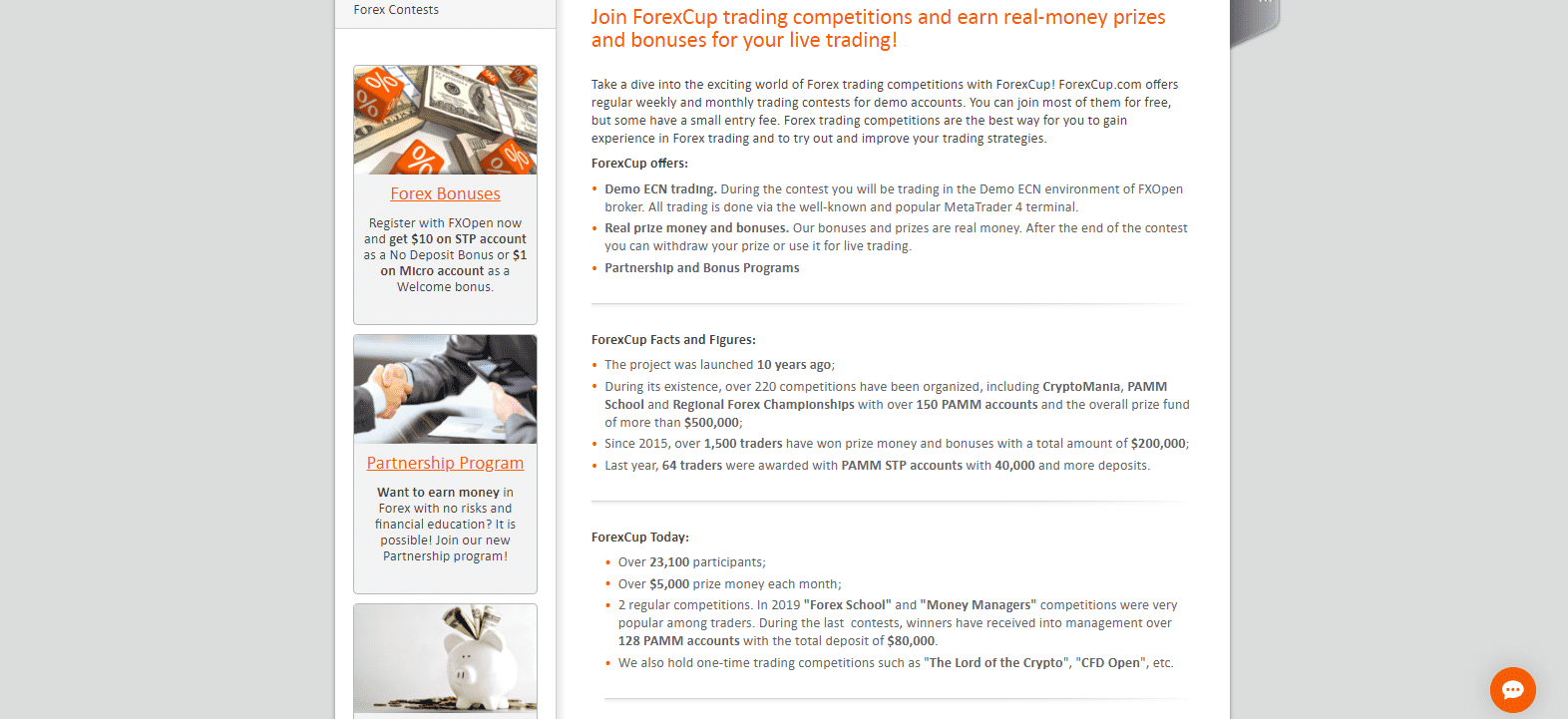

FXOpen offers a $10 no deposit bonus for the STP account, and a $1 welcome bonus for the Micro account. A time-limited cashback program is equally available with a rather complex structure. The ForexCup, a demo account competition, is offered; real cash awards are credited to trader accounts.

Traders interested in the bonus programs should read the terms and conditions carefully.

A 90-day cashback program appears poorly thought out.

The demo account contest awards real cash prizes.

