- The S&P 500 fell somewhat significantly during the trading session on Tuesday, to reach down toward the 50-Day EMA indicator.

- That being said, the market is probably more or less paying attention to the idea that the FOMC meeting is the next day, and that does make quite a bit of sense that perhaps people were not willing to take on a lot of risk.

- Furthermore, if you had bought the S&P 500 a couple of days ago, it does make a lot of sense to take a profit ahead of what could be an extraordinarily volatile session on Wednesday.

Technical Analysis

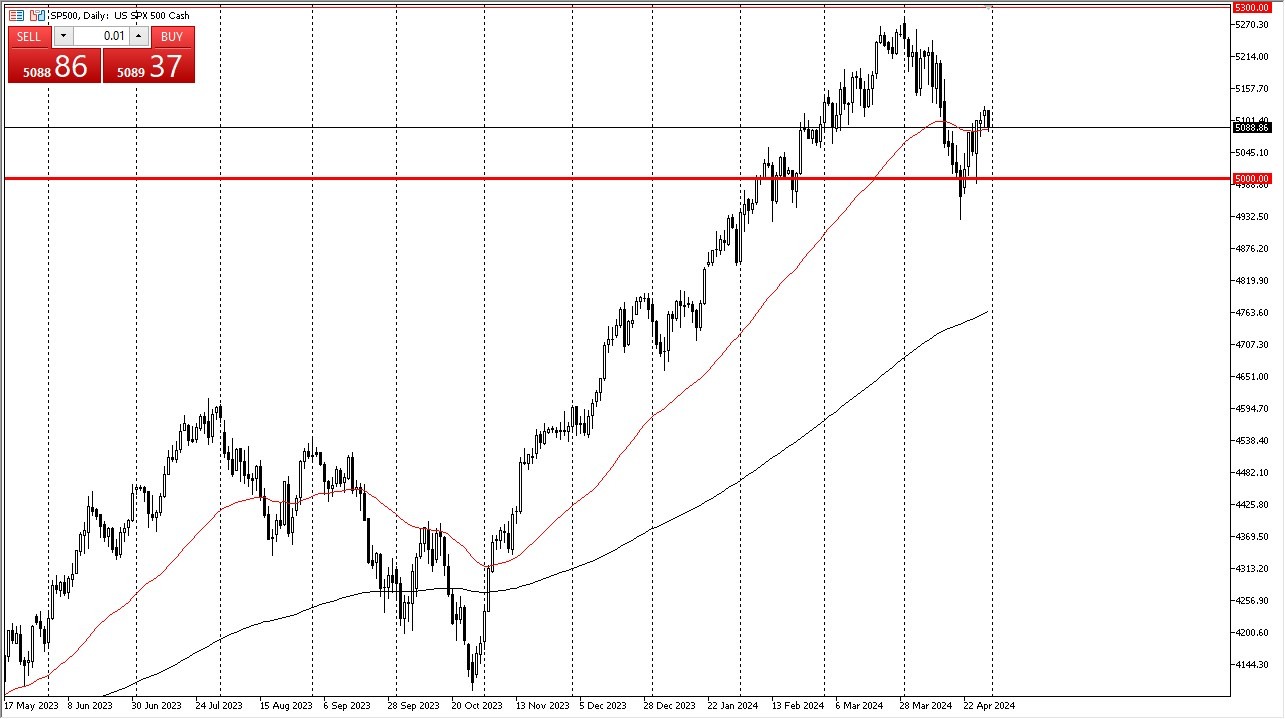

As I look at the chart, I think the most obvious level to pay close attention to is the 5000 level. The 5000 level courses a large, round, psychologically significant figure, and it is an area that I think you need to pay close attention to. If we were to pull back to that area, I would be very interested in buying some type of bounce. If we break down below there, I don’t necessarily think that we are going to collapse, but if we were to give up the 4925 level, that would be very bad news.

On the other hand, if we see bullish pressure reenter the market, we could aim for 5150, which is not only one of the best-selling Van Halen albums of all time, but it also happens to be an area where we’ve seen a lot of support earlier in the month. I suspect that area will continue to be a little bit important, but I don’t necessarily think that it is a “brick wall” in the market. After all, we have been bullish for some time now, and therefore I think it makes quite a bit of sense that the overall market still favors the upside.

The early part of the Wednesday session will probably be somewhat quiet, but I think at this point in time the market will look past almost anything that Jerome Powell does via his speech. Yes, he could sound a little bit more hawkish than people expect, but that almost certainly would only end up being a buying opportunity on the dip as it would offer a cheap entry point.

Ready to trade the Forex S&P 500? We’ve made a list of the best online CFD trading brokers worth trading with.