Opening an Account

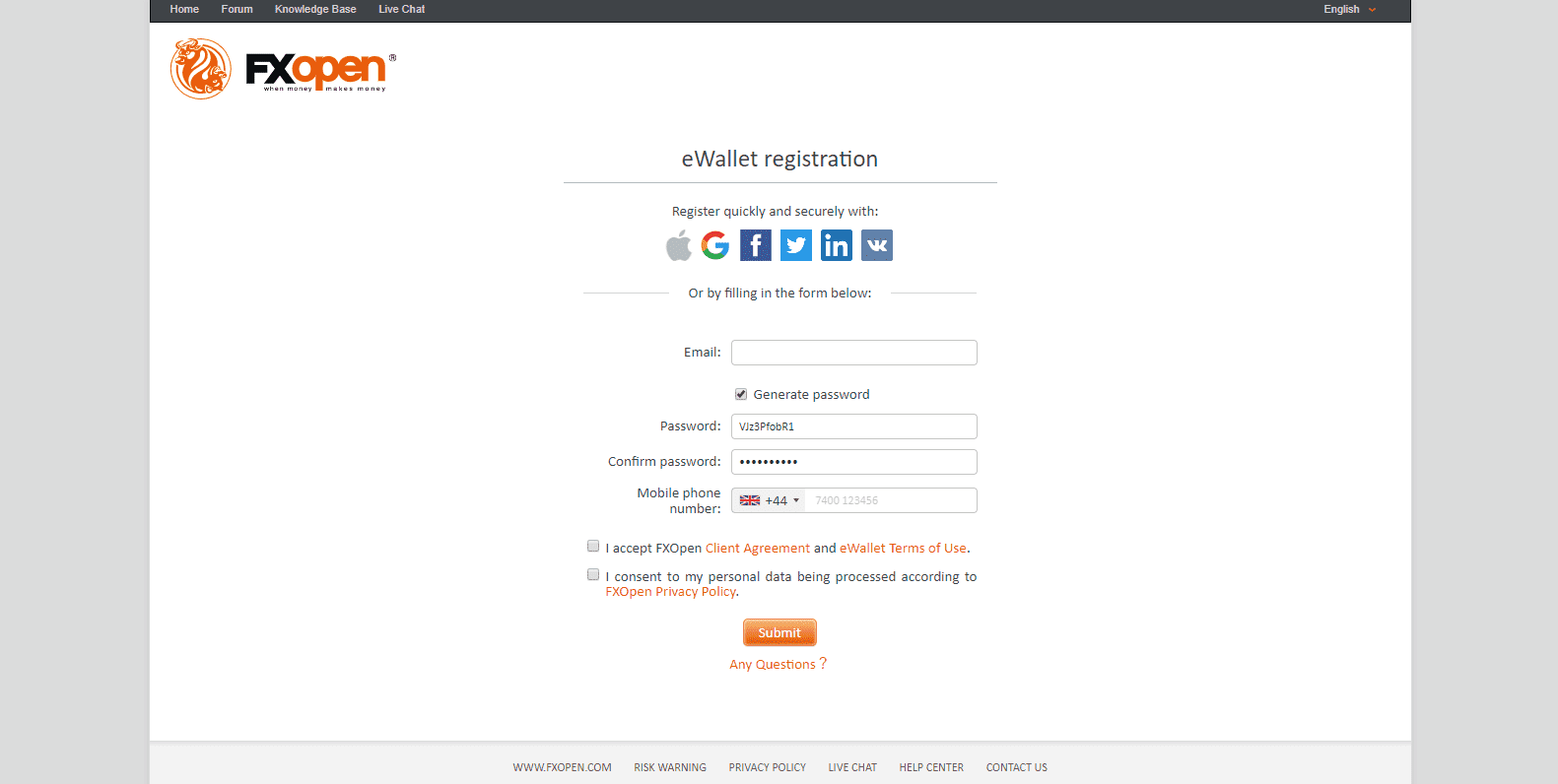

An online application for an eWallet initiates the account opening process. It may be completed by using an existing social media profile or by submitting an e-mail address and valid phone number. Password generation can be automated. Account verification is mandatory to comply with KYC/AML regulations.

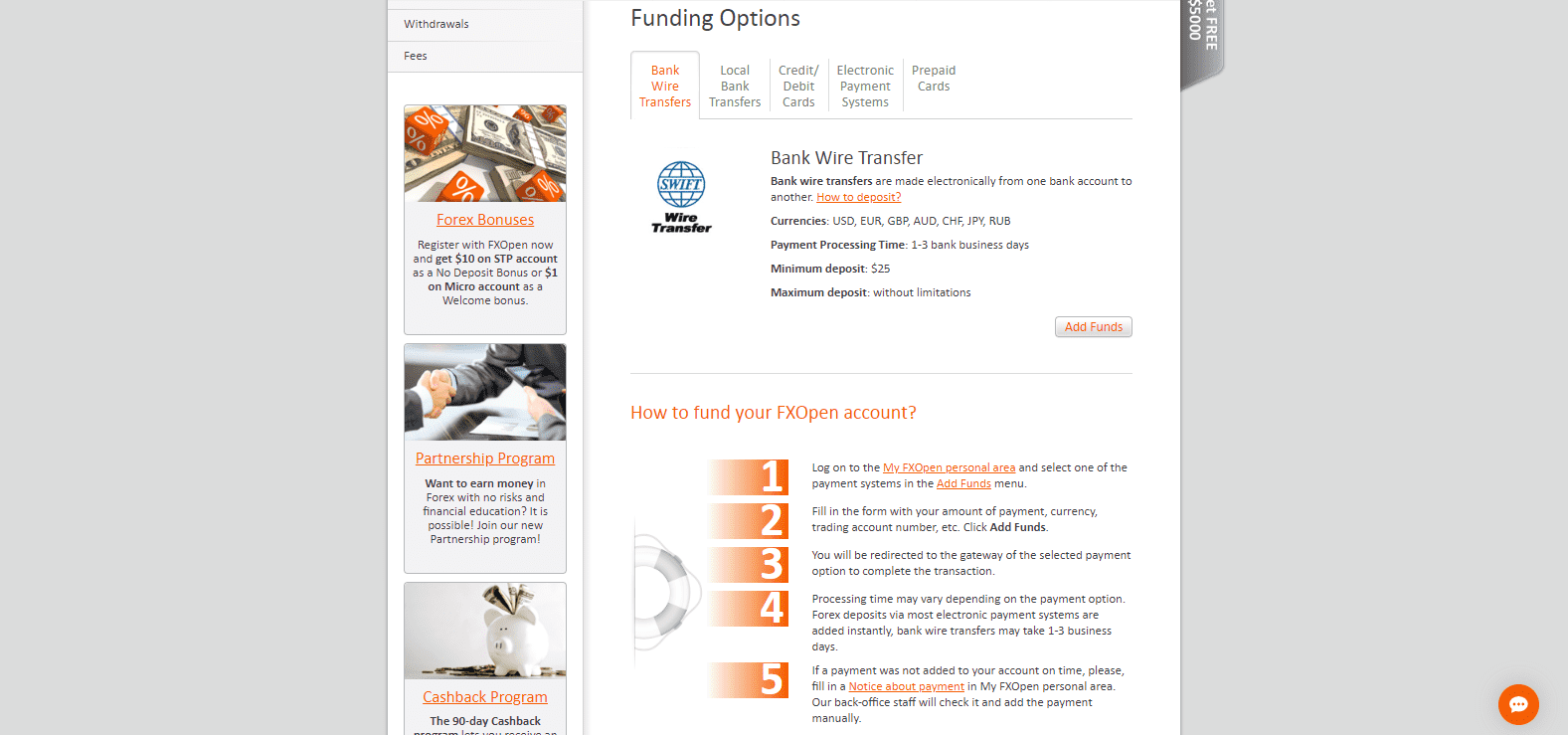

Deposits and Withdrawals

FXOpen supports bank wires, credit/debit cards, a range of local bank transfers, AstroPay, Redeem Codes, WebMoney, Perfect Money, QIWI Wallet, Yandex Money, FasaPay, and AirTM. Minimum and maximum deposit and withdrawal amounts depend on the preferred payment processor, as do processing times and fees. FXOpen provides traders with an excellent selection of established payment methods and new solutions.

FXOpen's funding options are excellent.

Summary

FXOpen maintains an extremely low-cost trading environment and real ECN pricing in its MT4/MT5 trading platforms. The ECN account is ideal for high-frequency traders, asset managers, and committed traders. Social trading is supported, while this broker is attempting to become a primary choice for PAMM managers and investors. A hybrid approach to regulation generates a trustworthy trading environment. Research and education are offered but are sub-par to other brokerages. Given the excellent trading conditions, FXOpen ranks in the top quartile of brokers and deserves genuine consideration for a deposit. A highly competitive trading environment elevates this broker into the top quartile. The cost structure and asset choice make the ECN account a natural choice for committed traders. FXOpen offers a Micro account from a minimum deposit of $1, while a $10 STP bonus is equally available. It is a bonus granted for new account registration without the need for a deposit. FXOpen is a legit brokerage. It maintains operating subsidiaries regulated by the UK’s FCA and Australia’s ASIC. The Financial Commission, based in Hong Kong, provides international oversight and investor protection. The minimum deposit is dependent on the account type and ranges between $1 and $1,000.FAQs

Is FXOpen a good broker?

Can I start trading with $10?

What is the FXOpen no deposit bonus?

Is FXOpen a scam?

What is the minimum deposit at FXOpen?